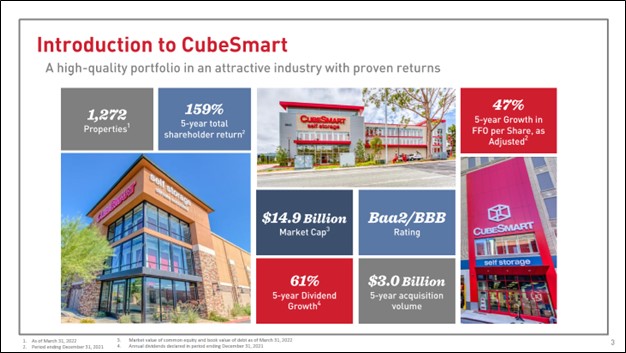

Image Shown: CubeSmart is one of our favorite high yielding ideas. Image Source: CubeSmart – June 2022 IR Presentation

By Callum Turcan

CubeSmart (CUBE) reported second quarter 2022 earnings that missed consensus top-line estimates but beat consensus bottom-line estimates. Last quarter, the self-storage real estate investment trust (‘REIT’) posted strong same-store net operating income (‘NOI’) growth due to its high occupancy rates and substantial pricing increases seen of late. CubeSmart also raised its full-year guidance for 2022 in conjunction with its latest earnings report, and that comes on the heels of the firm previously raising its full-year guidance during its first quarter of 2022 earnings update in April 2022.

We continue to be huge fans of CubeSmart and include shares of CUBE as an idea in the High Yield Dividend Newsletter portfolio. As of this writing, shares of CUBE yield ~3.5%. The REIT has economic interests in self-storage properties across roughly two dozen US states and also operates a sizable management platform for self-storage properties owned by third parties. CubeSmart’s owned portfolio (properties it has a direct economic interest in) was comprised of ~610 self-storage facilities at the end of June 2022 which housed 43.9 million rentable square feet.

Earnings Update

During the second quarter, CubeSmart’s same-store operating revenues rose by 14.0% year-over-year while its same-store property operating expenses rose by 2.5%, resulting in its same-store NOI growing by 19.0%. CubeSmart benefited from its average occupancy at its same-store properties coming in at 95.1% last quarter, down ~30 basis points year-over-year though still an incredibly strong performance. Its realized annual rent per occupied square foot at its same-store properties rose by 14.5% year-over-year in the second quarter, which along with its strong occupancy levels drove its same-store revenues significantly higher.

The self-storage REIT’s same-store property pool consisted of ~525 properties last quarter and the performance of these assets provides a useful gauge of CubeSmart’s underlying performance, given that it takes time for newly developed or acquired assets to fully lease out. With that in mind, its company-wide occupancy rate stood at 93.6% at the end of June 2022, which is quite impressive. Please note that CubeSmart is constantly optimizing its property portfolio and is incredibly active in the A&D space.

One of the reasons why we are big fans of the self-storage space, particularly in the US (CubeSmart is solely focused on the domestic market), is that powerful secular tailwinds are driving up demand for self-storage offerings. Households want to economically maximize their living space at a time when housing prices have boomed higher, and self-storage options are a prime way to accomplish that goal. In turn, CubeSmart can maintain strong pricing power and relatively high occupancy rates throughout the economic cycle.

CubeSmart’s adjusted funds from operations (‘FFO’) per share, a non-GAAP metric, rose by 24% year-over-year in the second quarter to reach $0.62. While an imperfect metric, a REIT’s FFO per share performance provides a snapshot of its financial trajectory. Its dividend payout ratio—dividends per share divided by its FFO per share—stood at ~69% in the second quarter of this year, well below the 80% level that is often used as a threshold to determine whether a REIT’s payout level is healthy, though we prefer to look at a REIT’s free cash flows to gauge its dividend strength.

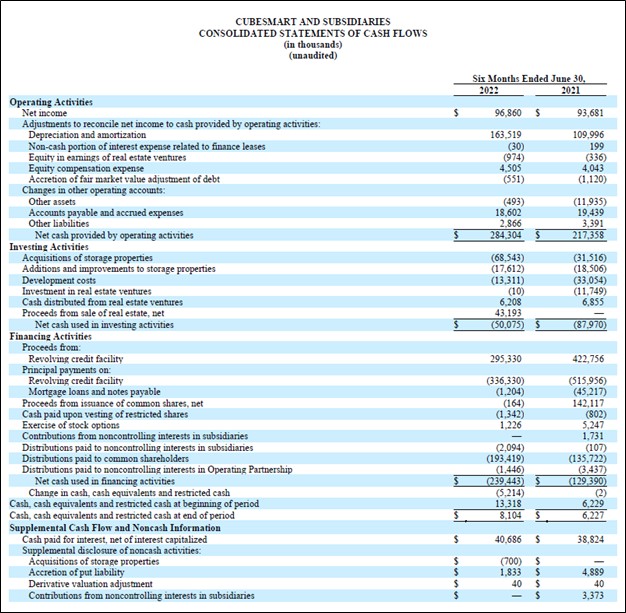

During the first half of 2022, CubeSmart generated $253 million in free cash flow (net operating cash flow less ‘additions and improvements to storage properties’ and ‘development costs’) while spending $197 million on its total payout obligations (‘distributions paid to noncontrolling interests in subsidiaries’ plus ‘distributions paid to common shareholders’ plus ‘distributions paid to noncontrolling interests in operating partnership’), allowing for $56 million in “excess” free cash flow. We are huge fans of self-storage REITs due to their ability to generate not just significant free cash flows, but significant excess free cash flows after covering their total payout obligations.

Image Shown: We are big fans of CubeSmart’s ability to generate excess free cash flows. Image Source: CubeSmart – 10-Q SEC filing covering the Second Quarter of 2022

However, we caution that CubeSmart has a large net debt load and substantial payout obligations. At the end of June 2022, CubeSmart’s net debt load (exclusive of restricted cash, inclusive of short-term debt) stood at $3.2 billion and the firm had minimal cash on hand at the end of this period. At the end of June 2022, CubeSmart’s $0.75 billion revolving credit facility had roughly $0.6 billion in remaining borrowing capacity, and that facility matures in June 2024. CubeSmart’s investment grade credit rating (Baa2/BBB) should help the REIT with its future refinancing activities, and its revolving credit line provides it with ample access to liquidity to meet its near-term funding needs.

Acquisitions generally require CubeSmart to tap capital markets to fund those activities. Its third-party property management platform is a key growth pipeline for CubeSmart. In the second quarter of this year, CubeSmart added 35 stores to that service, bringing the total up to ~680 stores with 45.9 million rentable square feet. The REIT has often acquired facilities managed by this service in the past and will likely continue to do so going forward. Additionally, the management service generates nice income streams for CubeSmart, though this part of its business is relatively small compared to its company-wide operations (a little over 3% of its total second quarter revenues).

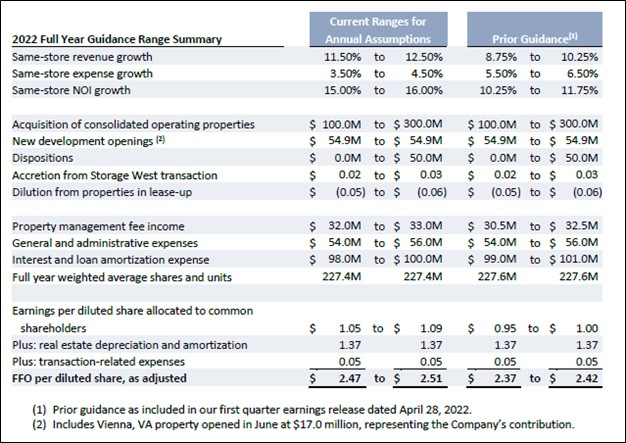

Guidance Update

CubeSmart boosted its full-year guidance for 2022 in conjunction with its latest earnings report after increasing its guidance during its first quarter update as we noted previously (we covered CubeSmart’s stellar first quarter performance and bright growth outlook in a June 2022 article that can be viewed here). The REIT’s latest guidance and its previous forecasts can be viewed in the upcoming graphic down below. At the midpoint of its current guidance, CubeSmart forecasts that its adjusted FFO per diluted share will grow by 18% annually in 2022 after growing by 23% annually in 2021.

Image Shown: CubeSmart is quite confident that the strong performance seen during the first half of 2022 will carry on into the second half of this year. The REIT raised its full-year guidance (again) during its second quarter earnings update. Image Source: CubeSmart – Second Quarter of 2022 Earnings Press Release

Concluding Thoughts

There is a lot to like about CubeSmart as the self-storage REIT has been doing great of late. CubeSmart possesses ample pricing power, its occupancy rates have been trending in the right direction of late, and the REIT is a stellar free cash flow generator. In our view, CubeSmart should be able to tap capital markets at attractive rates to meet its funding needs going forward. We appreciate CubeSmart’s latest guidance boost and continue to like shares of CUBE as an idea in the High Yield Dividend Newsletter portfolio.

—–

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Tickerized for CUBE, BX, PSA, LSI, EXR, REZ, STSFF, NSA, XLRE, IYR, VNQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on VRTX. American Tower Corporation (AMT), CubeSmart (CUBE), Life Storage Inc (LSI), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.