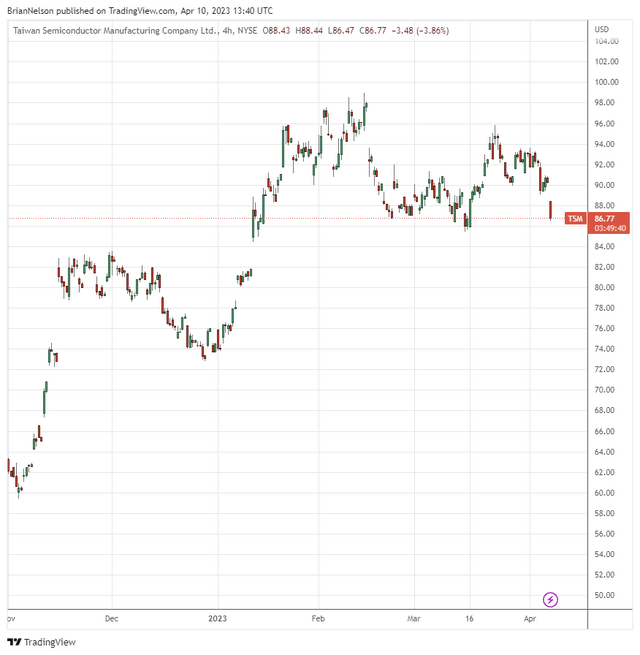

Image: Taiwan Semiconductor’s shares have rallied nicely since the beginning of November of last year.

By Brian Nelson, CFA

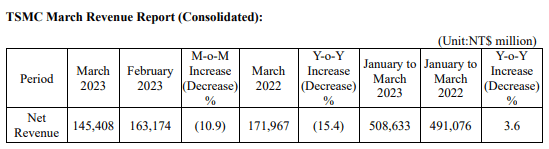

Taiwan Semiconductor (TSM) reported March revenue on April 10. During the month, net revenue dropped nearly 11% on a sequential basis and more than 15% on a year-over-year basis from March 2022. Though the top-line weakness in the month was somewhat of a surprise, the company’s revenue advanced 3.6% during the first quarter of this year.

The Taiwanese chip fabricator is an idea for the risk-seeking investor that is looking for exposure to the semiconductor space. The company pays a decent dividend yield, and the high end of our fair value estimate for shares stands at $90 per share. Taiwan Semiconductor’s equity is trading in the mid-$80s at the time of this writing.

Image Source: Taiwan Semiconductor

Whether it be a result of China’s relations with Russia given the latter’s involvement in the Ukraine war, its general lack of recognizing intellectual property rights, the country’s relations with Taiwan, and the perceived quality and independence of its accounting and ownership structures for Chinese ADRs (American Depository Receipts), Sino-American geopolitical tensions continue to escalate.

Taiwan Semiconductor remains at the center of such tensions, and the firm is working with the Biden administration for guidance on the CHIPS Act, which is focused on boosting “American semiconductor research, development, and production, ensuring U.S. leadership in the technology that forms the foundation of everything from automobiles to household appliances to defense systems.”

Micron (MU), Qualcomm (QCOM) and GlobalFoundries (GFS) have already taken strides in investing in American manufacturing since the passing of the act, while Taiwan Semiconductor is currently constructing a plant in Arizona.

We continue to like the long-term opportunities at Taiwan Semiconductor, and while shares have surged since the beginning of November 2022, we’re not ignoring the myriad risks, especially as revenue performance deteriorated meaningfully in March. The company remains an idea in the ESG Newsletter portfolio.

Tickerized for TSM, MU, QCOM, GFS, INTC, SSNLF, ADI, NXPI, QRVO, SWKS, TXN, MPWR, ON, WDC, AVGO

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.