Image: Caterpillar’s financial momentum is impressive. Image Source: Caterpillar

By Brian Nelson, CFA

We’ve raised our fair value estimate of Caterpillar Inc. (CAT) to $238 per share from $192 previously. As witnessed in Deere & Company’s (DE) fiscal fourth-quarter results, too, Caterpillar is driving considerable pricing expansion across its portfolio, and the impact on its financials has been quite impressive. Though not an idea in any newsletter portfolio, Caterpillar’s shares yield ~2% at the time of this writing, slightly better than the average S&P 500 company. The company is proud to be a Dividend Aristocrat.

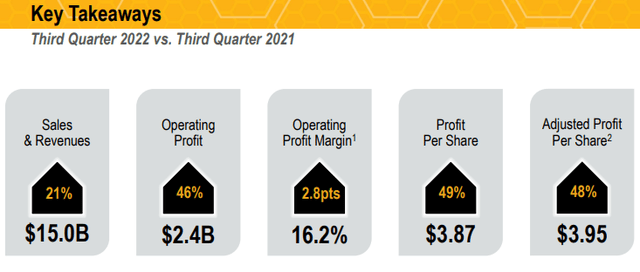

When Caterpillar reported third-quarter 2022 results back in October, the company recorded a 21% increase in revenue while adjusted profit per share leapt to $3.95 from $2.66 previously, up 48%. Both higher prices and volumes drove the strong performance that showcased ~280 basis points of operating-profit margin improvement during the period. Higher dealer inventories (which advanced $700 million during the third quarter of 2022), headwinds related to foreign currency, a moderating outlook for residential construction, and weakness in Europe and China (the latter in the excavator industry) were a few concerns, but overall, the quarterly performance was impressive.

Caterpillar operates in four divisions. Its ‘Construction Industries’ segment experienced a 19% increase in revenue, while the division’s profit advanced 40% in the third quarter. Its ‘Resource Industries’ segment drove revenue 30% higher, as the division experienced profit growth of 81%. Higher sales of aftermarket parts and equipment to end users helped propel the results there. Revenue and profit advanced 22% and 32%, respectively, in Cat’s ‘Energy & Transportation’ segment in the quarter. ‘Financial Products’ revenue increased 7%, while the segment showed 27% profit growth in the period.

Looking ahead, management was optimistic about its outlook on the third-quarter conference call:

While we continue to closely monitor global macroeconomic conditions, overall demand remains healthy across our segments. We expect top line growth in the fourth quarter both year-over-year and sequentially. This expected performance reflects healthy demand and favorable price realization. We anticipate sales increases across our three primary segments as order levels and backlogs remain strong. As a reminder, dealers have been focused on supplying customer orders, and we’ll look to replenish aging rental fleets over time when the supply chain situation improves.

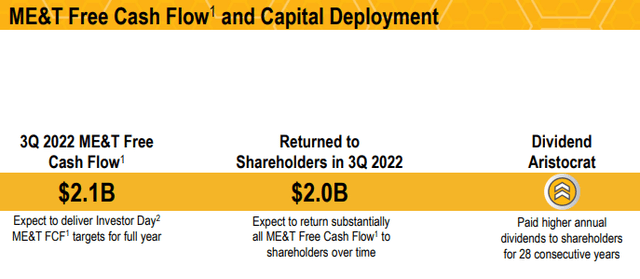

We expect adjusted operating profit margins to be significantly higher in the fourth quarter versus the prior year and slightly higher than in the third quarter. However, we now anticipate that our full-year margins will be at the low end or slightly below the low end of the Investor Day target range. The headwind is primarily due to ongoing manufacturing inefficiencies related to supply chain constraints, ongoing inflationary pressures within manufacturing costs, and our conscious decision to continue to invest for profitable growth. That said, we expect to achieve our Investor Day ME&T (full year) free cash flow target range of $4 billion to $8 billion.

During the third quarter, Caterpillar returned $2 billion to shareholders in the form of share repurchases and dividends. Liquidity remains strong with the firm ending the period with an enterprise cash balance of $6.3 billion. Capital spending is targeted at $1.4 billion for the full year, and price realization should more than offset cost increases in the fourth quarter, as it did during the Caterpillar’s third quarter. The firm’s order backlog was up $1.6 billion on a sequential basis and up a solid $9.4 billion on a year-over-year basis in the quarter.

Concluding Thoughts

Image: Caterpillar has a nice consecutive annual streak of dividend increases. ME&T = Machinery, Energy & Transportation (excludes Financial Products). Image Source: Caterpillar

Things are looking good for Caterpillar, and the company’s free cash flow strength continues to support its payout and Dividend Aristocrat status. Caterpillar’s results are cyclical and exhibit operating leverage, which cuts both ways, but the firm’s pricing power is working wonders on its financials at the moment. Higher dealer inventories due in part to timing and labor shortages, foreign currency headwinds, and weakening dynamics in the residential construction market and in Europe and China are concerns, but the company’s strong performance warrants a fair value estimate increase, in our view. Though we like Caterpillar quite a bit, we’re not looking to add shares to any simulated newsletter portfolio at this time, however.

Caterpillar’s 16-page Stock Report (pdf) >>

Caterpillar’s Dividend Report (pdf) >>

Tickerized for CAT, DE, MTW, AGCO, CNHI, and for holdings in the XME.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.