Image Source: Valuentum

By Brian Nelson, CFA

The health of the consumer continues to be one of the biggest questions heading into 2023. Many consumers are working through the excess savings garnered via COVID-19 stimulus (and many market observers expect this savings to run out by mid-2023) and credit card debt is on the rise. Inflation is taking a bite out of consumer discretionary spending as more and more of consumer financial capacity is being allocated to necessities including food and grocery items. Food at home costs have soared, and many have had to cut back in other areas.

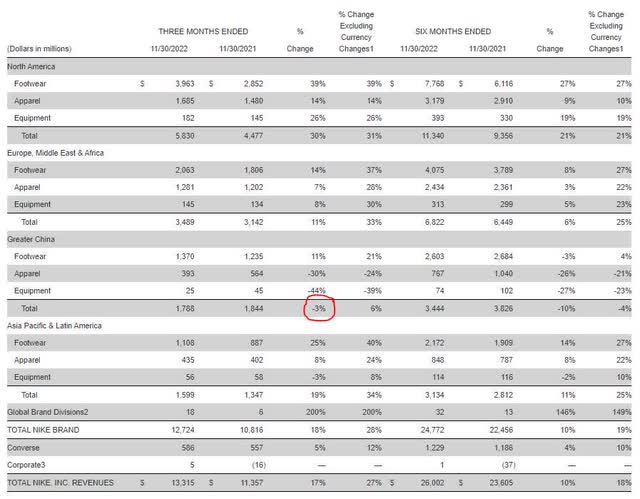

Nike’s (NKE) second-quarter fiscal 2023 results, released December 20, showed a very discerning consumer that is looking to drive a hard bargain these days. Though Nike’s core customer may be willing to pay up during good times, consumers appear to be taking advantage of markdowns in an environment that is being defined on the corporate level by higher inflationary cost pressures in the midst of stiff currency headwinds due to a stronger U.S. dollar. It’s clear that Nike’s brand strength continues to resonate with consumers, but recession economics are hard to dismiss. On a reported basis, sales China fell 3% due to huge declines in apparel (-30%) and equipment (-44%), though footwear remained resilient (+11%). Adjusted sales in China advanced 6%.

Image: Nike’s sales in China faced pressure on a reported basis. Image Source: Nike

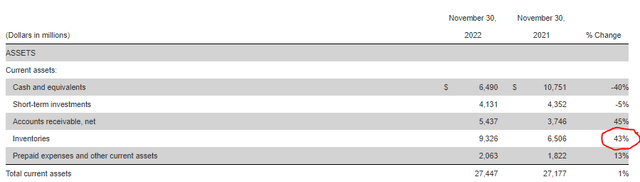

On the surface, things in the quarter looked okay. During Nike’s second-quarter fiscal 2023, revenues advanced 17% compared to the prior year and were up a whopping 27% on a currency-neutral basis. Growth was solid across its direct, digital and wholesale avenues. However, the company’s gross margin fell 300 basis points, to 42.9% in the period, revealing both cost pressures and markdown efforts. Inventories for Nike at the end of 2023 stood at $9.3 billion, up 43% compared to the same period last year, and the company’s bottom line growth in the quarter wasn’t great either, with diluted earnings per share nudging only 2% higher.

Image: Inventories at Nike remain bloated. Image Source: Nike

During Nike’s second quarter of fiscal 2023, the company returned roughly $2.1 billion to shareholders, reflecting $1.6 billion in buybacks on its recently approved $18 billion share repurchase program and the balance as dividends. Nike has raised its dividend in each of the past 20 years and has a forward estimated dividend yield of ~1.3%, which while respectable, trails the average company in the S&P 500. Quarterly dividends per share are up ~9.7% from last year’s tally, and Nike’s Dividend Cushion ratio remains resilient at ~3.1. A ratio materially greater than 1 (parity) generally indicates healthy dividend growth potential on the basis of forward estimated financial capacity.

Looking ahead to the back half of Nike’s fiscal 2023, we’re not overly concerned about the company’s resilience, but that doesn’t mean we’re excited about the stock. The company has a loyal customer base and deep consumer connections, while the launch of new items such as the Lebron 20 and new signature debuts from its Jordan brand and in women’s fitness are exciting catalysts. Nike’s Mercurial boots were well-represented in this year’s World Cup, and consumers responded by paying up for this brand, despite Nike having to markdown other areas amidst its large inventory overhang. Though China sales continue to face pressure on a reported basis, Nike’s efforts to build lifelong relationships with consumers will pay off down the road.

Concluding Thoughts

Nike’s second-quarter fiscal 2023 earnings report, released December 20, revealed strong revenue growth, but concerns lurked beneath the surface. Gross margin pressure, markdowns, lofty inventory levels, and a decline in reported sales in China were among the many concerns. Nike’s strong brand and close ties with consumers, however, offer key competitive advantages, and while consumer discretionary spending is facing considerable pressure in the near term, Nike remains a strong long-term global story, in our view. Shares yield ~1.3% and are trading modestly above the high end of our fair value estimate range at the time of this writing.

Nike’s 16-page Report (pdf) >>

Nike’s Dividend Report (pdf) >>

Tickerized for NKE, UA, UAA, FL, SKX, LULU, SBUX, DKS, HIBB, ADDYY, ADDDF, FXI, MCHI, KWEB

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.