Image Source: American Tower

By Brian Nelson, CFA

On December 8, American Tower (AMT) upped its quarterly payout by 6.1%, to $1.56 per share relative to its last sequential dividend issued in October, and now shares yield ~2.9% on a forward estimated basis. Equity REITs have been pummeled in 2022, and AMT has unfortunately failed to buck the trend.

Though we like the scale and leverage inherent to cell tower stocks’ business models (which we’ll talk about in this work), we’re taking note of weakening adjusted funds from operations (FFO) and free cash flow trends at AMT, particularly in light of the tower operator’s massive net debt position. Interest rates have been working against REITs during 2022.

Image Source: American Tower

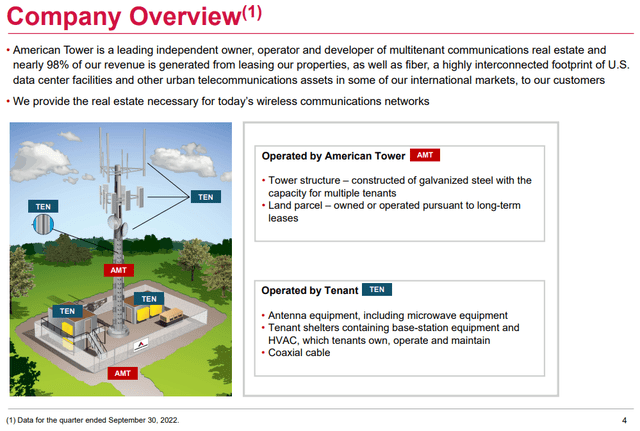

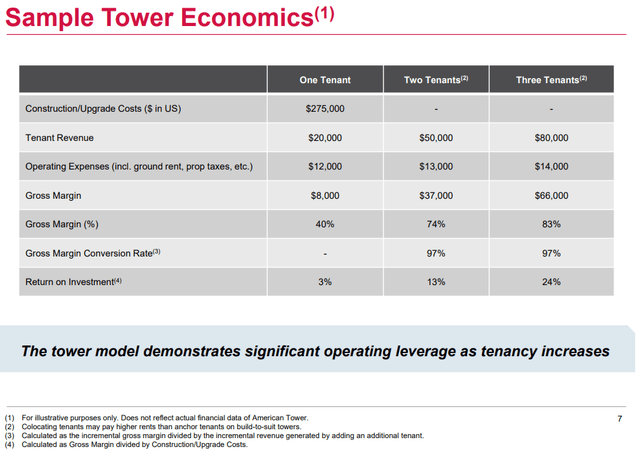

American Tower has roughly 223,000 communication sites around the globe, with ~43,100 in the U.S., ~76,400 in India, and others scattered around South America, Africa, Europe, Asia, and Australia. What we like most about American Tower’s revenue model is the operating leverage inherent to it. Once a tower is built, costs are generally fixed (ground rent, insurance, taxes and the like), so adding new tenants to the tower generates scale as minimal additional costs are incurred at the tower.

As shown in the sample (image above), in a hypothetical tower with three tenants, American Tower may generate a return on investment of 24%, while in a tower with just one tenant, that same return on investment may be 3%. Though companies with this type of operating leverage are risky because leverage cuts both ways, because of the stickiness of American Tower’s customer base, operating leverage has continued to work in its favor over the years thanks to several material demand drivers.

For starters, growing wireless penetration will drive the need for more towers. In the U.S. alone, total mobile connected devices are expected to increase in number to 975 million in 2027 from ~605 million today, while average data per device is expected to soar at a remarkable 20% compound annual growth rate over the same time period. Years ago, we might have only used a mobile device to send an email, but today, the average data used by each activity on our phones has increased multi-fold as consumers are now streaming shows on their devices from the likes of Netflix (NFLX) and others.

Image Source: American Tower

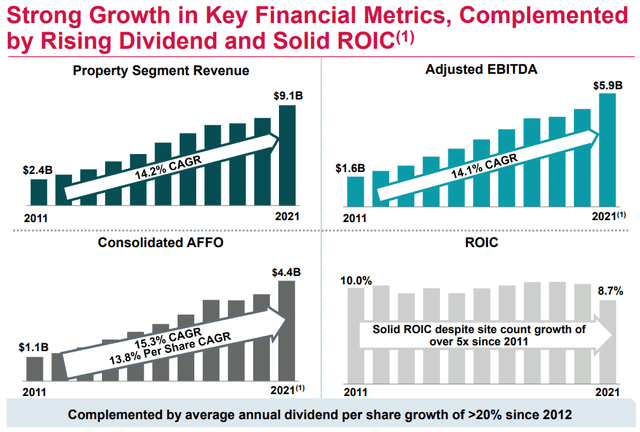

The results at American Tower speak for themselves. During the past 10 years, property segment revenue has advanced at a 14.2% compound annual growth rate, adjusted EBITDA has increased at a 14.1% compound annual growth rate, consolidated AFFO has leaped at a 15.3% compound annual growth rate, and American Tower has put up a decent return on invested capital, as it has continued to invest in the future. Continuing to drive further operating leverage in its business model through leasing growth across its existing portfolio and improving operating and maintenance capital efficiencies remain key focus areas at the company.

Though we’re huge fans of American Tower, recent trends in its third-quarter 2022 results, released in late October, were mixed. Property revenue increased 10.2% and net income advanced 12.9% but consolidated adjusted funds from operations (AFFO) fell modestly. AFFO to AMT common shareholders fell 3.3% on a year-over-year basis in the quarter, too. Operating cash flow dropped by more than half in the quarter on a year-over-year basis as total capex ballooned, and its free cash flow growth rate fared worse. AMT continues to work to position itself for 5G as it navigates through economic volatility.

Image Source: American Tower

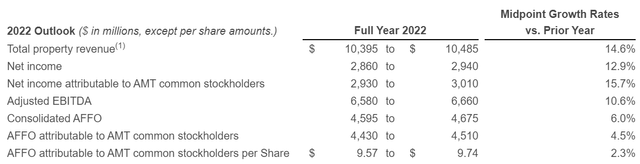

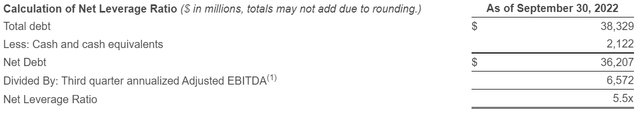

Back in October, AMT raised its guidance for the midpoint of its full-year 2022 outlook for property revenue and adjusted EBITDA, but it lowered the midpoint of its consolidated AFFO and AFFO attributable to AMT common stockholders for the year. Management noted “incremental reserves associated with VIL and the negative effects of foreign exchange rate fluctuations” as the culprit, but free cash flows were also notably weaker on a year-to-date basis, meaning that we’re not merely shrugging off the lowered guidance, particularly in light of the firm’s huge net debt position, as shown below.

Image Source: American Tower

Valuentum members know that we love dividend payers that generate fantastic free cash flow in excess of their cash dividend payouts, but also have impressive net cash positions. However, given the investments required, many REIT business models come with considerable leverage, and AMT’s is no exception, with a net leverage ratio of 5.5x. American Tower has an investment-grade balance sheet, and while we’d much prefer it have a lower net debt load, it remains an idea in the simulated High Yield Dividend Newsletter portfolio due in part to the favorable operating economics and scalability of its revenue model.

Concluding Thoughts

Cell tower operator American Tower raised its dividend more than 6% from its last payout in October, and while we like the payout growth momentum, we’re taking note of weakening AFFO and free cash flow trends. The REIT’s net debt position takes on greater prominence in the current rising interest rate environment, too, and its forward estimated dividend yield stands at just ~2.9%, about in line with traditional near-term rates on certificates of deposits. We’re watching deteriorating REIT economics closely.

Tickerized for AMT, SBAC, CCI, VOD, VTWRF, T, VZ, LUMN, TMUS, CLLNY, DISH, NFLX, CHTR, CMCSA, VPN, COR, BYTE, LBTYA

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.