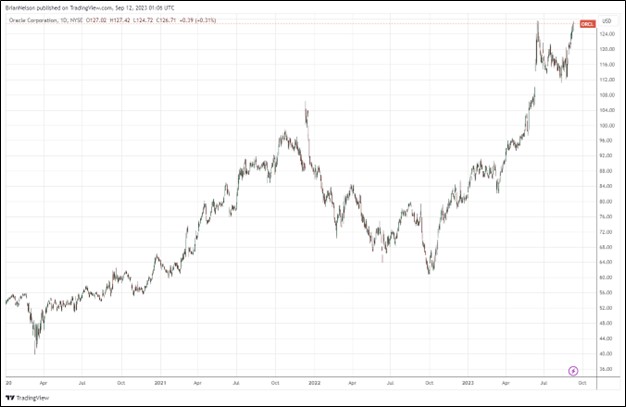

Image: Oracle’s shares may have sold off aggressively during the trading session September 11, but they have done quite well as a member of the Dividend Growth Newsletter portfolio.

By Brian Nelson, CFA

On September 11, Dividend Growth Newsletter portfolio holding Oracle Corp. (ORCL) reported first-quarter fiscal 2024 results that missed expectations modestly on the top line. Shares tumbled aggressively during the trading session September 12, but we think most of the sell-off is just profit taking. Prior to the report, Oracle’s shares were up more than 50%, while they are up over 64% during the past year. The high end of our fair value estimate stands at $136, while the firm yields ~1.3% on a forward estimated basis.

During the company’s first quarter of fiscal 2024, revenue advanced 8.7%, while cloud revenue and cloud infrastructure revenue increased 29% and 64% in constant currency, respectively. Clearly, these are fantastic growth rates, but the market had been expecting more. Non-GAAP operating income advanced 12% in constant currency, while the company’s non-GAAP operating margin came in at 41%. Impressively, operating cash flow leapt 9% while free cash flow increased 21%. Though the quarterly results may not have pleased the Street, we were happy with the free cash flow performance, and Oracle is off to a great start to its fiscal year.

Management had the following to say about revenue acceleration on the call:

From a financial standpoint, we see this customer and partner ecosystem as a leading indicator of our income statement. I’ve been talking with you about our revenue acceleration for some time now. In Q1, our remaining performance obligations or RPO, climbed to nearly $65 billion, with the portion excluding Cerner, up 11%. We have now signed several deals for OCI greater than $1 billion in total value. In the first week of Q2, we booked an additional $1.5 billion in business, which isn’t even included in the Q1 numbers. Approximately 49% of total RPO is expected to be recognized as revenue over the next 12 months. My point here is that customer momentum is continuing to build. This momentum is turning into bookings and that gives me the confidence that our annual revenue growth will continue to accelerate moving forward.

All things considered, it’s difficult to be unhappy with the types of growth rates that Oracle is putting up these days. Nevertheless, the market used Oracle’s first-quarter 2024 results as an excuse to take some profits. We still like Oracle’s long-term potential, especially with respect to the cloud and artificial intelligence [AI], and its free cash flow performance remains solid. Though the pullback in shares today wasn’t great, we think Oracle has the momentum behind its business to hit the high end of our fair value estimate range of $136 per share.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.