Image Source: Chuckcars

By Brian Nelson, CFA

On November 30, the Association of American Railroads reported that North American rail traffic is down 1.9% on a year-to-date basis through November 26. Carloads of chemicals, coal, motor vehicles and parts, nonmetallic minerals, and petroleum products were strong, but weakness in farm products, forest products, grain, and metallic ores and metals weighed on overall strength. Rail remains among the most economical way to ship goods over long distances.

The railroads were front and center in the news recently about a potential work stoppage over the issue of paid sick leave. President Joe Biden, however, was able to put an end to the potential for a strike by signing “into law a joint resolution…between the country’s railroad companies and its unions, forcing both parties to reach a deal that would mean higher wages for workers.” Had workers gone on strike December 9, as intended, it would have put a huge dent in the U.S. economy, to the tune of $2 billion per day by some estimates.

The iShares U.S. Transportation ETF (IYT) is one of the best ways to get a lens as to how the railroads may be performing, as it holds roughly 30% of assets in railroad equities, as of December 13, 2022. Roughly 30% of IYT assets are invested in air freight & logistics companies, ~23% in trucking, ~15% in airlines and marine. Year-to-date, the IYT is down ~18%, slightly worse that that of the S&P 500, but some holdings have fared better. The largest weighting in the IYT is one of our favorite rails, Union Pacific (UNP), which is down ~11% year-to-date.

When Union Pacific reported third-quarter 2022 results October 20, revenue advanced 18%, beating the consensus estimate, while non-GAAP earnings per share of $3.19 exceeded expectations by ~$0.13. Though the headline numbers relative to consensus were solid, Union Pacific management noted that “inflationary pressures and operational inefficiencies” continued to challenge the firm. Business volumes advanced 3% on a year-over-year basis in the quarter, and increased fuel surcharge revenue and pricing growth combined to drive the top line.

However, Union Pacific’s operating ratio, which is calculated by dividing the railroad’s total operating costs by its net sales, increased 190 basis points, to 59.9%, despite lower fuel prices positively impacting the measure. Both freight car velocity and locomotive productivity fell, while workforce productivity advanced modestly. Though Union Pacific could do a much better job controlling costs, in our view, adjusted operating income still advanced 13% in the period, which isn’t bad by any stretch.

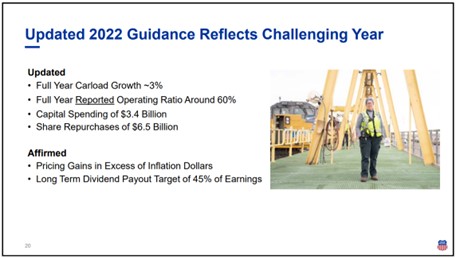

Image Source: Union Pacific

For all of 2022, Union Pacific’s management expects full year carload growth of ~3%, which is better than year-to-date performance across all rail traffic in North America, but its full-year operating ratio of ~60% is still a bit higher than what we would like. Pricing strength should continue during the fourth quarter for Union Pacific, and we like its target for long-term dividends to be 45% of earnings as it buys back ~$6.5 billion in shares during the year.

Concluding Thoughts

The rail industry may have avoided a labor strike, but North American rail traffic remains under pressure, while many operators are struggling with inflationary pressures and operational inefficiencies. Union Pacific remains our favorite way to play the rails, but 2022 has been a difficult year for the firm, with free cash flow coming under pressure as capital investments have soared so far in 2022. Union Pacific garners an ‘A’ rating by Moody’s, Fitch and S&P, so we’re not too worried about its large net debt position. Shares yield ~2.4% at the time of this writing, but we’re not pulling the trigger.

Tickerized for stocks in the IYT.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.