By Brian Nelson, CFA

Dividend Aristocrat Pepsi (PEP) Raises Dividend for 52nd Consecutive Year

On February 9, Best Ideas Newsletter portfolio holding Pepsi reported mixed fourth quarter results that showed revenue pressures but a modest beat with respect to non-GAAP earnings per share. Organic revenue growth was 4.5% in the period, lower than the consensus forecast calling for 5.9% expansion, while core constant currency earnings per share increased 9%. The company experienced organic volume declines across the board in its operating divisions, with the greatest weakness coming from its Quaker Foods North America segment, where volumes fell 8%. Management seemed cautious in the quarterly press release noting that it “navigated another year of elevated levels of inflation, macroeconomic volatility, geopolitical tensions and international conflicts.” That said, Pepsi is doing a good job adjusting to changing consumer behavior following the COVID-19 pandemic, and the firm remains laser focused on managing costs. For 2024, Pepsi is targeting 4% organic revenue growth and “at least 8% core constant currency earnings per share growth,” which isn’t bad but both measures were below what the Street was expecting. The Dividend Aristocrat upped its payout 7%, and now has raised its dividend in each of the past 52 years. Though Pepsi is not an exciting of an idea as that of other names found in big cap tech and large cap growth these days, we think it fits well for diversification purposes in the Best Ideas Newsletter portfolio.

Disney’s (DIS) Cost Cuts Helping Free Cash Flow, Raises Its Dividend 50%

On February 7, former Best Ideas Newsletter portfolio holding Disney reported decent first quarter fiscal 2024 results for the period ending December 30, 2023, where revenue came in roughly flat from the prior year’s quarter, while adjusted diluted earnings per share leapt to $1.22 per share from $0.99 in the prior-year period. Free cash flow improved to $886 million in the quarter from a free cash burn of $2.15 billion in the year-ago period. In its Experiences division, the firm set all-time records for revenue, operating income, and operating margin in the quarter, and it continues to build on the momentum in this area. ESPN also achieved revenue and operating income expansion in the quarter. The firm’s Linear Networks division continues to face revenue and operating income pressure, however. Following the return of CEO Bob Iger, Disney is working hard to get its cost structure better aligned with business trends. The company noted it achieved $500+ million in overheard and operating expense savings in its fiscal first quarter and that it was on track to hit its target of $7.5 billion in annualized savings by the end of fiscal 2024. It expects its combined streaming operations to become profitable by the fourth quarter of fiscal 2024 thanks in part to domestic price increases, which was very welcome news, and growth in its Disney+ Core subscriber net additions to the tune of 5.5-6 million in the fiscal second quarter are expected. Management is now targeting fiscal 2024 adjusted earnings per share to advance by 20%+ and to generate free cash flow of ~$8 billion in the fiscal year, a nice increase from last year’s levels. Disney plans to buy back $3 billion in stock during fiscal 2024, and the firm raised its semi-annual dividend 50%, to $0.45 per share. Disney is looking much better these days, and the market rewarded the improved performance with a double-digit share price gain the day following the release of the report.

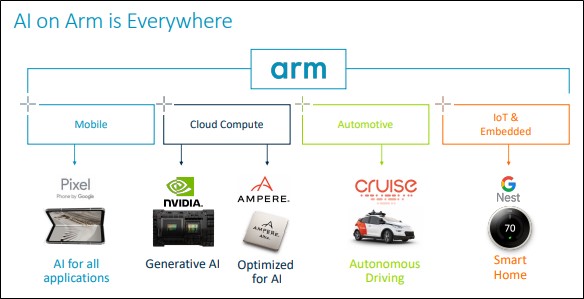

Shares of Chip Maker ARM Holdings plc (ARM) Rocket Higher, Benefiting from All Things Artificial Intelligence

Image Source: Arm Holdings plc

On February 7, ARM Holdings plc reported fantastic results for its third quarter of fiscal 2024 for the period ended December 31, 2023, where it beat the high end of its guidance range for both revenue and non-GAAP earnings per share. The company generated its highest-ever royalty revenue in the quarter as adoption of its Armv9 technology (~15% of Arm’s royalty revenue) advanced nicely and the firm continued to capture share in cloud servers and automotive. A look at ARM’s website is enough to get investors excited: “Arm compute platforms are the most power-efficient on the planet and continue to push the thresholds of performance to enable the next generation of smart, AI-capable, visually immersive, and increasingly autonomous experiences on everything from the tiniest sensors to the smartphone to the automobile and to the datacenter. This unique combination of performance and efficiency enabled Arm to change the world by fueling the smartphone revolution – and it’s the reason Arm will power every technology revolution moving forward.”

Arm noted in its shareholder letter that its business is also benefiting from “all things AI” both big and small:

Growth will be driven by the need for more energy-efficient compute and AI capability. We are seeing the demand for Arm technology to enable AI everywhere, from the cloud to edge devices in your hand. Generative AI and Large Language Models (“LLM”) need very high-performance processors. These processors need to operate within constrained energy and thermal budgets making a power-efficient computing platform essential. The most demanding AI applications are already running on Arm today, for example, NVIDIA (NVDA) recently announced that dozens of new AI supercomputers are coming online incorporating their Arm-based GH200 Grace Hopper Superchip. Key players like Dell Technologies (DELL), Hewlett Packard Enterprise (HPE), Lenovo, Quanta and Supermicro (SMCI) are among those using the GH200 to tackle some of the world’s most challenging problems. At the edge, Google (GOOG) (GOOGL) recently revealed their LLM, Gemini Nano, running on the latest Arm-based Pixel 8 smartphone, and Samsung, Vivo and Xiaomi all have announced new Arm-based smartphones that demonstrate generative AI and LLM capabilities. Some of the features include live call translation, intuitive search features such as circle to search, and advanced photo and video capabilities.

Management was very excited about its long-term growth drivers noting that it is “only at the beginning,” further saying that it expects next quarter’s revenue to set another record and come in ahead of previously announced guidance. For fiscal 2024, management is now targeting revenue in the range of $3.155-$3.205 billion (was $2.96-$3.08 billion), and non-GAAP diluted earnings per share in the range of $1.20-$1.24, up from $1.00-$1.10 previously. These are exciting times for companies leveraged to AI, and Arm Holdings plc has a strong runway of future growth in this area. Shares rocketed almost 50% on the news.

Philip Morris (PM) Expects Continued Strong Organic Revenue Growth, Shares Yield ~5.8%

On February 8, Philip Morris reported mixed fourth-quarter results that showed revenue beating on the top line, but non-GAAP earnings per share coming in slightly lower than expectations. On an adjusted basis, net revenue advanced 8.3% thanks to a 13.6% surge in smoke-free product net revenues (~39.3% of total net revenues), while operating income increased 8% and diluted earnings per share advanced 12.2% from the prior year period. What we like most about Philip Morris these days is the momentum behind its Zyn nicotine pouch product, where shipment volume in the U.S. came in at 116.3 million cans, representing incredible growth of 78.2%. Though cigarette volumes remain under pressure, the company’s purchase of Swedish Match has accelerated its transition to more smoke-free product revenue, while providing a solid basis for sustainable revenue growth. Looking ahead to 2024, management is targeting organic net revenue growth of 6.5%-8% and adjusted diluted earnings per share, excluding currency, to the range of $6.43-$6.55, which is better than the $6.01 per share mark it achieved in 2023. Operating cash flow for 2024 is expected in the range of $10-$11 billion, while capital spending is targeted at $1.2 billion, resulting in a forecasted free cash flow range of $8.8-$9.8 billion, providing a strong base to support its dividend. Shares yield ~5.8% at the time of this writing.

—–

Tickerized for PEP, DIS, ARM, TSM, AVGO, MRVL, GFS, STM, ON, LSCC, RMBS, CRUS, MPWR, NVDA, AMD, INTC, MU, DELL, HPE, SMCI, GOOG, GOOGL, LNVGY, LNVGF, SSNLF, XIACF, XIACY, PM

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.