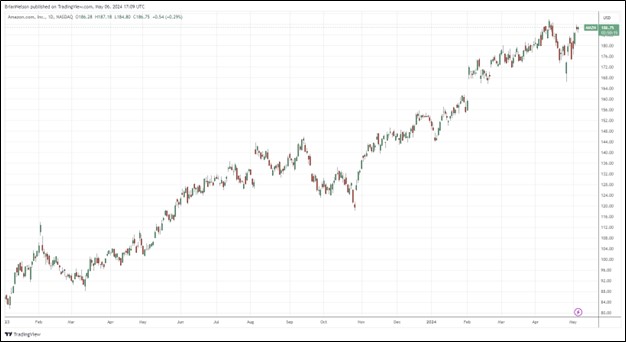

Image: Amazon’s shares have made a solid run higher since the beginning of 2023.

By Brian Nelson, CFA

On April 30, Amazon (AMZN) reported better-than-expected first quarter results that showed net sales increasing 13% thanks in part to AWS segment sales growth of 17%. Operating income exploded higher to $15.3 billion in the first quarter compared to $4.8 billion in the same period a year ago thanks to particularly strong performance at its North America segment as well as its AWS segment, where operating income jumped to $9.4 billon from $5.1 billion in the same period a year ago. Amazon’s net income jumped to $10.4 billion from $3.2 billion in the year-ago period.

Management was upbeat on the performance:

It was a good start to the year across the business, and you can see that in both our customer experience improvements and financial results. The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate); our Stores business continues to expand selection, provide everyday low prices, and accelerate delivery speed (setting another record on speed for Prime customers in Q1) while lowering our cost to serve; and, our Advertising efforts continue to benefit from the growth of our Stores and Prime Video businesses. It’s very early days in all of our businesses and we remain excited by how much more we can make customers’ lives better and easier moving forward.

The big story with Amazon in the quarter not only was the strong performance at AWS, but also the company’s free cash flow. Over the trailing twelve-month period, operating cash flow increased 82% to $99.1 billion compared to $54.3 billion over the same period ended Mrach 31, 2023. Free cash flow also improved considerably to $50.1 billion for the trailing twelve-month period, up from an outflow in the same trailing twelve-month period a year ago.

Looking to the second quarter of 2024, Amazon is targeting top-line growth of 7%-11% on a year-over-year basis, while operating income is expected to come in at $10-$14 billion, up from $7.7 billion in the year-ago period. We’re liking what we’re seeing at Amazon these days, especially the company’s AWS performance, operating income expansion, and free cash flow trends. Right now, we don’t include Amazon in any newsletter portfolio given the valuation sensitivity of key inputs, but for risk-seeking investors, Amazon is one interesting consideration.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.