Image Source: Public Storage

By Brian Nelson, CFA

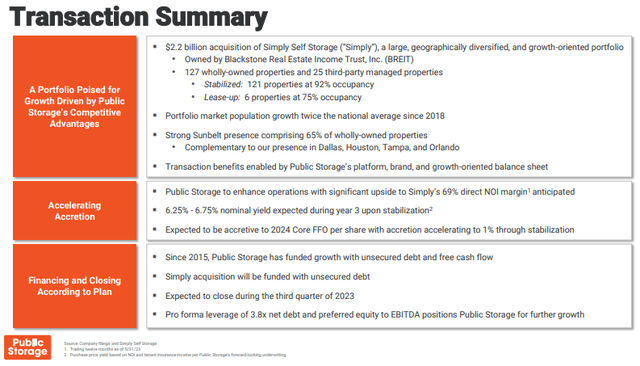

On July 24, Public Storage (PSA) announced that it had agreed to acquire Simply Self Storage from Blackstone (BX) Real Estate Income Trust (BREIT) for $2.2 billion.

The news follows the Public Storage-Life Storage (LSI) takeout saga that ended with Life Storage running to Extra Space Storage (EXR) for a deal. A PSA-LSI deal had made a lot of sense, and we’re not sure why LSI wanted nothing to do with PSA, but it may have had to do with a poor cultural fit. LSI apparently said it wasn’t for sale right before it tied the knot with EXR–moves that just didn’t seem to add up, in our view.

In any case, we’re glad PSA walked away from a possible “winner’s curse” had it pursued LSI, and we’re largely indifferent to the smaller transaction regarding Simply Self Storage. Here’s more about Simply Self Storage:

The [Simply Self Storage] portfolio comprises 127 wholly-owned properties and 9 million net rentable square feet that are geographically diversified across 18 states and located in markets with population growth that has been approximately double the national average since 2018. Approximately 65% of the properties are located in high-growth Sunbelt markets. During BREIT’s ownership period, Blackstone made investments into the Simply platform that enabled the company to enhance the quality of the portfolio and management team, and ultimately significantly increased Simply’s net operating income.

Rolling up self-storage facilities and leveraging cost savings across a larger combined portfolio has been working great for Public Storage given the success behind the REIT’s aggressive, opportunistic growth strategy, which has put ~55 million of additional net rentable square feet in its portfolio since 2019. CubeSmart (CUBE) and National Storage Affiliates (NSA) are other self-storage REITs that may eventually throw their hats into the M&A ring, too.

Among the REIT sub-sectors, we continue to favor the self-storage space mostly because its traditional free cash flow dynamics are much more attractive. Self-storage REITs are generally recession-resistant, too, offer high operating margins, and generally lower maintenance capital requirements. Public Storage is our favorite self-storage REIT and yields ~4.1% at the time of this writing. Shares of PSA have advanced nearly 8% year-to-date in 2023.

NOW READ: Extra Space Storage Pursues the Winner’s Curse; LSI Shareholders Should Take the Money and Run (pdf)

NOW READ: Why Are the Dividends of REITs So Risky?

NOW READ: The Impact Rising Interest Rates Have on Equity REITs

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.