By Brian Nelson, CFA

On March 7, Broadcom (AVGO) reported better than expected first-quarter results for fiscal 2024. Revenue advanced 34% from the same period a year ago, while adjusted EBITDA increased 26% on a year-over-year basis. On a non-GAAP basis, net income increased to ~$5.3 billion, up from ~$4.5 billion in the same period a year ago. Non-GAAP adjusted earnings per share increased to $10.99 from $10.33 in the year-ago period. Shares yield ~1.6% at the time of this writing, and the company continues to push through meaningful dividend increases.

Management was upbeat when it came to artificial intelligence [AI] in its press release:

We are pleased to have two strong drivers of revenue growth for Broadcom in the first quarter and fiscal year 2024. First, our acquisition of VMware is accelerating revenue growth in our infrastructure software segment, as customers deploy VMware Cloud Foundation. Second, strong demand for our networking products in AI data centers, as well as custom AI accelerators from hyperscalers, are driving growth in our semiconductor segment. We reiterate our fiscal year 2024 guidance for consolidated revenue of $50 billion and adjusted EBITDA of $30 billion.

Consolidated revenue grew 34% year-over-year to $12.0 billion, including the contribution from VMware, and was up 11% year-over-year, excluding VMware. Adjusted EBITDA increased 26% year-over-year to $7.2 billion. Free cash flow, excluding restructuring in the quarter, continued to be strong at $5.4 billion. We have started to pay down debt, beginning with $3 billion to date in 2024, and expect to continue to pay down debt in fiscal year 2024.

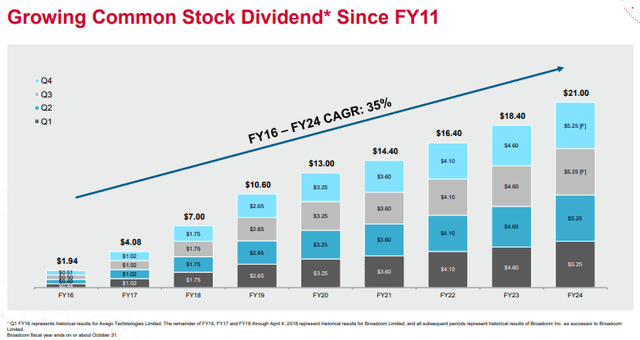

Image Source: Broadcom

The company ended the period with $11.9 billion in cash and cash equivalents and $75.9 billion in total debt, so Broadcom operates with a hefty net debt position, something that we generally don’t like. We prefer equities with strong net cash positions, as that is a key source of cash-based intrinsic value. Broadcom is nonetheless deleveraging. During the quarter, Broadcom generated cash flow from operations of $4.8 billion and spent just $122 million in capital equipment, translating into tremendous free cash flow generation, well in excess of the $2.4 billion it paid in dividends in the quarter. We see Broadcom as a key beneficiary of AI investment and are keeping a close eye on this asset-light, strong free-cash-flow generator.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.