Image: Amazon had a very strong and better-than-expected third-quarter report, and the firm is now on pace to generate positive free cash flow during 2023.

By Brian Nelson, CFA

Value traps can do some serious long-term damage to one’s portfolio. But what is a value trap? Well, in layman’s terms, it’s a stock that looks cheap at face value using valuation multiples–the most common of which being the price-to-earnings [P/E] ratio–but the stock may actually be fully valued, or worse expensive, after considering the process of enterprise valuation (also known as the discounted cash-flow [DCF] method) and after assessing the company’s cash-based sources of intrinsic value: net cash on the balance sheet and future expected enterprise free cash flows. We’ve used the following hypothetical example before, but it bears repeating in this work to illustrate how investors can go wrong if they skip the DCF and instead rely on short-cut valuation multiples.

Let’s say a hypothetical company has 100 shares outstanding and generates $1 in earnings. Its share price is trading at $100 per share, and it has no debt and no contingent liabilities or other concerns. On the balance sheet stands $1 billion in cash, however. Would you buy this hypothetical stock for 100 times earnings? You might balk, and say “No way! Not at 100 times earnings. That’s far too expensive.”

Well, let me tell you. If you were to buy 100 shares of stock of this hypothetical company for $100 each (as in the hypothetical example), then you’d spend $10,000 for all the assets of the firm [100 shares of stock x $100 per share], and guess what? There is $1 billion of cash just sitting on the balance sheet that would be yours. As the then-owner of the company (you own all the shares), you would also own all the assets of the firm, too. Said another way, you’d be trading $10,000 [the purchase price for all the stock] for a $1 billion of cash on the balance sheet by buying all of this company’s stock at 100 times earnings. You’d also get all the company’s future free cash flows as a bonus.

The market is not this inefficient, of course, where situations like this would occur, but this hypothetical example is very important for two reasons. It shows: 1) valuation multiples can be misleading, and 2) the balance sheet is an absolutely critical component of value, often ignored…

…The stock market is not necessarily full of investors buying low P/E stocks and selling high P/E stocks, but rather it is full of investors that are selling stocks that they believe whose price is above a reasonable estimate of intrinsic value, and investors that are buying stocks that they believe whose price is below a reasonable estimate of intrinsic value. One could sell a high P/E stock because one thinks it is overvalued just because of the P/E, but the stock might not be overvalued at all. That stock could have a huge net cash position on the balance sheet just like the example above, or other valuation dynamics that are fantastic, which aren’t captured within this year’s or next year’s accounting earnings (i.e. the ‘E’ in the P/E ratio).

Warren Buffett has famously said that in similar words that ‘value’ is a component of ‘growth,’ and the term “value investing” is redundant. What he is referring to in part is how growth in future enterprise free cash flows within the DCF valuation process in part drives the value of the company–a company’s intrinsic value estimate on the basis of the stock’s cash-based sources of intrinsic value. A stock is not undervalued because it has a low P/E or a low price-to-book [P/B] ratio, but rather a stock can be considered undervalued if a reasonable DCF-derived fair value estimate is meaningfully above its share price. Likewise, a stock is not overvalued because it has a high P/E or a high price-to-book [P/B] ratio, but rather a stock can be considered overvalued if a reasonable DCF-derived fair value estimate is meaningfully below its share price. ‘Value’ and ‘growth’ are tied at the hip in this regard.

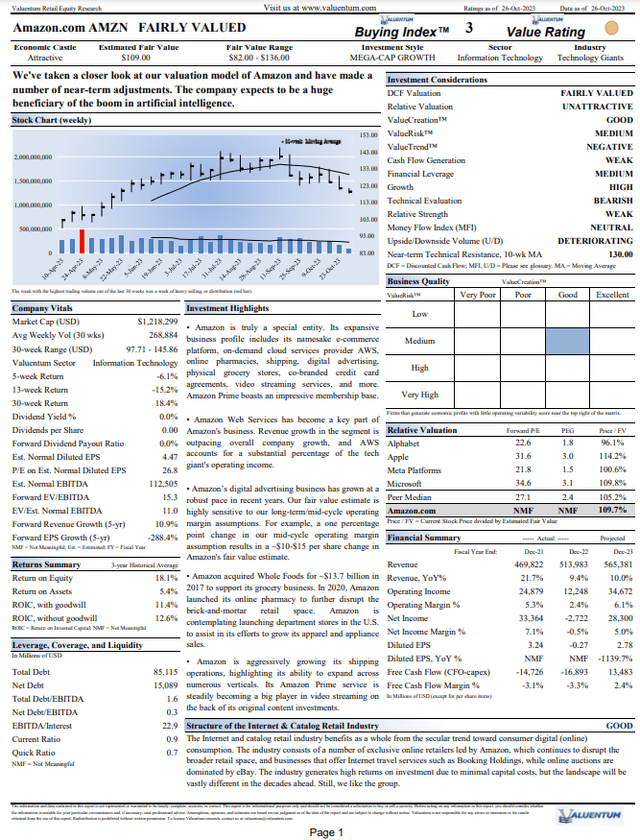

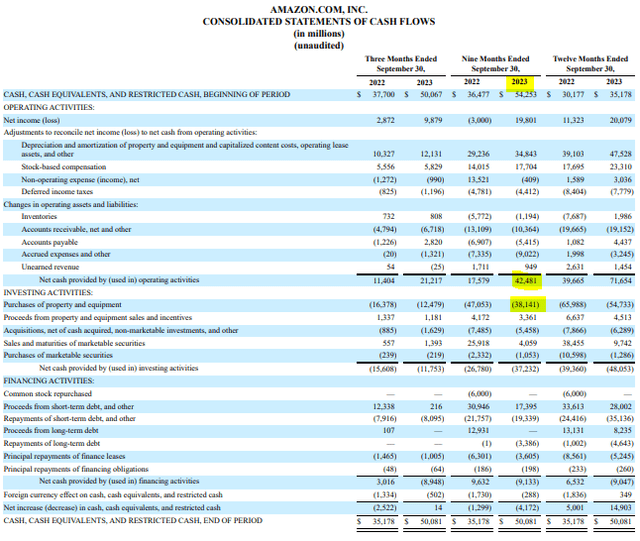

With that said, let’s have a look at the cash-based sources of intrinsic value of Amazon (AMZN), the key drivers of its fair value estimate. As reported in Amazon’s third-quarter 2023 press release, the retail giant’s “free cash flow improved to an inflow of $21.4 billion for the trailing twelve months, compared with an outflow of $19.7 billion for the trailing twelve months ended September 30, 2022.” Cash and marketable securities were ~$64.2 billion at the end of its third quarter compared to ~$61.1 billion in long-term debt, meaning that Amazon has a modest net cash position, but nothing near the likes of other big cap tech and large cap growth peers. All eyes will continue to be on Amazon Web Services [AWS] and its growth trajectory, but when it comes to the cash-based sources of intrinsic value, Amazon is back on the right track.

Please select the image below to download its 16-page stock report.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.