Image Source: Micron

By Brian Nelson, CFA

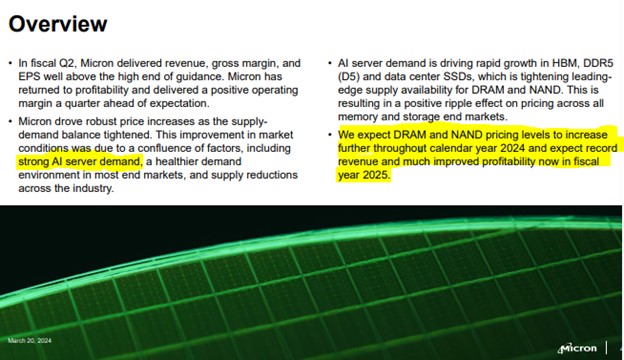

On March 20, Micron (MU) reported better than expected second quarter fiscal 2024 results that showed considerable revenue growth and a nice beat with respect to non-GAAP earnings per share. Revenue advanced to $5.82 billion versus $3.69 billion in the same period last year, while non-GAAP net income swung into positive territory at $0.42 per share, up from a loss of $1.91 during the second quarter of fiscal 2023. Operating cash flow surged to $1.22 billion in the quarter from $343 million in the same period a year ago.

Here’s what management had to say about the performance in the quarterly press release:

Micron delivered fiscal Q2 results with revenue, gross margin and EPS well above the high-end of our guidance range — a testament to our team’s excellent execution on pricing, products and operations. Our preeminent product portfolio positions us well to deliver a strong fiscal second half of 2024. We believe Micron is one of the biggest beneficiaries in the semiconductor industry of the multi-year opportunity enabled by AI.

Micron’s adjusted free cash flow was negative $29 million in the quarter, and the memory maker ended the quarter with $9 billion in cash and short-term investments and $13.7 billion in short- and long-term debt, translating into a net debt position. Looking to the third quarter of fiscal 2024, on a non-GAAP basis, revenue is expected to be $6.6 billion +/- $200 million, while diluted earnings per share is expected to come in at $0.45 +/- $0.07. Consensus at the time was $6 billion in revenue and $0.21 in non-GAAP diluted earnings per share, revealing increased momentum behind Micron’s business.

Micron operates in the ultra-cyclical semiconductor industry, and while the next few quarters may be robust, we’re cautious on the sustainability of the momentum and memory pricing health beyond the next few quarters, despite management’s optimism in fiscal 2025. Free cash flow has also been negative during the first six months of its fiscal year, and its net debt position precludes it from being a net-cash-rich, free-cash-flow generating powerhouse like so many other companies in the technology space. All things considered, we liked Micron’s quarterly report and outlook, but it’s not enough for us to pull the trigger on the idea for the Best Ideas Newsletter portfolio.

———-

Tickerized for MU, AVGO, WDC, STX, LRCX, ASML, KLAC, AMAT, QCOM, TXN, NVDA, ADI, INTC, AMD, NVDA.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.