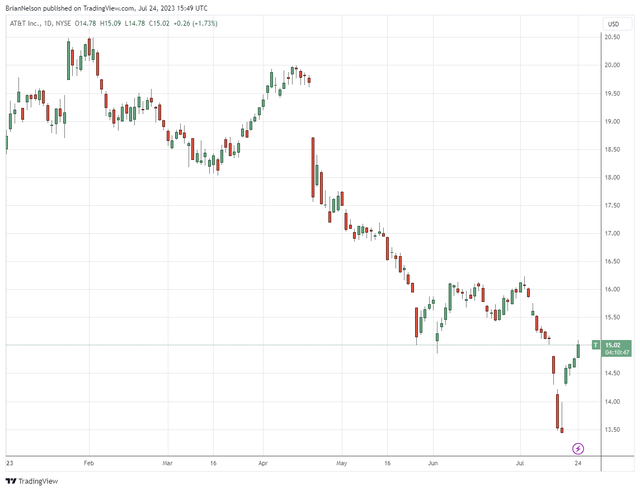

Image: AT&T’s shares continue to disappoint.

By Brian Nelson, CFA

There are sometimes reasonable risks to take with respect to new ideas, and AT&T (T) may have been one of them a few years ago. But not today, in our view. We removed the company from the High Yield Dividend Newsletter portfolio way back in November 2021, and we’re not looking back. The company has been struggling for a long time now, and we don’t think the future is very bright. Another dividend cut cannot be ruled out.

AT&T’s dividend story has been a very convoluted one. When the company filed its 2020 Annual Report in February 2021, CEO John Stankey noted that the executive team would support the dividend. Shortly thereafter, the company rightsized its dividend payout when it spun off Warner Bros. Discovery (WBD). Many income-oriented investors felt burned by the strategic change, and we were highly disappointed, too.

Right now, the market has grown concerned about potentially toxic lead-covered cables, which has created a potential contingent liability for the firm at a time when free cash flow is already under pressure while its massive net debt position remains ominous. According to the Wall Street Journal, as reported by CNN, “telecom firms including Verizon (VZ) and AT&T have left more than 2,000 lead-coated cables from the legacy Bell System’s telephone network in the U.S. ground and water and on transmission poles, leaving Americans potentially at risk of health complications related to lead exposure.”

This story reminds us of the troubles related to Johnson & Johnson’s (JNJ) talc liabilities as well as 3M’s (MMM) forever chemicals and ear plugs. We’re not interested in AT&T at all and believe that shares may remain under significant pressure until 1) material top-line growth resumes, 2) the firm’s capital-intensity lessens, 3) free cash flow improves significantly, 4) dividend increases resume 5) its leverage improves and 6) there is more visibility related to the potential contingent liabilities associated with lead-covered cables. We doubt all six of these things will happen, and therefore we believe the best days are likely behind AT&T.

Order the monthly ESG Newsletter >>

———-

NOW READ: Stock Report Updates

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.