By Brian Nelson, CFA

Back on December 19, FedEx (FDX) reported second quarter results for its fiscal 2024. Revenue fell 2.6% on a year-over-year basis, but the company was still able to drive operating income and adjusted operating income higher to the tune of 9% and 17%, respectively. FedEx’s revenue outlook for the remainder of fiscal 2024 wasn’t great, and the company now expects a low-single-digit decline in revenue from 2023 (was “approximately flat” previously). The package shipping giant, however, raised its earnings per share forecast for 2024 to $15.35-$16.85 per share before the MTM (mark-to-market) retirement plans accounting adjustments (from $15.10-$16.60 previously).

Though FedEx is an important data point for the health of the consumer, we’re not reading too much into its performance given the competitive environment. FedEx seems to always disappoint on the top line, and even its prior guidance for flattish revenue growth for fiscal 2024 is not representative of a U.S. economy that is growing at a mid-single-digit clip. For example, real gross domestic product in the U.S. advanced 4.9% in the third quarter of 2023 following a 2.1% advance in the second quarter of the year. FedEx should seem like a bellwether to the U.S. economy given the number of packages it delivers each year, but the company’s underlying performance hasn’t traditionally been a great indicator of U.S. economic health in the past.

Here is what management had to say about its most recent quarterly report:

FedEx has delivered an unprecedented two consecutive quarters of operating income growth and margin expansion even with lower revenue, clear evidence of the progress we are making on our transformation as we navigate an uncertain demand environment. We are moving with speed to make our network more efficient while delivering outstanding service to our customers through the peak season with the fastest Ground network in the industry. I am confident in our strategy as we make our global network more flexible, efficient, and intelligent.

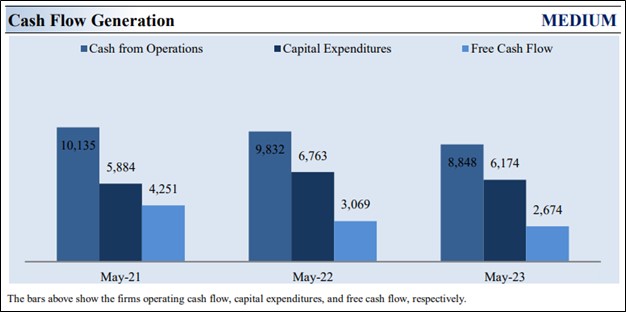

Cash Flow Dynamics

Image Source: Valuentum

FedEx’s operations are capital intensive, characterized by significant investments in aircraft, vehicles, technology, facilities, and equipment. Capital expenditures have come in at ~7% of its sales in recent fiscal years. Though FedEx is a tremendous generator of operating cash flow, its free cash flow performance has been rather volatile, and the firm has a large net debt load, but not one that investors should be overly concerned about. To help with its profitability, FedEx has driven roughly $1.8 billion in permanent cost reductions from its DRIVE transformation program, and this has helped buoy not only operating income but also free cash flow performance.

ESG Initiatives

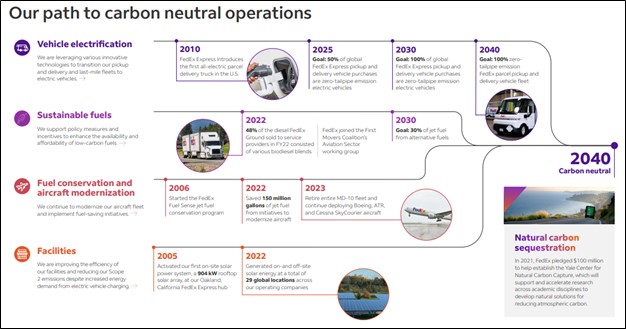

Image Source: FedEx 2023 ESG Report

Though the ebbs and flows in FedEx’s business may not be as informative to the broader U.S. economy as one might think, the company’s fleet of 700 aircraft and 215,000 motorized vehicles are still a key dynamic when it comes to assessing ESG initiatives.

Here is how FedEx is tackling key considerations of the (E)nvironment, excerpted from its 2023 ESG Report:

Our commitment to acting responsibly and resourcefully also drives our efforts to reduce our carbon footprint and build a more sustainable future. We are taking bold action to tackle climate change and invest in solutions to achieve our goal of carbon neutral operations globally by 2040. We have reduced our emissions intensity on a revenue basis by nearly 50% over the last 13 years, even as our average daily package volumes grew by 142%. We are determined to make even greater progress as evidenced by our ambitious goal.

Through our Reduce, Replace, Revolutionize strategy, our investments in three critical areas —vehicle electrification, sustainable energy, and carbon sequestration—have sparked exciting advancements. We continue to expand our zero tailpipe emissions fleet in the United States with the first-ever vehicles from General Motors’ (GM) BrightDrop, and we doubled the number of electric cargo bikes in use across Europe…

…We continuously work to reduce the environmental impact of our aircraft fleet. To help conserve fuel, we look for ways to optimize our airline routes and leverage our vast network to find lower-emission alternatives when moving goods. Since 2005, we reduced our overall aircraft emissions intensity by 27.6%, primarily because of our ongoing FedEx Fuel Sense and aircraft modernization initiatives…

…Our commitment to modernizing our aircraft fleet lowers costs, enhances reliability and operational adaptability, improves fuel efficiency, and reduces emissions intensity. Through our modernization efforts, we saved over 150 million gallons of jet fuel and avoided almost 1.5 million metric tons of CO2 in FY22.

As it relates to (S)ocial, again from its 2023 ESG Report:

Image: FedEx

We are focused on making FedEx an outstanding place to work by fostering a diverse and inclusive team that reflects our operations globally. Our diversity, equity, and inclusion (DEI) commitments are aligned with our shared culture values and guided by the absolute belief that everyone deserves to be themselves and see themselves at FedEx. To highlight one example of this belief in action, FedEx team members who identify with a minority group held 36% of U.S. management roles in FY22.

And its (G)overnance, excepted from its 2023 ESG Report:

The FedEx Board of Directors is committed to the highest quality of corporate governance. We seek to maintain a Board that reflects a wide breadth of experiences, perspectives, and knowledge in addition to a diversity of gender, race, ethnicity, and age. Of the 15 members currently comprising our Board, 33% are female, and 20% are racially or ethnically diverse. Further, 13 of the 15 directors are independent in accordance with the requirements of the New York Stock Exchange and the Board’s more stringent director independence standards.

Concluding Thoughts

FedEx’s revenue outlook for the remainder of fiscal 2024 wasn’t great, and while the company is a key input to assessing the health of the U.S. economy, we’re not reading too much into the weakness. We find that FedEx is doing a great job with respect to its ESG initiatives across the board, and while we won’t be adding it to any newsletter portfolio at this time, the company’s efforts with respect to ESG are a refreshing reminder of the companies in our coverage universe that are doing things right.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.