Image Source: CubeSmart

By Brian Nelson, CFA

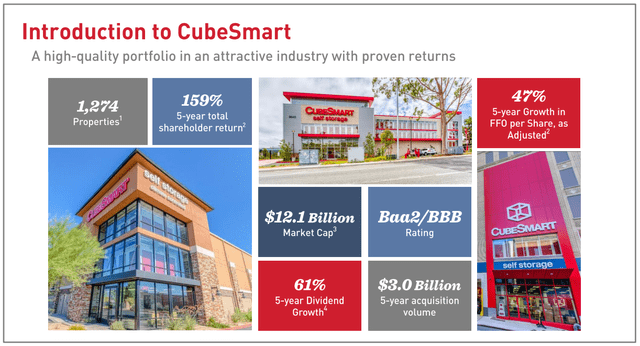

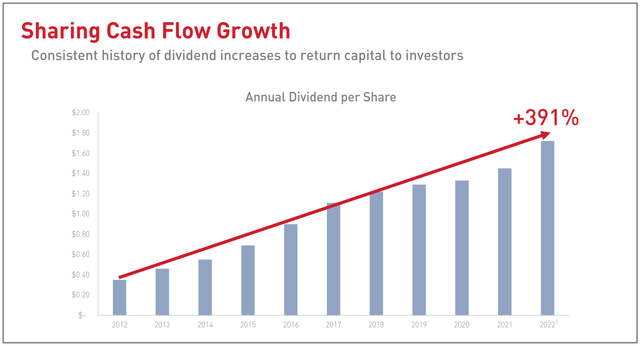

On December 7, CubeSmart (CUBE) raised its quarterly dividend 14%, to $0.49 per share, which implies a forward estimated dividend yield of ~4.5% at the time of this writing. Though we’ve grown more cautious on REITs the past many months in light of rising interest rates, we include a number of REITs across our newsletter portfolios, and CubeSmart is included in the High Yield Dividend Newsletter portfolio.

Image Source: CubeSmart

The REIT has economic interests in self-storage properties across roughly two dozen US states and also operates a sizable management platform for self-storage properties owned by third parties. CubeSmart’s owned portfolio (properties it has a direct economic interest in) was comprised of ~610 self-storage facilities at the end of September 2022 which housed ~44 million rentable square feet.

Here’s what CubeSmart had to say when it reported third-quarter results October 27:

We continue to see solid demand across the portfolio as we returned to more normalized seasonal trends during the quarter. We are in an outstanding position as our focus shifts to 2023. With another year of positive cash flow growth and a strong balance sheet, we’re well-positioned to perform in any economic climate and capitalize on all growth opportunities that present themselves.

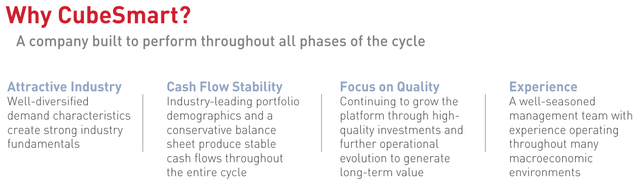

During its third quarter, CubeSmart drove same-store net operating income expansion of 15.4% on a year-over-year basis. Adjusted funds from operations (FFO) came in at $150 million for the third quarter of 2022 versus $118.4 million in last year’s period. On a per-share, adjusted FFO per share advanced 17.9%, to $0.66 in the third quarter of 2022, compared to $0.56 in the year-ago period. On the surface, things continue to go well for CubeSmart and the firm remains in an attractive industry, but cracks are starting to form.

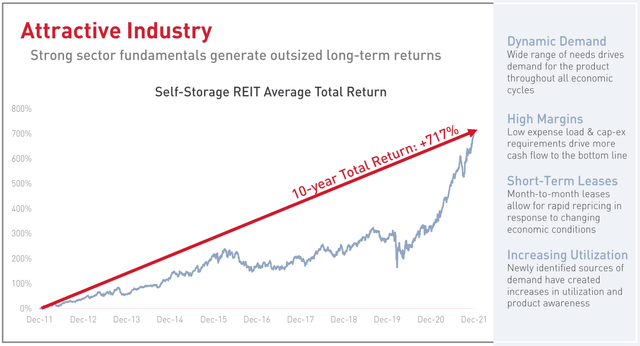

Image Source: CubeSmart

Same-store occupancy rates are okay, averaging 94.4% in the quarter, but they ended the period at 93.8%, suggesting deteriorating economics. The decline in occupancy rates is consistent with some of the scuttlebutt we’ve been hearing across the self-storage arena in which many cost-conscious consumers are cutting back discretionary outlays. This is part of the reason why we look at CubeSmart as a source of “portfolio cash” in the High Yield Dividend Newsletter portfolio if we find another idea that may be better. REIT dynamics remain under pressure, in our view.

Here’s what CUBE’s management had to say about its debt maturity profile:

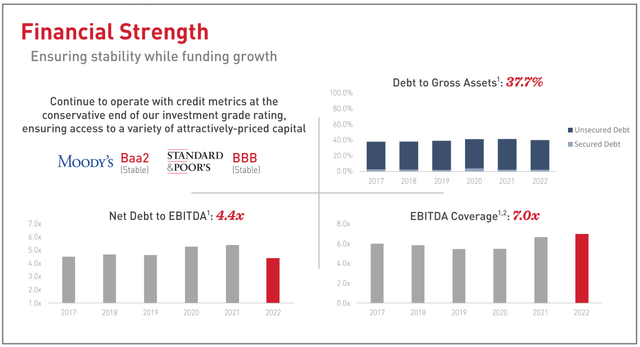

We continue to successfully execute on our disciplined investment strategy, as evidenced by the sale of the assets in our HVPSE venture during the quarter. While not included in FFO, the promoted return we received once again showcased the significant shareholder value creation generated by our operating platform and strong industry relationships. In addition, we expanded our liquidity profile as the recent recast of the revolving credit facility created additional capacity and further extended our maturity profile, now with no significant debt scheduled to mature until 2025.

Image Source: CubeSmart

The company ended September with $8.2 million in cash and cash equivalents and $2.77 billion in unsecured senior notes, $86 million pulled on its revolver, and $164.1 million in mortgage notes. Valuentum members know that we prefer equities that have net cash positions, and CubeSmart does not have one – far from it, in fact. A massive net debt position isn’t unusual for high yield dividend payers, and we point to CUBE’s investment-grade credit rating (Baa2/BBB) as the primary reason why we’re not overly concerned about its massive net debt position at this time.

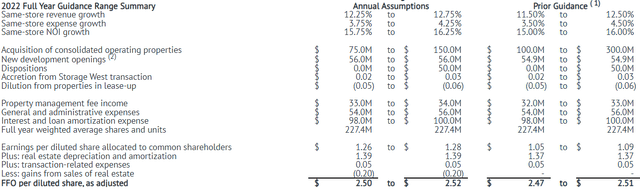

Image: CubeSmart’s recently raised its FFO per diluted share guidance, as adjusted. Image Source: CubeSmart

For 2022, CUBE is forecasting fully diluted earnings per share on the year to be between $1.26-$1.28 (was $1.05-$1.09) and adjusted FFO per share in the range of $2.50-$2.52 (was $2.47-$2.51). Though we like that earnings and adjusted FFO are on the rise at CUBE, the more important consideration is its capital costs, particularly given its massive net debt position. Rising interest rates have increased cap rates across the REIT sector, depressing asset values. CUBE is not immune to this dynamic.

Image Source: CubeSmart

Quite simply, interest rates have put the hurt on the REIT sector during 2022, with the share prices of equity REITs and mortgage REITs facing tremendous pressure, and we can’t ignore deteriorating occupancy rates across CubeSmart’s portfolio as well as its lofty net debt position. Though CUBE will remain an idea in the High Yield Dividend Newsletter portfolio for the time being, we won’t hesitate to remove shares if we find a better idea, preferably one outside the REIT space. We continue to like dividend payers with massive net cash positions and tremendous free cash flow generation in excess of their cash dividends paid, but these characteristics are often difficult to find with respect to high dividend yielders.

Concluding Thoughts

Image Source: CubeSmart

CubeSmart announced a 14% increase in its dividend payout December 7. The REIT upped its guidance for earnings per share and adjusted FFO when it reported its third-quarter results last October but deteriorating occupancy rates and the impact of rising interest rates on the firm’s massive net debt position have us on alert. We continue to monitor these dynamics closely in light of the REIT’s weak share-price performance during 2022.

Tickerized for CUBE, BX, PSA, LSI, EXR, REZ, STSFF, NSA, XLRE, IYR, VNQ

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.