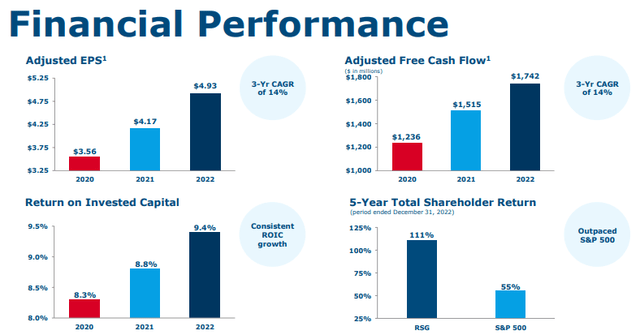

Image: Republic Services has been executing nicely, growing its adjusted free cash flow at a 14% compound annual growth rate the past three years. Image Source: Republic Services

By Brian Nelson, CFA

Things are looking good at garbage hauler Republic Services. (RSG). The company reported fourth-quarter 2022 results a couple months ago that showed revenue growth of 19.7% and non-GAAP earnings per share of $1.13. Both numbers came in better than expected. Roughly 8.3 percentage points of the firm’s top-line expansion in the quarter came organically, with core price comprising 7.4 percentage points of the organic increase. For the full year, Republic Services beat its guidance that called to grow adjusted free cash flow 15% and adjusted earnings per share 18%.

Republic Services benefits significantly from its long-term disposal assets as these operations grow more attractive as time passes thanks to the increasing regulatory nature of the waste business, as well as citizen groups opposed to greenfield sites growing in number and strength. These disposal assets, including its Apex landfill in Nevada, which is the busiest facility of its kind in the US, represent the material barriers to entry that give the company a large portion of its moaty characteristics. Republic operates an essential business and roughly 80% of its revenue has an annuity-type profile.

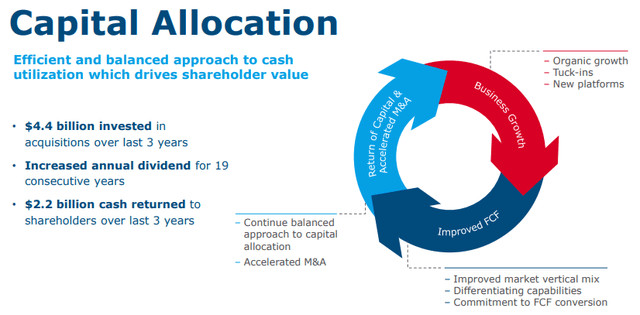

We continue to monitor the integration of the Republic Services’ acquisition of U.S. Ecology, which remains on track. For 2023, Republic Services is targeting revenue in the range of $14.65-$14.8 billion and adjusted free cash flow in the range of $1.86-$1.9 billion, up from $1.742 billion in 2022. We expect Republic Services to continue to price services in excess of inflation, with average yield growth targeted at 5.5%-6.5% during 2023. Such pricing strength should provide support for continued dividend increases in the coming years, and we expect the firm to add to its already very attractive near 20-year consecutive annual dividend increase track record.

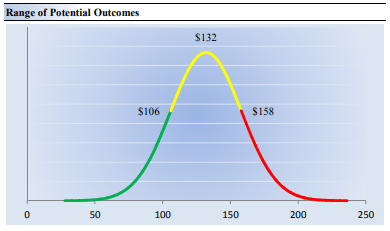

Image: We view valuation as a range of probable fair value outcomes derived by the uncertainty of future expected free cash flows. The high end of our fair value estimate range of Republic Services is $158 per share.

On the basis of our discounted cash-flow derived valuation process, we think Republic Services is worth $132 per share with a fair value estimate range of $106-$158 per share. The margin of safety around our fair value estimate is driven by the company’s LOW ValueRisk rating. Our near-term operating forecasts in our valuation model, including revenue and earnings, do not differ much from consensus estimates or management guidance. The trash-taking space is a largely predictable industry, so we wouldn’t expect any large beats or misses.

Republic Services is growing at a very nice clip at the moment, and we forecast a compound annual revenue growth rate of 8.3% during the next five years, as well as a 5-year projected average operating margin of 18.5%, which is above Republic Services’ trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3.4% for the next 15 years and 3% into perpetuity. For Republic Services, we use an 8.7% weighted average cost of capital to discount future free cash flows, which is slightly lower than that of the average firm in our coverage universe.

Image Source: Republic Services

Shares of Republic are trading about in line with our fair value estimate ($130-$135) but have valuation upside on the basis of the high end of our fair value estimate range ($158 per share), in our view. The company boasts an investment-grade credit rating and has liquidity of ~$1.7 billion, while most of its debt doesn’t come due until after 2029. Republic Services’ equity is currently yielding ~1.5% at the moment, and we think it is a great fit for the newsletter portfolios. The garbage hauler continues to deliver in both good times and bad, and we have no reason to believe that it won’t continue to do so. Trash is cash when it comes to the waste-management business.

Tickerized for RSG, WM, WCN, CWST, SRCL, EVX, USMV, CLH, CVA, DAR, VEOEY, SZEVY, ENGIY

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.