Image Source: Cisco

By Brian Nelson, CFA

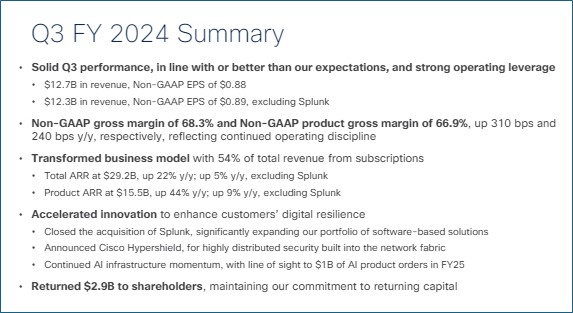

On May 15, Cisco Systems (CSCO) reported better than feared third quarter results for its fiscal 2024. Revenue faced pressure, falling 13% on a year-over-year basis, as management noted that customers continue to implement “products on-hand.” Non-GAAP earnings per share of $0.88 beat consensus. Management spoke of a dynamic market environment, while mentioning some stabilization of demand:

We delivered a solid Q3 performance in what remains a dynamic environment. Our unique ability to bring together networking, security, observability, and data enables Cisco to offer our customers unrivaled digital resilience for the AI era.

Revenue, gross margin and non-GAAP EPS in Q3 were at the high end or above our guidance range, both including and excluding Splunk, resulting in continued operating leverage. Customers are consuming the equipment shipped over the last few quarters in line with our expectations and we are seeing stabilization of demand as a result. The addition of Splunk to our product line will be a catalyst for further growth.

Looking to the fourth quarter of fiscal 2024, Cisco is targeting revenue in the range of $13.4-$13.6 billion and non-GAAP earnings per share in the range of $0.84-$0.86 (consensus was $0.84 per share). For the fiscal year, revenue is targeted in the range of $53.6-$53.8 billion, while non-GAAP earnings per share is expected in the range of $3.69-$3.71 (consensus was $3.64 per share). Shares of Cisco are trading at an attractive 13.4x multiple of current fiscal year earnings, while shares yield ~3.2% on a forward estimated annualized basis. We like its position in the newsletter portfolios.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for CSCO, JNPR, ANET

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.