Image Source: General Mills

By Brian Nelson, CFA

On March 20, General Mills (GIS) reported better-than-expected third quarter results for its fiscal 2024. Though net sales fell 1% in the period, the company’s adjusted operating profit advanced 14% in constant currency. On a two-year compound growth basis, the firm’s organic net sales increased 7%, so while there was some pressure on revenue in the quarter, most of it can be attributed to difficult comparisons. Our fair value estimate for General Mills stands at $60, with the company trading at a modest premium to those levels at the time of this writing.

General Mills continues to focus on its Accelerate strategy, which breaks down into four pillars: boldly building brands, relentlessly innovating, unleashing scale, and standing for good. The company’s gross margin expanded 100 basis points in the quarter thanks to a strong combination of positive price realization and mix as well as cost savings. Impressively, the company’s adjusted operating profit margin was up 220 basis points, helped in part by lower compensation and benefits expenses. Adjusted diluted earnings per share increased 22% in constant currency in the quarter.

General Mills ended the quarter with $588.6 million in cash and cash equivalents compared to total debt of ~$12.5 billion in short- and long-term debt and notes payable, so the company operates with a rather hefty net debt position. For the nine-month period ended February 25, 2024, General Mills’ cash flow from operations advanced to ~$2.44 billion from ~$2.03 billion. Capex expanded to $485.6 million over the same time period versus $351.3 million. Free cash flow for the first nine months of the fiscal year was ~$1.9 billion, considerably greater than the $1.03 billion it paid in dividends over the same time period.

ESG Considerations

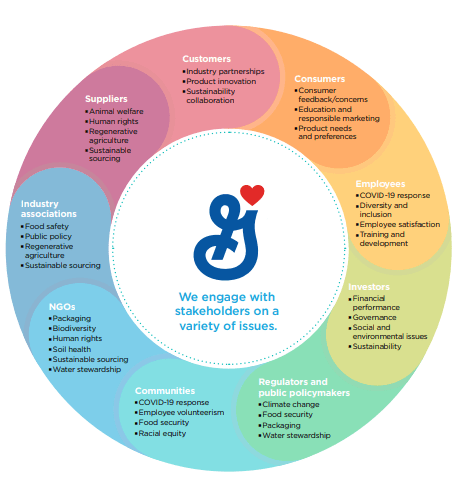

General Mills has a long history, and the company’s ESG standards are admirable. Management is committed to the concept that the G in General Mills stands for “Good.” In 2022, for example, 29 million meals were enabled by donations of General Mills food across the globe. Roughly 87% of renewable energy was sourced for its global operations, while 92% of the company’s packaging is recyclable or reusable, as measured by weight. As for people, 50% of its Board of Directors are women, while 33% are ethnically diverse. During 2022, $90 million was contributed to charities by the company and its Foundation worldwide.

Concluding Thoughts

When it reported its fiscal third quarter results, General Mills reaffirmed its prior outlook. The company expects organic net sales to be in the range of down 1% to flat, with adjusted operating profit and adjusted diluted earnings per share to advance 4%-5% in constant currency. Management expects free cash flow conversion to be at least 95% of its adjusted after-tax earnings. Given recent trends in free cash flow, we view that target as achievable. We like General Mills quite a bit, but we think there is more bang for investors’ buck in the areas of big cap tech and large cap growth these days. A Dividend Cushion ratio of 0.6 means to us that dividend increases will continue to be modest in nature.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.