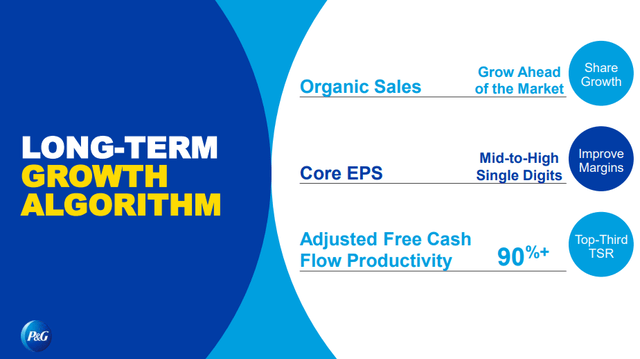

Image: Procter & Gamble has delivered pre-, during, and post-pandemic, and its long-term growth targets remain reasonable, in our view. Image Source: P&G

By Brian Nelson, CFA

Procter & Gamble (PG) is doing a lot of things right these days. Years ago, we were skeptical of management’s decision to streamline its business by reducing the number of its valuable brands to 65 from 170, but it has paid off. Over the past five years, shares of P&G have advanced more than 60%, and this excludes its nice and growing dividend payout. We liked a lot about what P&G revealed during its Investor Day November 17, and the company remains a strong consideration for both income and dividend growth investors alike.

P&G owns a huge portfolio of consumer branded items, including Pampers, Luvs, Always, Tampex, Bounty, Tide, Crest, NyQuil, Charmin, Puffs, Downy, Swiffer, Braun, Vicks and the list goes on and on. These brands tend to dominate or be among the top few considerations for consumers in their respective categories, and management has done a fantastic job retaining the trust that consumers have established with such brands over decades.

Not only has P&G shed some of its lesser brands, but a more focused strategy and organizational design have also paid off for investors during the past few years. P&G calls its new org structure “The Thicket,” where people are “moving frequently between businesses, markets and functions. We think this has helped the firm navigate COVID-19 well, but it also gives it a leg up in the current inflationary environment, allowing the company to react quickly and effectively to changes, in our view.

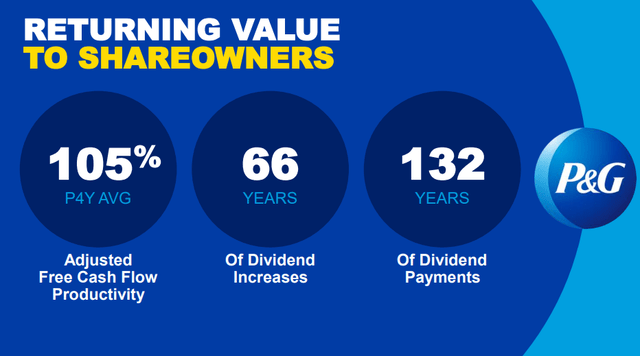

Image: Procter & Gamble is about as consistent as it gets when it comes to consumer staples entities. The firm has put up 66 consecutive years of dividend increases, having paid a dividend for more than 130 years. Image Source: P&G

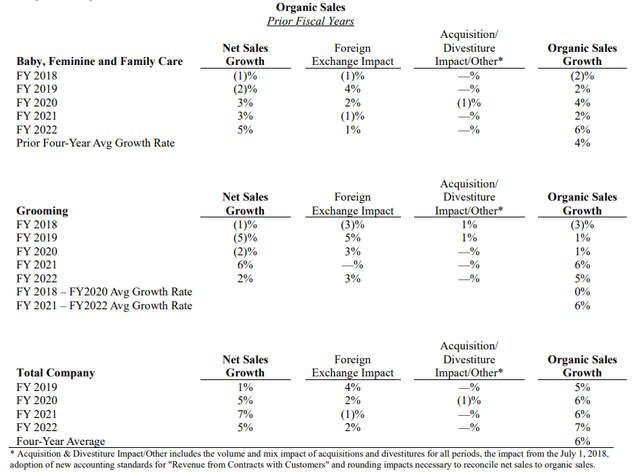

Looking to fiscal 2023 guidance (ends June 2023), Procter & Gamble expects organic sales growth in the range of 3%-5%, with constant-currency core earnings per share expansion in the range of 9%-13%. There’s a lot of moving parts to those numbers, as all-in sales expansion is targeted to fall in fiscal 2023, while core EPS growth is anticipated to grow only marginally given headwinds from a stronger dollar.

Still, we like the firm’s financial resilience in the current economic environment, despite consumers’ tightening pocketbooks in light of inflation and rising interest rates (read about Target’s latest quarterly report here, for example). When P&G released its first-quarter fiscal 2023 report on October 19 for the three months ended September 30, the firm noted that it “continues to expect adjusted free cash flow productivity of 90% and expects to pay around $9 billion in dividends and to repurchase $6 billion to $8 billion of common shares in fiscal 2023.” The company remains very shareholder friendly.

Procter & Gamble is not completely immune to the current economic malaise, however, given that consumers have been looking to trade down to off-brand items given budgetary constraints amid an inflationary environment. Management also reiterated a few more “market realities” during its Investor Day, not the least of which are input cost headwinds, foreign currency exchange headwinds, and retailers tightening inventory and weak consumer confidence. Thus far, however, P&G has navigated the market environment well, as it has any environment for the past 130+ years–and particularly through the worst of the COVID-19 pandemic.

Image: Procter & Gamble has managed to keep organic sales growth moving in the right direction through thick and thin the past few years. Image Source: P&G

Concluding Thoughts

Procter & Gamble has raised its dividend in each of the past 66 years and has paid a dividend in each of the past 132 years. Though the maker of Pampers, Bounty, Tide, Crest, and a number of other household brands is facing the market realities of inflationary pressures on consumers, input cost headwinds and retailers tightening their inventories, we think it will be able to achieve its core targets for fiscal 2023, while rewarding dividend investors along the way. With shares yielding ~2.6% at the time of this writing, P&G remains a solid income and dividend growth consideration for conservative investors. The high end of our fair value estimate range stands at $158 per share.

Tickerized for PG, CHD, CLX, CL, ENR, HELE, JNJ, KMB, K, HSY, HRL, KHC, CPB, HAIN, SPB, REV, NWL, GIS, COTY, TWNK, MKC, OLPX, REYN, HNST, UL, XLP

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.