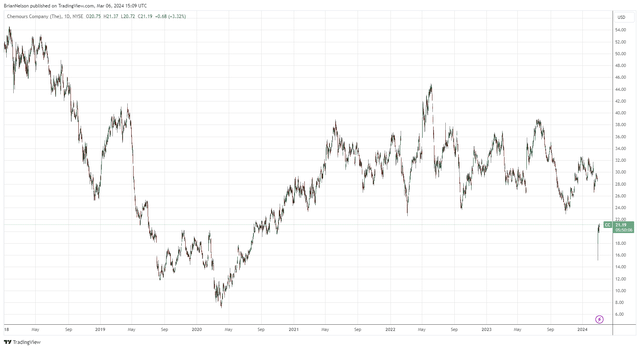

Image: Chemours stock has been pummeled recently over an accounting probe.

By Brian Nelson, CFA

A lawsuit was filed against Kimberly-Clark (KMB) on February 28, 2024, alleging that the company used per- and polyfluoroalkyl substances, commonly known as “PFAS” or forever chemicals, in a facility in Connecticut where it makes Kleenex tissues. The lawsuit claims that the chemicals could have been released into the air and seeped into groundwater as paper waste was disposed of at a local landfill. The hazards of PFAS, which do not easily break down in nature, gained significant prominence in the media of late given recent lawsuits targeting 3M (MMM). Though the outcome of any lawsuit remains uncertain, Kimberly-Clark maintains the allegations are “unfounded.” Regardless, we expect to monitor the situation closely given the implications on Kimberly-Clark’s Environmental, Social, and Governance [ESG] assessment.

On January 21, Archer Daniels Midland (ADM) noted that it had put its CFO on administrative leave as a result of accounting issues tied to intersegment transactions with respect to the company’s Nutrition reporting segment. At the time, the firm noted that it would delay both its fourth-quarter earnings release as well as its Annual Report on Form 10-K for the fiscal year 2023. ADM appointed Ismael Roig as Interim Chief Financial Officer, a 20-year veteran of the company with global financial and operating experience. At the time of the announcement, ADM lowered its outlook for adjusted earnings per share for fiscal 2023 to $6.90 (prior guidance was $7.00+ and the consensus forecast at the time of was $7.27) and withdrew its forward-looking outlook for the Nutrition segment. We continue to monitor the situation, and the bad news has undoubtedly become a black eye for the Dividend King.

DuPont (DD), Chemours (CC), and Corteva (CTVA) recently agreed to a $110 million settlement related to “PFAS” over allegations that a plastics facility polluted the environment in Ohio. Reports indicate that DuPont spinoff Chemours is responsible for half the bill, but the company’s troubles don’t end there. Chemours recently delayed its reporting for its fourth-quarter and full year 2023 results as it needed more time to evaluate “its internal control over financial reporting as of December 31, 2023, with respect to maintaining effective controls related to information and communications.” On February 26, the firm placed both its CEO and CFO on administrative leave as it works to complete an internal review, but by the end of the month, reports indicated that the “accounting issues they were made aware of two weeks ago were much worse than they had realized.” Shares of Chemours have fallen more than 40% in the past year.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.