By Brian Nelson, CFA

Home Depot (HD) is one of the most resilient companies across the retail arena. The firm weathered the Great Financial Crisis [GFC] well and it handled the vicissitudes of the COVID-19 pandemic and aftermath flowingly as it juggled supply chain issues, changing consumer buying preferences, and increased demand as consumers remodeled and upgraded their working and living spaces while cocooning at home. The company’s second-quarter 2023 results, released August 15, came in better than expected, but comparable store sales fell 2% both in aggregate and in the U.S. Though comparable store sales declines improved from bigger declines in the first quarter, Home Depot’s guidance for comparable sales to fall 2%-5% for all of fiscal 2023 indicates there may be some further year-over-year weakness ahead. We’re sticking with Home Depot in the Dividend Growth Newsletter portfolio, however.

With 30-year mortgage rates advancing to ~7.51%, according to Bankrate, home buyers and real estate investors continue to be cautious, and while rising borrowing costs have not impacted housing prices negatively (yet), we may be seeing some reverberations in the home improvement market as homeowners slow down the pace of big investments in their homes. The COVID-19 pandemic served as a huge catalyst for home improvement spending, pulling some demand forward, so many that pored thousands of dollars into remodeling efforts during the pandemic to expand working and living space don’t have as much need for large upgrades at the present moment. That said, Home Depot noted that it continues to experience strength in categories associated with smaller projects but spending on bigger-ticket discretionary categories has faced pressure. 2023 may be a slow year for Home Depot, but the long term remains bright as consumers will continue to prefer larger living and working spaces, in our view, having cocooned at home throughout most of the COVID-19 pandemic.

For the second quarter, Home Depot’s total net sales dropped 2%, while operating income fell 8.6%. Net earnings dropped 9.9% in the period, while buybacks slowed the year-over-year declines in diluted earnings per share to 7.9%. The drop in net earnings and diluted earnings per share on a year-over-year basis was slightly worse than the pace that Home Depot experienced during the first quarter of this year. The number of customer transactions fell 1.8% on a year-over-year basis in the second quarter, while average ticket prices were about flat from the same period a year. Home Depot retains a large net debt position, something we’re not huge fans of, but free cash flow has surged during the first six months of the year, as working capital movements have been favorable. Net cash from operations increased to ~$12.2 billion from ~$7.18 billion during the first half of the year, while capital expenditures nudged up modestly to ~$1.7 billion from ~$1.5 billion in last year’s period. For the first six months of 2023, free cash flow came in at ~$10.5 billion, up materially from ~$5.74 billion in the same period a year ago.

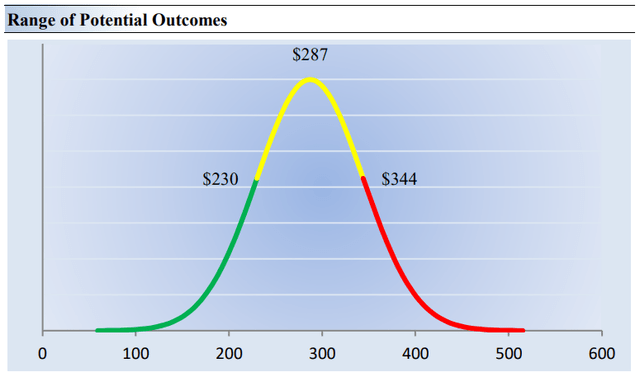

Image: Our fair value estimate range of Home Depot. Shares of Home Depot are trading at the high end of the range at ~$325 per share at the time of this writing.

All told, Home Depot’s quarterly results were fine, and we continue to like the world’s largest home improvement retailer for the long haul. The performance did show weakness in bigger ticket items, which may be concerning for more discretionary purchases across the broader retailing space, but overall July retail sales reported by the Commerce Department remained strong, coming in at a 1% increase, excluding autos, better than the consensus forecast. Home Depot authorized a new $15 billion buyback program, which should continue to support its stock, and while shares are trading near the high end of our fair value estimate range, we won’t be making any changes to its position in the Dividend Growth Newsletter portfolio. The company has a forward estimated dividend yield of ~2.5% at the time of this writing.

NOW READ: A Market Pullback Should Be Expected; Focusing on Generating Alpha

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Tickerized for holdings in the XHB.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.