By Brian Nelson, CFA

On October 17, Dividend Growth Newsletter portfolio holding Lockheed Martin (LMT) reported decent third-quarter 2023 results with the firm growing revenue roughly 1.8% on a year-over-year basis, and the firm beating the consensus estimate for non-GAAP diluted earnings per share. We like Lockheed as our aerospace and defense exposure more than Boeing (BA), given the latter’s long list of troubles and deteriorated financial health, punctuated in part by troubles during the height of the COVID-19 pandemic and loss of life related to its 737 MAX platform. We think Lockheed offers a much better risk/reward and a healthy dividend to boot. Lockheed Martin yields ~2.8% at the time of this writing.

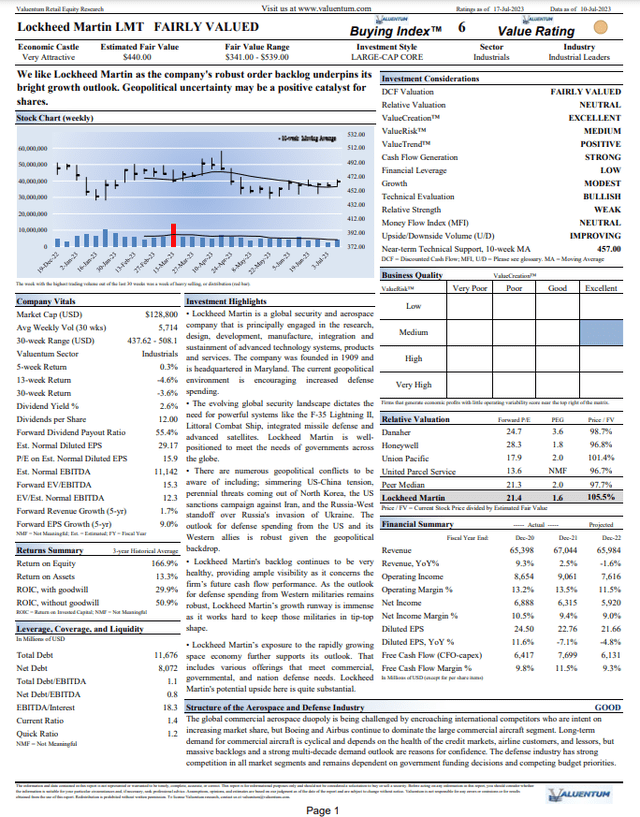

When Lockheed reported third-quarter results, the firm reiterated its outlook for 2023, with net sales expected in the range of $66.25-$66.75 billion and diluted earnings per share in the range of $27.00-$27.20 for the year, both roughly in line with what the Street was expecting. Our fair value estimate of Lockheed stands at $440 per share, about in line with where shares are trading, and we’re okay with its share buyback program, the authorization of which was recently increased $6 billion, to $13 billion. With geopolitical tensions around the globe on the rise, Lockheed is in a good position to continue to build upon its $156 billion backlog, as it generates robust free cash flow to fuel dividend increases. We won’t be making any changes to our valuation model of Lockheed Martin at this time, and we continue to like this dividend growth idea for long-term investors.

Please select the image below to download its 16-page stock report.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.