Image: Coca-Cola’s pace of price/mix expansion continues to drive strong performance.

By Brian Nelson, CFA

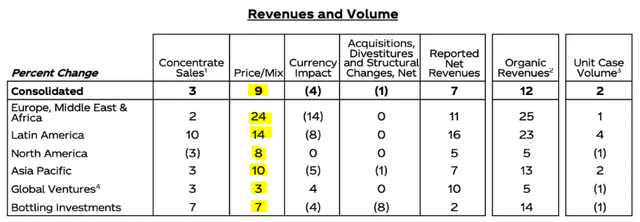

On February 13, Coca-Cola (KO) reported strong fourth quarter results that exceeded expectations on both the top and bottom lines. The standout metric in the quarter was organic revenue growth, which advanced an impressive 12% in the quarter thanks to a solid 9 percentage-point increase in price/mix and 3 percentage-point expansion in concentrate sales. The company’s outlook for 2024 was strong as well, with the company targeting organic revenue expansion of 6%-7% for the year, and we like the momentum behind Coca-Cola’s performance. The Dividend King continues to deliver for investors, and while shares are trading above our fair value estimate, investors can do a lot worse than investing in Coca-Cola, in our view.

In the quarter, net revenues advanced 7% as the company delivered price/mix strength across the board with particularly impressive increases in Europe, Middle East & Africa (+24%), Latin America (+14%) and the Asia Pacific (+10%) regions. Concentrate sales advanced in every region except North America, where the firm experienced a modest 3% decline in the quarter. Comparable currency-neutral operating income advanced 20% in the quarter. Leading the charge was the company’s Europe, Middle East & Africa region, where currency-neutral operating income expanded 50%, while the firm’s Latin America (+24%) and Asia Pacific (+18%) regions also put up a very strong showing. Non-GAAP comparable earnings per share increased 10% in the quarter, to $0.49 per share.

On a consolidated basis, unit case volume nudged 2% higher in the quarter, as strength in Mexico and Germany offset some headwinds experienced in the U.S. and Chile. Coca-Cola continues to do well in emerging markets, where Brazil and India experienced nice increases in unit case volume. What we liked most about Coca-Cola’s full-year results is the company’s cash-flow performance. The beverage giant’s cash flow from operations increased $581 million for the full year, to $11.6 billion, while free cash flow advanced $213 million, to $9.7 billion in the year. Cash dividends paid were $7.95 billion for the year, so Coca-Cola continues to generate free cash flow in excess of its cash dividend obligations, though it retains a sizable net debt position.

Looking to 2024, Coca-Cola’s organic growth is targeted in the range of 6%-7%, and the company is looking to grow currency-neutral earnings per share in the range of 8%-10% on the year, solid growth rates. We’re big fans of Coca-Cola’s business model and ability to generate significant free cash flows. The firm’s current stakes in CCEP (CCEP) and Monster (MNST) are quite valuable, offering a boost to its intrinsic value. Though Coca-Cola’s shares are not undervalued on the basis of our fair value estimate, it’s hard not to like this Dividend King, and we think it is yet another solid dividend payer worthy of consideration.

NOW READ: Stock Reports on 25 Dividend Kings to Pad Your Dividend Growth Portfolio

—–

Tickerized for KO, CCEP, MNST, KDP, CELH, FIZZ, COKE, PBJ, XLP, VDC.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.