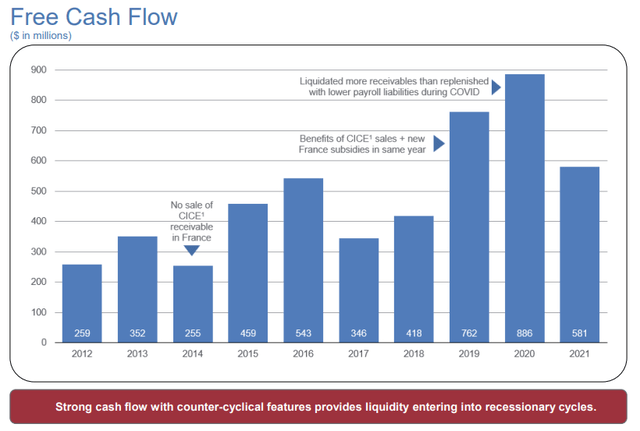

Image: Manpower Group is a tremendous generator of free cash flow, though performance can be lumpy at times. Image Source: Manpower Group

By Brian Nelson, CFA

Manpower Group (MAN) continues to be a fantastic free cash flow story, and we think shares have upside potential on the basis of our discounted cash-flow-derived fair value estimate of $100 per share. Manpower Group is a global workforce solutions company, and it helps to find employment for millions of job seekers every year. It works with companies in the Fortune 100 as well as small- and medium-sized companies, too.

We’re highlighting Manpower Group because it stood out in our data screener as it relates to a non-energy equity with an outsized free cash flow yield. During 2021, for example, Manpower Group generated free cash flow of $580.6 million, which is good for an impressive 12.9% free cash flow yield on the basis of its current market capitalization of ~$4.5 billion. Through the first nine months of 2022, Manpower Group hauled in $233.3 million in free cash flow, which handily covered its cash dividends paid over the same time period of $71.2 million, too.

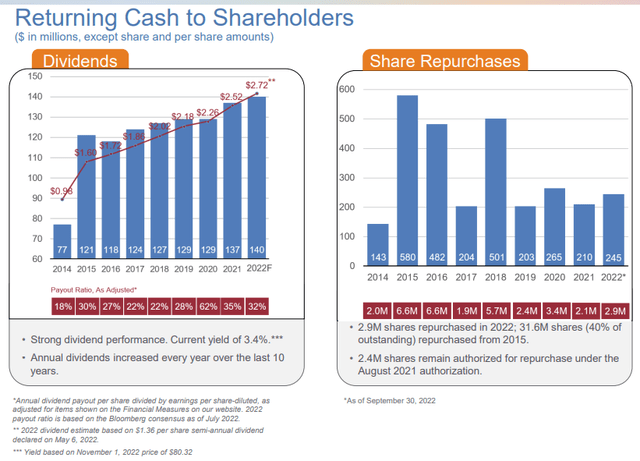

Though free cash flow has faced pressure this year, on the basis of the firm’s historical trends, one should expect free cash flow to be somewhat lumpy through the course of the economic cycle. Shares of Manpower Group have a very attractive dividend yield of ~3%, so such strong free cash flow coverage is quite impressive, even if 2022 hasn’t been as strong of a year. The Dividend Cushion ratio for Manpower Group stands at 3.4. At the end of the third quarter of 2022, ManpowerGroup held a manageable net debt position of $368.7 million.

Unlike many other entities with elevated free cash flow yields, Manpower Group’s outsized free cash flow yield is more of a function of its strong cash-generating abilities than a massive net debt position weighing on shares (its equity value). To arrive at equity value within the discounted cash-flow valuation construct, for example, one must subtract net debt from enterprise value.

What this means is that some entities with outsized free cash flow yields have them largely because their equity values are depressed by their net debt positions (e.g. AT&T). In this regard, the free cash flow yield calculation, which divides free cash flow by market capitalization, can sometimes be misleading (overstated) for companies with leveraged capital structures.

A company’s net debt should always be viewed alongside its free cash flow yield to assess whether that free cash flow yield is heavily dependent by the low-quality application of leverage. All else equal, one would prefer a company with a free cash flow yield of 10% and no net debt (or net cash) rather than a company with a free cash flow yield of 10% and a massive net debt position. Be sure to pay close attention to the balance sheet.

Image: ManpowerGroup has a strong dividend that has been raised in each of the past 10 years. The firm’s excess free cash flow generation has been used to buy back stock. Image Source: ManpowerGroup

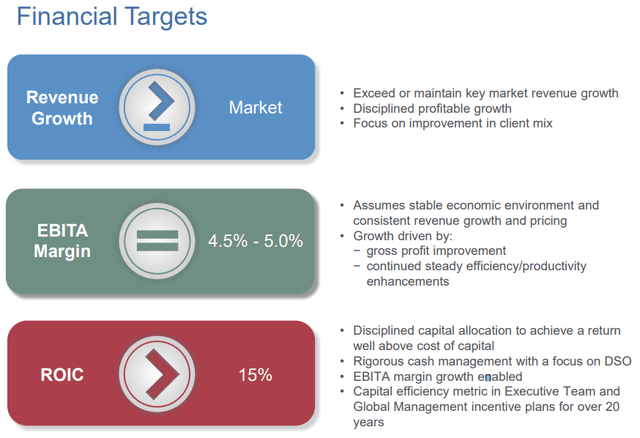

Image: Manpower Group has been a strong generator of economic returns thanks in part to its rigorous cash management focus. Image Source: ManpowerGroup

Concluding Thoughts

Manpower Group has been acquisitive and is facing increased competition of late, but the company’s financials, particularly its free cash flow generation, remain quite attractive. The firm continues to buy back stock at a nice clip, too, as it pays its attractive semi-annual dividend of $1.36 per share. Though its free cash flow yield will face some pressure using pending 2022 results, Manpower Group could be an idea for investors seeking equities with outsized free cash flow yields in this market, in our view. We expect to fine-tune our assumptions within our discounted cash-flow model once the company’s fourth-quarter results are released in the coming weeks, but very few non-energy firms have such a strong normalized free cash flow yield as that of Manpower Group.

Manpower Group’s 16-page Stock Report (pdf) >>

Manpower Group’s Dividend Report (pdf) >>

Tickerized for KFY, ADP, DLX, EFX, JOBS, MAN, NSP, PAYX, RHI, HURN

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.