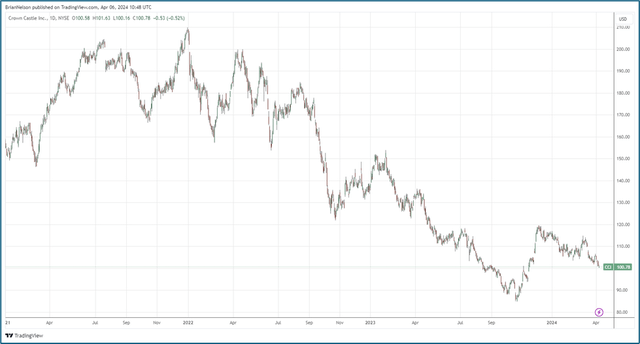

Image: Crown Castle’s shares have been under pressure the past couple years.

By Brian Nelson, CFA

Back in January, Crown Castle (CCI) reported better-than-expected results for the fourth quarter of 2023, capping off an eventful year. Site rental revenues advanced 4% on the year, while net income dropped 10% for the full year 2023. Adjusted EBITDA nudged 2% higher on the year, however, while adjusted funds from operations (AFFO) increased at a similar pace, with the measure reaching $7.55 per share for the year, well in excess of its run-rate $6.26 per share in annual dividends. Shares yield ~6.2% at the time of this writing.

Management had the following to say about the performance:

Crown Castle delivered 2023 results in line with our expectations, including site rental billings, Adjusted EBITDA, and AFFO. We generated full-year tower organic revenue growth of 5%, achieved 8,000 new small cell nodes for the year, with 2,000 additional nodes completed that are expected to begin billing in first quarter 2024, and returned to year-over-year fiber solutions revenue growth of approximately 3% in the fourth quarter.

The growth delivered in 2023 across towers, small cells, and fiber solutions demonstrates our customers’ continued demand for our assets, and we are well positioned to execute on our expectations for 2024. In December, we issued $1.5 billion of long-term fixed rate debt at a weighted average interest rate of 5.7%, allowing us to end the year with more than 90% fixed rate debt, a weighted average debt maturity of 8 years, limited maturities through 2024, and more than $6 billion of available liquidity under our revolving credit facility.

Looking out to the full year 2024, management expects site rental billings to be between $5.74-$5.78 billion, with site rental revenues in the range of $6.347-$6.392 billion. Adjusted EBITDA is targeted at $4.138-$4.188 billion, while net income is expected in the range of $1.213-$1.293 billion. AFFO per share is expected in the range of $6.85-$6.97 on the year (consensus was at $6.87 at the time). Crown Castle continues to deal with activist pressure from Elliott Investment and founder Ted Miller (Boots Capital Management).

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.