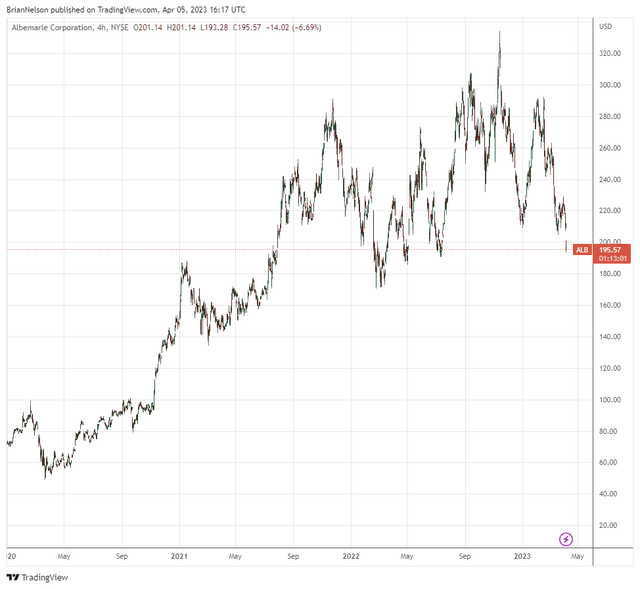

Image: Albemarle’s shares have faced pressure as lithium prices are expected to moderate in the near term. We continue to like Albemarle’s long-term story, however.

By Brian Nelson, CFA

On March 27, it became public that lithium maker Albemarle (ALB) is looking to bolster its future opportunities on the acquisition front, seeking to scoop up a smaller Australian lithium start-up Liontown Resources (LINRF). Though Liontown rejected the offer, other lithium stocks, including Standard Lithium (SLI), Sigma Lithium (SGML), Piedmont Lithium (PLL) and Lithium Americas (LAC) soared on the news.

According to the firm’s website, Liontown’s project in Western Australia in Kathleen Valley is expected to be one of the world’s largest lithium mines, “supplying ~500,000 tonnes of 6% lithium oxide concentrate per year when it comes on stream in 2024.” Another of its prospects is also located in Western Australia (Buldania), which has a “mineral resource estimate of 15 million tonnes of 1.0% lithium oxide.” We continue to monitor developments on this front.

Though lithium prices have faced some pressure and may continue to do so based on the futures curve, Albemarle is fantastically positioned, in our view. We liked its long-term outlook released in January 2023. For 2023, Albemarle is targeting net sales in the range of $11.3-$12.9 billion and adjusted diluted earnings per share in the range of $26.00-$33.00. Cash flow from operations in the year is targeted at $2.1-$2.4 billion, while capital spending is targeted at $1.7-$1.9 billion, implying positive free cash flow on the year.

As we noted in that prior note, by 2027, things are expected to get even better for Albemarle, especially for free cash flow which is expected to be $2.6-$2.7 billion thanks to tremendous sales and adjusted EBITDA expansion. Over the next five years, revenue is expected to expand at a 19%-21% CAGR while adjusted EBITDA is expected to reach $7.2-$8.4 billion, up from $4.2-$5.1 billion in 2023 and $3.44-$3.49 billion in 2022. We’ll be monitoring lithium prices closely but maintain our belief that Albemarle remains one of the best ways to play the space. Our fair value estimate stands at ~$260 per share.

Albemarle’s 16-page Stock Report (pdf) >>

Albemarle’s Dividend Report (pdf) >>

Also tickerized for SQM, LTHM, LIT.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.