By Brian Nelson, CFA

Stock prices and returns are a function of a company’s net cash on its books and future expectations of free cash flow. No matter what qualitative dynamic one considers in an investment, it must materialize within the discounted cash flow model to have any value. Maybe you love the management and corporate governance of a company? This may show up in a lower discount rate applied to future expected cash flows, as they may be more dependable. What about the brand of a firm? Well, the brand is implicitly valued within how much future free cash flows a company will generate. Pick another qualitative factor. Whatever it may be, it finds its way into the discounted cash flow process.

But peculiarly, one particular aspect of a company does not. The dividend is not a driver behind a company’s valuation. In fact, the dividend payment is a headwind to a firm’s intrinsic value build over time. Dividends are paid from the cash a company has on its balance sheet, and the reduction of this cash balance results in a reduction to the firm’s intrinsic value. This is why the stock price is adjusted downward by the amount of the dividend on the ex-dividend date. Let’s say, you have a $10 stock and it pays a $1 in cash dividends. You don’t have a $10 stock and a $1 in cash now. You have a $9 stock and a $1 in cash, as the free dividends fallacy explains.

The two most important components of a firm’s intrinsic value not only drive most of a firm’s intrinsic value estimate, but they also help to derive a company’s return on invested capital [ROIC], which is the pre-tax earnings generated on the net operating assets of the firm–net working capital plus net property, plant, and equipment. Some of the best companies on the market have high returns on invested capital. What this means is that they generate higher pre-tax earnings on a relatively small net operating asset base. We like to find companies that generate strong free cash flow and have modest capital spending, resulting in high incremental ROICs.

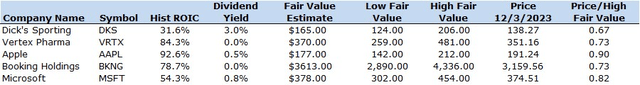

We often use a fair value estimate range in our work. What this means is that while we think a certain company may be worth our point fair value estimate, we understand that the future is inherently unpredictable and that there will be variance with respect to our forecasts as actual results come in. We provide a low fair value estimate and a high fair value estimate in order to combat the bias that is precision. After all, one should not view a stock to be worth precisely $100, but rather one should view a stock in the context of a fair value estimate range, somewhere between $80 and $120, for example. With all of this said, let’s talk about five of our favorite stocks in such a context.

Key Stats (Valuentum)

Dick’s Sporting Goods (DKS)

Dick’s Sporting Goods (DKS) reported excellent third-quarter results November 21, with its revenue advancing 2.8% from the same period last year. Comparable store sales growth of 1.7% anniversaried a solid 6.5% increase in last year’s period. The sporting goods retailer’s non-GAAP earnings per share came in at $2.85 in the quarter, up from $2.60 in the same period a year ago. The go-to firm for the athlete also upped its 2023 comparable store sales growth guidance range to of 0.5%-2% from flat-to-2% previously. It also increased its 2023 non-GAAP earnings per share target to the range of $12.00-$12.60 from the previous guidance range of $11.50-$12.30 per share. We liked the quarterly report and continue to believe that shares of Dick’s Sporting Goods are mispriced, trading at a low double-digit P/E ratio. Our fair value estimate stands at $165 per share, well above where shares are trading at the moment. The high end of our fair value estimate range suggests even more upside potential.

Vertex Pharma (VRTX)

Vertex Pharma (VRTX) remains one of the best-positioned biopharma names, boasting a lucrative cystic fibrosis [CF] franchise and potential novel therapies in acute pain management and other areas, including CRISPR gene-editing therapy. Though revenue didn’t quite come in-line with expectations in its third quarter report, released November 6, Vertex did raise its full year 2023 product revenue guidance to ~$9.85 billion as the firm will launch its CF therapy TRIKAFTA in the 2-5 age group and as its TRIKAFTA/KAFTRIO combination experiences increased demand internationally. The company’s CF franchise generates robust free cash flow, and it holds a huge net cash position on the balance sheet. The high end of our fair value estimate range stands north of $480, and we continue to like Vertex as one of our favorite ideas.

Apple (AAPL)

What can we say about Apple that has not already been said? Probably not much, but to get things going, let’s first reiterate what Warren Buffett has recently said about the name:

“The good thing about Apple is (Berkshire) can go up (in our ownership stake). They keep buying their stock; instead of our owning 5.6%, if they get down to… 15.25 billion of shares outstanding, without our doing anything we got 6%. Our criteria for Apple isn’t different than the other businesses we own; it just happens to be a better business than any we own. And we put a fair amount of money in it… and our railroad business is a very good business, but it is not remotely as good as Apple’s business. Apple has a position with consumers where they are paying $1,500 or whatever it may be for a phone, and these same people pay $35,000 for having a second car, and if they had to give up their second car or give up their iPhone, they’d give up their second car. I mean it’s an extraordinary (product). We don’t have anything like that that we own 100% of… but we’re very, very, very, happy to have 5.6% or whatever it may be percent (of Apple), and we’re delighted every tenth of a percent that it goes up.”

Second, we’ll reiterate our thoughts on the firm’s cash-based components of intrinsic value: “Total cash and marketable securities stood at ~$162.1 billion versus ~$15.8 billion in short-term debt and commercial paper and ~$95.3 billion in long-term debt. Apple has a robust net cash position at the moment, and its free cash flow generation remains sound, coming in at ~$99.6 billion for fiscal 2023.” These financials are astounding, by any measure.

We think the next upcoming catalyst for Apple is an announcement on how it may further integrate artificial intelligence [AI] into its process. We’re also waiting anxiously to hear about the next Apple ‘Watch X’ and its new functionality, and we expect its ‘Vision Pro’ to eventually be a big hit. The high end of our fair value estimate range continues to spell upside for Apple, in our view.

Booking Holdings (BKNG)

Booking Holdings reported excellent third-quarter results November 2 with revenue jumping 21.3% and non-GAAP earnings per share beating the consensus forecast. People around the world continue to book travel and accommodations as pent-up demand from the COVID-19 pandemic continues to showcase itself in Booking Holdings’ results. Gross travel bookings advanced 24% (21% on a constant-currency basis) in the quarter on a year-over-year basis, and the firm converted this strong demand into a 51% increase in net income. We like the asset-light, free-cash-flow generating nature of Booking Holdings, and we continue to believe the firm has upside potential on the basis of both our fair value estimate and the high end of the fair value estimate range.

Microsoft (MSFT)

Microsoft is another popular name, so we’re probably not going to add much new with our blurb — you can visit its webpage here — other than to say that we like the company a lot and that its recent strong performance during 2023 hasn’t curbed our enthusiasm behind the name. Quite frankly, there may be no other firm out there that is better suited to providing the world with the latest applications in AI, and Microsoft has made one of the best moves with its investment in ChatGPT. Certainly, the market is building in some excitement surrounding artificial intelligence, but Microsoft isn’t an up-and-comer. The firm’s net cash position and free cash flow generating abilities offer tremendous support for the stock to the point where AI becomes icing on the cake. We see further upside with shares on the basis of the high end of our fair value estimate.

Concluding Thoughts

The five stocks highlighted in this article generate tremendous amounts of free cash flow, have healthy balance sheets with either a net cash position or net-neutral position, generate high ROICs, and offer upside potential on the basis of the high end of our fair value estimate range. We think Apple and Microsoft are our two favorites, while Dick’s Sporting Goods may be the one true “value” play with a low double-digit P/E ratio. Vertex Pharma has tremendous long-term potential, in our view, while shares of Booking Holdings appear cheap to us. We think the risk/reward remains in favor of the long-term investor that considers these five names.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.