Image: The market-cap weighted S&P 500 (SPY) bounced off technical support last week, both the 200-day moving average as well as the breakout of the downtrend line, but while this may push off any leg down in the near term, we won’t hesitate to “raise cash” on a few newsletter portfolio names if a breakthrough of support to the downside happens. Image Source: TradingView

By Brian Nelson, CFA

The 200-day moving average remains a key technical level for the market-cap weighted S&P 500. The risks that the market may break through both the 200-day moving average and the breakout of the technical downtrend line remain elevated, but the past week showed a successful test of technical support levels, in our view, and that means to us markets may avoid any substantial leg down for the time being. We continue to be cautious on the equity markets in the near term, and we won’t hesitate to “raise cash” across the newsletter portfolios if the S&P 500 breaks through its 200-day moving average and the breakout of the technical downtrend line.

Why are we still concerned about the markets in the near term when it looks like a technical bottom has been carved out and reinforced? For starters, the forward 12-month P/E ratio on the market stands at ~17.5, which is still rather high, particularly in the current environment where rates are normalizing to long-run averages. The 10-year Treasury yield stands at ~3.91% after hitting north of 4% last week. The 30-year fixed mortgage rate stands at 7.08%, while the 15-year fixed mortgage stands at 6.22%. After years of loose financial conditions, things have tightened up quite a bit, and there is still risk to the market P/E ratio. The 10-year rate, in particular, is inversely correlated to stock and bond values.

The fourth quarter of 2022 wasn’t great for S&P 500 companies. According to FactSet, “the blended earnings decline for Q4 2022 was -3.3%,” which was “the first time the index has reported a year-over-year decline since Q3 2020 (-5.7%).” There were some big misses during the quarter, including disappointments from Goldman Sachs (GS) and Intel (INTC), but for the most part, fourth-quarter 2022 earnings season was better than feared. The big reason for the resilience in fourth-quarter 2022 earnings came from the energy sector (XLE), where earnings expanded roughly 55%-60% on a year-over-year basis. We don’t view the energy sector as a great place to put long-term capital, but 2022 marked a great year for a “trade,” and we hit the ball out of the park in that regard.

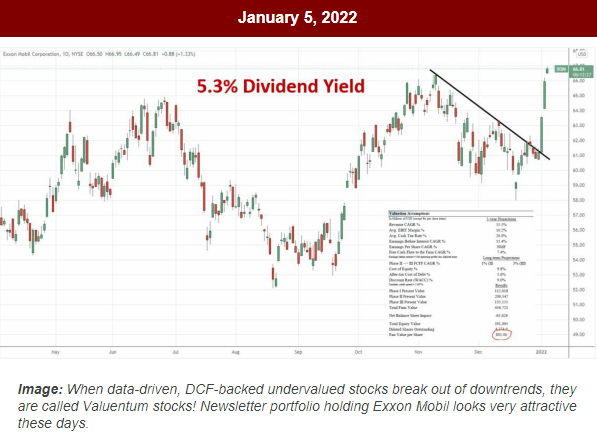

We were very bullish on the energy sector at the start of 2022 (more than 14 months ago now), and this view became the biggest source of “alpha” last year. We not only included energy giants Exxon Mobil (XOM) and Chevron (CVX) in the newsletter portfolios – the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio – but we pounded the table on Exxon Mobil, in particular. At the close on January 5, 2022, for example, Exxon Mobil was trading at ~$67 per share, and now shares are trading north of $112 each. Here is the email notification we sent to members early last year, “ALERT: XOM Is A Valuentum Stock with A Hefty Dividend Yield! on January 5, 2022 (more than a year ago) — note the image is from January 5 of last year:

Image: We highlighted Exxon Mobil to start 2022, and the stock was one of the best performers in the S&P 500 last year. Exxon Mobil was a “Valuentum” stock last year, with shares being undervalued, exhibiting a strong technical breakout, and sporting an attractive dividend yield to boot. The stock became a huge winner.

Fast forward to today, with shares of Exxon Mobil and Chevron having surged in the newsletter portfolios, we’re now considering “taking profits” on these equities. We’re also looking to remove Johnson & Johnson from the newsletter portfolios, as the firm is planning to spin-off its Consumer Health division, which will be named Kenvue (KVUE). We don’t like the added complexity at JNJ these days and believe management may be distracted somewhat. Importantly, however, we’re not making any changes to the newsletter portfolios at this time, but these three names—XOM, CVX, and JNJ—are a “source of cash” in the event that the markets breakthrough the 200-day moving average and the breakout of the technical downtrend line. With that backdrop set, let’s cover a number of companies that we’re watching today.

- With the FTX catastrophe and the Securities and Exchange Commission (SEC) cracking down on the sale of unregistered cryptocurrency securities, it has become extremely difficult for companies to operate in the crypto space. Also in January 2022, we highlighted Silvergate Capital Corp. (SI) as a short-idea consideration in the Exclusive publication at $128.49 per share, and now the company is trading at $5.38 per share. We previously “closed” that idea in the Exclusive publication for a huge “gain,” and shares have continued to plummet. We continue to urge caution if investors are interested in investing in crypto-related equities. With a market capitalization now less than $200 million, the risk of Silvergate liquidating has surged in light of its delayed 10-K filing due to concerns about the “evaluation of the effectiveness of the company’s internal control over financial reporting.”

- Dollar General (DG), despite the word “dollar” in its name, is not a dollar-store in the traditional sense and operates more like a discount retailer, which is still a great place to be, but perhaps not as well-positioned as a Dollar Tree (DLTR), for example–the latter up 4% year-to-date, while Dollar General has fallen more than 11% year-to-date. We think even wealthy consumers are trading down in the current inflationary environment, but the biggest winner, in our view, is not Walmart’s (WMT) Sam’s Club or Costco (COST), but rather the German discount chain Aldi. On February 23, Dollar General reported preliminary fourth-quarter results that came in slightly below internal expectations. Same-store sales growth for Dollar General during the fourth quarter of 2022 came in at 5.7%, which was modestly below its target range of 6%-7%. Fourth-quarter 2022 earnings per share is now expected in the range of $2.91-$2.96 compared to prior expectations of $3.15-$3.30. Dollar General will report full financial results on March 16, 2023.

- Norfolk Southern (NSC) had another train derailment this past weekend on March 4 in none other than Ohio, if you can believe it. According to reports, “derailment of about 20 cars of a 212-car train happened as it was traveling southbound near Springfield (Ohio).” Unlike the February 3 derailment in East Palestine, Ohio, that released a considerable amount of toxic chemicals, it is reported that Norfolk Southern’s management said no injuries have been reported and that no hazardous materials were involved (though power outages seem to be prevalent in the area). The railroad industry continues to be in the news of late, with Union Pacific (UNP) recently catching a bid on the departure of its CEO and GATX Corp (GATX) being implicated as the owner of the railcar that likely caused the derailment in East Palestine. Though the railroads have strong business models, we’re going to steer clear of the space for now. There are so many other areas out there that are of greater interest.

- The hype surrounding artificial intelligence continues, and perhaps the poster child for market speculation in this area remains C3.ai (AI), which even has the ticker symbol AI. The company’s market capitalization stands at ~$3.2 billion, so the equity continues to ebb and flow with capital moving in and out of the name. Though shares of C3.ai are up ~25-30% during the past 52 weeks, they have soared nearly 170% year-to-date, attracting a significant amount of aggressive growth and quantitative momentum capital. The company reported $66.7 million in revenue during its third-quarter fiscal 2023 results, released March 2, a level that fell 4.5% on a year-over-year basis. C3.ai reported a non-GAAP loss per share of -$0.06, and while the number was a lower-than-expected loss, the quarter was hardly anything to write home about. We continue to like Microsoft (MSFT) as our favorite play on artificial intelligence, “Microsoft Is Betting Big on Artificial Intelligence (AI); Fiscal Q2 Shows Meager Revenue Growth, Weaker Cash Flow Generation (Jan 25, 2023),” but we can’t rule out a continuation of the speculative frenzy in small-cap AI-related names.

Concluding Thoughts

Markets have bounced off key technical support levels, and this should prevent any big leg down in the near term. However, a still-lofty market P/E ratio and challenged earnings growth remain ominous fundamental trends, while a still-strong labor marker and stubborn inflation readings mean the Fed will continue along its path of raising the federal funds rate, in our view. We’ll be looking to shed Exxon Mobil, Chevron, and Johnson & Johnson from the newsletter portfolios in the near term and would take the opportunity to do so if the markets break through the 200-day moving average and the breakout of the technical downtrend line. Let’s enjoy this rally for now, but we think the markets will be testing key technical support levels again in the not-too-distant future.

Tickerized for SPY, DIA, RSP, QQQ, HOOD, COIN, MSTR, INTC, GS, XLE, CVX, XOM, KVUE, JNJ, GBTC, SI, COST, WMT, DG, DLTR, COST, NSC, GATX, UNP, MSFT, AI, SIVB, SBNY, KBE, XLF

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.