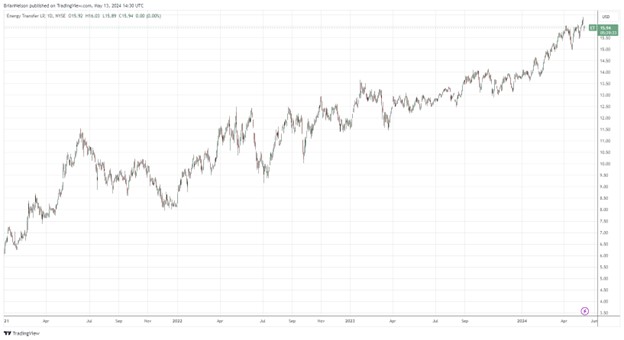

Image: Energy Transfer’s financials are in much better shape than they were years ago.

By Brian Nelson, CFA

On May 8, Energy Transfer (ET) reported strong first-quarter 2024 results. Adjusted EBITDA for the three months ended March 31 came in at $3.88 billion, which was nicely higher than the $3.43 billion mark it achieved in the same period last year. Distributable cash flow [DCF] in the quarter came in at $2.36 billion, which was materially better than the $2.01 billion registered during the first quarter of 2023.

During the first quarter of 2024, the company’s crude oil transportation volumes increased 44%, which set a new record. Crude oil terminal volumes increased 10%, NGL fractional volumes increased 11%, NGL exports increased ~6%, NGL transportation volumes moved 5% higher, interstate natural gas transportation volumes advanced 5%, while midstream gathered volumes nudged 1% higher. Energy Transfer continues to benefit from new growth projects and acquisitions.

Looking ahead to the full-year 2024, adjusted EBITDA is now targeted in the range of $15-$15.3 billion, which was increased from the previous range of $14.5-$14.8 billion due in part to Sunoco LP’s acquisition of NuStar Energy L.P. Energy Transfer’s credit is also on firmer ground these days, with Fitch upgrading its senior unsecured debt rating to BBB which followed S&P’s upgrade to BBB last year.

Looking at the company’s recent 10-Q was encouraging. Energy Transfer’s cash flow from operations during the first quarter of 2024 was $3.772 while the firm spent $795 million in capital spending, resulting in traditional free cash flow of ~$2.98 billion, far in excess of distributions paid to partners, noncontrolling interests, and redeemable noncontrollable interests. We like Energy Transfer’s EBITDA growth, free cash flow coverage of the distribution, and improved credit quality. The pipeline operator has come a long way in the past decade.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.