Image: Kinder Morgan is back on track. Image Source: Kinder Morgan.

By Brian Nelson, CFA

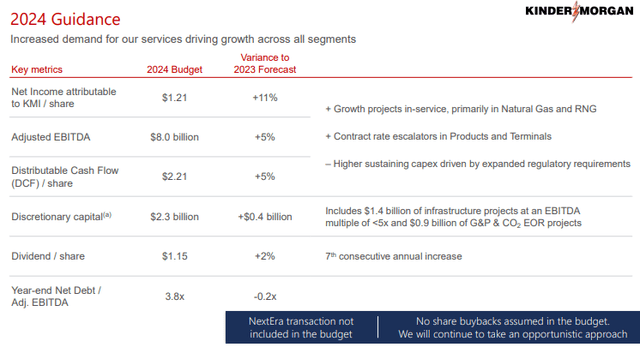

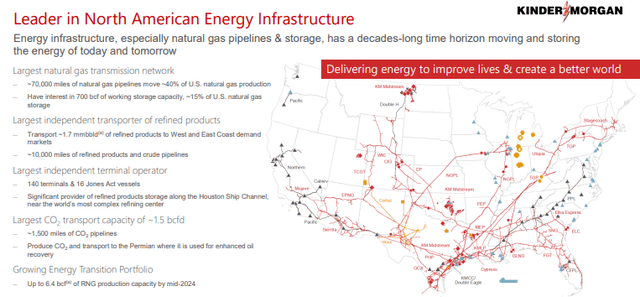

Early in December, Kinder Morgan (KMI) released financial expectations for 2024 that showed the midstream energy giant is back on track. Excluding its recent purchase of NextEra Energy Partners’ (NEP) STX Midstream assets, Kinder Morgan expects 5% expansion in adjusted EBITDA and distributable cash flow [DCF] in 2024 thanks to growth in its Natural Gas Pipelines and Energy Transition Ventures segments coupled with rate escalations across its operations.

For 2024, management is targeting its 7th consecutive year of dividend increases with a projected annualized dividend of $1.15 in 2024. Net debt-to-Adjusted EBITDA is targeted at 3.8x at the end of 2024, a level that is materially lower than its long-term target of 4.5x. We’re liking the continued improvements at Kinder Morgan in recent years. Here is what Kinder Morgan’s President Tom Martin had to say in the press release:

We expect to continue benefiting from strong natural gas market fundamentals driving growth on our existing natural gas transportation, storage, and gathering and processing assets as well as expansion opportunities. In addition, we anticipate benefitting from increased rates in our refined products businesses, demand for renewable diesel and renewable diesel feedstocks, and demand for renewable natural gas.

Our focus when it comes to the strongest income ideas rests in part on whether the company can generate traditional free cash flow, as measured by cash flow from operations less all capital spending, in excess of cash dividends or distributions paid. During 2022, for example, Kinder Morgan generated operating cash flow of ~$4.97 billion and spent $1.62 billion in total capital expenditures, resulting in traditional free cash flow of $3.35 billion, which handily covered the $2.5 billion and $116 million it paid out in dividends and distributions in noncontrolling interests over the same time, respectively.

Image: Kinder Morgan may be among the more attractive energy plays given its financial improvements in recent years. Image Source: Kinder Morgan.

Through the first nine months of 2023, Kinder Morgan generated operating cash flow of ~$4.17 billion and spent ~$1.69 billion in capital expenditures, resulting in traditional free cash flow of ~$2.48 billion, which was comfortably greater than cash dividends and distributions to noncontrolling interests of ~$1.9 billion and $121 million over the same time, respectively. The firm plans to step up capital spending in 2024, investing $2.3 billion in discretionary capital expenditures, but free cash flow should still come out more than dividends paid during the year. Kinder Morgan’s dividend is much stronger these days, and the company’s ~6.4% yield isn’t too shabby either. If Kinder Morgan can work to drive its net debt load continuously lower, we would not be surprised if it eventually makes the cut for the simulated newsletter portfolios.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.