Image: Microsoft’s cloud business continues to showcase strong growth momentum.

By Brian Nelson, CFA

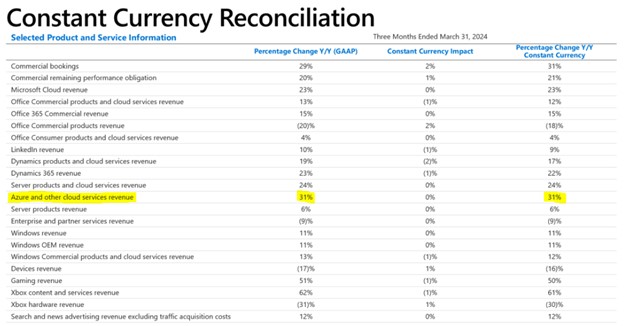

On April 25, Microsoft (MSFT) reported fantastic third-quarter results for fiscal 2024 that showed continued fundamental momentum at the tech giant. Revenue increased 17% in the quarter, while operating income surged 23%. Both net income and diluted earnings per share advanced 20% in the quarter on a year-over-year basis. The big standout in the quarter was Azure and other cloud services revenue, which increased a better-than-expected 31% in the period.

Management spoke to continued opportunities in artificial intelligence [AI] and cloud revenue:

Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry. This quarter Microsoft Cloud revenue was $35.1 billion, up 23% year-over-year, driven by strong execution by our sales teams and partners.

Microsoft ended the quarter with $80.0 billion in cash and short-term investments, which is greater than its short- and long-term debt balance of $65.4 billion, so Microsoft has a nice net cash position. For the nine months ended March 31, cash flow from operations jumped to $81.4 billion from $58.8 billion, as the company continues to turn heads with respect to cash flow generation. Free cash flow was $50.7 billion during those nine months, up from $39.6 billion in last year’s period.

All told, we like Microsoft’s financials and fundamental momentum. The company continues to benefit from AI adoption across its product suite and guidance for the fourth quarter of its fiscal year was solid. We’re huge fans of Microsoft’s net cash position on its balance sheet, and very few other firms are showing the magnitude of operating cash flow increases we’re witnessing at Microsoft. The firm remains one of our favorite ideas in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.