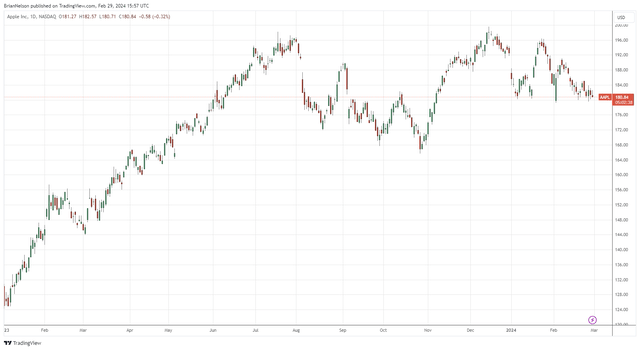

Image: Apple’s shares have done quite well since the beginning of 2023.

By Brian Nelson, CFA

When Apple (AAPL) reported calendar fourth quarter results (its first quarter fiscal 2024 results), concerns over sales in China and the momentum behind its Services business cast a cloud over results. Sales from Greater China came in at $20.8 billion in the quarter, but this was much lower than the $23.5 billion that analysts had been expecting. The company’s Services business performed well, but it also came in a bit lower than expectations, despite segment revenue and its installed base of active devices hitting all-time highs.

Revenue for its iPhone came in better than expectations in the quarter, so while there was some profit taking following the quarterly report, Apple’s bread-and-butter iPhone remains in high demand, with all eyes on the company’s launch of the Vision Pro. Apple ended 2023 with cash and marketable securities of $172.6 billion and term debt of $106 billion, good for a solid net cash position, as it hauled in $37.5 billion in free cash flow during the year. Though Apple’s results disappointed some investors at the time, we plan to continue to stick with this net-cash-rich, free-cash-flow generating, secular growth powerhouse in the newsletter portfolios.

We see three positive catalysts on the horizon for Apple. First, Apple is now shifting resources from its electric car endeavor to work on generative artificial intelligence [AI]. Though an Apple Car would have been a nice deliverable later this decade, we like the move, as it relates to future iterations of the iPhone, which will likely have varying levels of AI features. This should drive a meaningful upgrade cycle across its installed base of iPhones. Second, we think Apple’s Vision Pro is another revenue driver, and recent reports indicate that demand has been higher than expected. Third, we think the Apple Watch X, the next iteration of its wearables line-up that will likely have features to measure blood pressure and detect sleep apnea, will also drive a lot of upgrades across its installed base, in our view.

Many investors are growing concerned about Apple’s pace of top- and bottom-line expansion, but these three catalysts should keep revenue moving in the right direction in the coming years. The company’s installed base of active devices is now ~2.2 billion, a dynamic that not only reveals its potential for future upgrade cycles across its product suite, but also an opportunity to continue to push its Services revenue higher. Furthermore, strong revenue performance and growth in higher-margin Services pushed Apple’s gross margin to 45.9% in its latest quarterly results, up from 43% in the same quarter a year ago. Its first-quarter 2024 earnings per share set a record, too, climbing 16% on a year-over-year basis. Competition from Huawei Technologies in China, the trajectory of Vision Pro adoption, DOJ pressure with respect to its App Store, and its patent dispute with Massimo (MASI) in wearables are key risks, but the Apple story is far from done, in our view. We still like shares.

———-

Tickerized for AAPL, MASI, FXI, MCHI, SPY, VOO, XLK.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.