Image Source: Tesla

By Brian Nelson, CFA

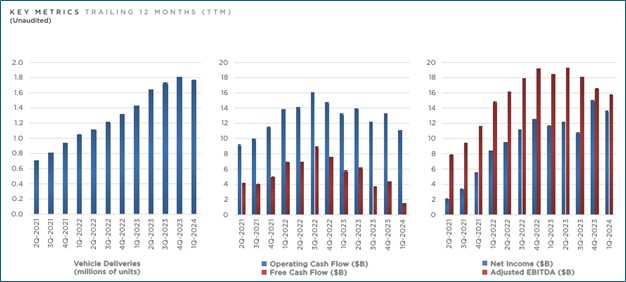

On April 23, Tesla (TSLA) reported lower-than-expected first-quarter 2024 results as reduced vehicle prices weighed on performance. Total automotive revenues fell 13% on a year-over-year basis, while total revenues, in aggregate, fell 9%. Its total gross profit fell 18%, while income from operations dropped by more than half. The first quarter was negatively impacted by the Red Sea conflict and an arson attack at Gigafactory Berlin.

Management summed up the quarter with the following:

Global EV sales continue to be under pressure as many carmakers prioritize hybrids over EVs. While positive for our regulatory credits business, we prefer the industry to continue pushing EV adoption, which is in-line with our mission. To support our growth, we have been increasing awareness and expanding vehicle financing programs, including attractive leasing terms for our customers.

While many are pulling back on their investments, we are investing in future growth – including our AI infrastructure, production capacity, our Supercharger and service networks and new products infrastructure – with $2.8B of capital expenditures in Q1.

We recently undertook a cost-cutting exercise to increase operational efficiency. We also remain committed to company-wide cost reduction, including reducing COGS per vehicle. Ultimately, we are focused on profitable growth, including by leveraging existing factories and production lines to introduce new and more affordable products.

The future is not only electric, but also autonomous. We believe scaled autonomy is only possible with data from millions of vehicles and an immense AI training cluster. We have, and continue to expand, both. To make FSD (Supervised) 5 more accessible, we reduced the price of subscription to $99/month and the purchase price to $8,000 in the US.

Cash flow performance wasn’t great at Tesla during its first quarter of 2024 either. Net cash provided by operating activities fell 90%, to $242 million, while capital expenditures increased 34%, to ~$2.77 billion, translating into a free cash flow burn of ~$2.53 billion for the period. Cash and cash equivalents totaled $26.86 billion at the end of the quarter, while the firm had $5.36 billion in debt and finance leases, good for a strong net cash position.

Tesla’s performance hasn’t been great of late, as the industry’s preference for hybrids has impacted its results and competition remains fierce. The company nevertheless notes that it is “currently between two growth waves” – consisting of the global rollout of the Model 3/Y platform and continued advancement in autonomy. It should not be surprising to investors if Tesla’s vehicle volume growth rate is much lower in 2024 than it was in 2023.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.