Image Shown: Shares of Public Storage, one of our favorite income generation ideas, have boomed higher over the past five years with room for additional upside.

By Callum Turcan

Public Storage (PSA) reported second quarter 2022 earnings that missed consensus top-line estimates but beat consensus bottom-line estimates as the self-storge industry in the US continues to benefit from robust demand. Surging home prices have made many households turn to self-storage options as an economical way to maximize their living space. During its second quarter earnings update, Public Storage also moderately raised its full-year guidance for 2022 which we appreciate.

We are huge fans of Public Storage as the real estate investment trust (‘REIT’) is able to generate sizable “excess” free cash flows after fully covering its total payout obligations, something most REITs outside of the self-storage industry are unable to do given their hefty capital expenditure obligations. Public Storage is included as an idea in the High Yield Dividend Newsletter portfolio.

Earnings Update

In the second quarter, Public Storage’s same store direct net operating income rose 17.8% year-over-year due to its same store revenue growth of 15.9% far outpacing its same store direct operating expense growth of 8.7% during this period. The REIT’s weighted-average occupancy rate per square foot, on a same store basis, stood at 95.8% last quarter. While down by ~120 basis points on a year-over-year basis, that is still impressive performance. Public Storage’s realized annual rent per occupied square foot rose 17.2% year-over-year in the second quarter as the REIT benefited from pricing increases on new and existing customers.

For reference, Public Storage defines its same store properties as such (from its second quarter earnings press release):

The Same Store Facilities consist of facilities that have been owned and operated on a stabilized level of occupancy, revenues, and cost of operations since January 1, 2020. The composition of our Same Store Facilities allows us to more effectively evaluate the ongoing performance of our self-storage portfolio in 2020, 2021, and 2022 and exclude the impact of fill-up of unstabilized facilities, which can significantly affect operating trends. We believe the Same Store information is used by investors and analysts in a similar manner. However, because other REITs may not compute Same Store Facilities in the same manner as we do, may not use the same terminology, or may not present such a measure, Same Store Facilities may not be comparable among REITs.

As of June 30, Public Storage’s same store asset base represented ~75% of its aggregate net rentable square feet of its consolidated U.S. properties. Its same store US properties consisted of over 2,280 facilities with almost 150 million net rentable square feet. Put another way, its same store operations are a good barometer for its underlying performance given that it takes time for new facilities (whether newly constructed properties or properties that Public Storage recently acquired) to reach “normalized” occupancy rates.

We caution that Public Storage had a sizable net debt load on the books of $6.3 billion (inclusive of short-term debt) at the end of June 30, 2022. Its $1.0 billion in cash and cash equivalents on hand at the end of this period provides Public Storage with ample liquidity to meet its near-term funding needs.

However, as a capital-market dependent entity, it is essential that Public Storage retains access to debt and equity markets at attractive rates to refinance maturing debt and to fund its growth ambitions, such as acquisitions of additional self-storage facilities. Recent capital-market activity indicates that has been the case in the recent past, and we expect that will continue being the case going forward.

During the first half of 2022, Public Storage generated $1.1 billion in free cash flow (defined as net operating cash flow less ‘capital expenditures to maintain real estate facilities’ and ‘development and expansion of real estate facilities’) which fully covered $0.8 billion in total payout obligations during this period (defined as ‘distributions paid to preferred shareholders, common shareholders, and restricted share unitholders’ and ‘distributions paid to noncontrolling interests’).

Beyond Public Storage’s cash on hand, its ability to generate significant excess free cash flows supports our view that the REIT will be able to stay on top of its net debt load going forward, with its payout intact.

Looking at its GAAP performance, Public Storage’s revenues were up 24% year-over-year last quarter to reach $1.0 billion and its diluted EPS rose by 74% year-over-year to reach $3.42. The self-storage REIT’s non-GAAP core funds from operations (‘FFO’) per share rose by 27% year-over-year in the second quarter to reach $3.99. Please note that its core FFO per share metric is a non-GAAP measure that has its flaws, but the metric is useful for gauging the underlying performance of REITs.

Guidance Update and Special Dividend

On July 20, Public Storage completed the divestment of its equity stake in PS Business Parks to affiliates of Blackstone Real Estate, which is affiliated with the alternative asset management firm Blackstone Inc (BX) that’s based in the US. The deal raised ~$2.7 billion in cash proceeds and resulted in a ~$2.3 billion gain on the divestment, which Public Storage distributed back to shareholders via a special dividend to reward investors and to maintain its tax compliance as a REIT.

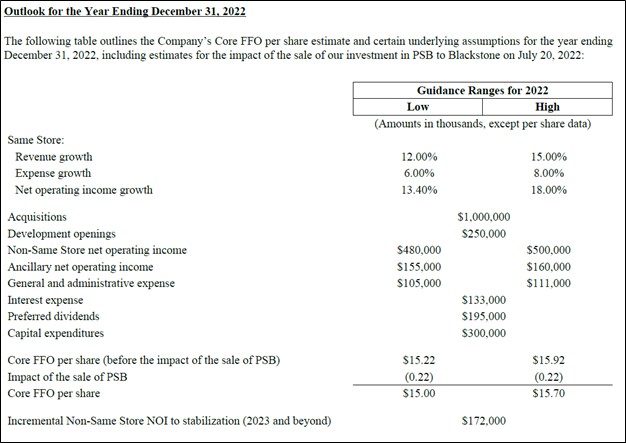

With those cash proceeds, Public Storage declared a one-time special dividend of $13.15 per share that was paid out in early August 2022. As we have noted in the past (link here), we like the deal as it effectively grew Public Storage’s exposure to the self-storage industry given that PS Business Parks focused on commercial facilities such as multi-tenant industrial, flex, and office properties. Public Storage updated its full-year guidance for 2022 during its second quarter earnings report that reflects the impact of this divestment as you can see in the upcoming graphic down below.

Image Shown: Public Storage is guiding for robust same store net operating income growth which is expected to drive substantial growth in its bottom-line. Image Source: Public Storage – Second Quarter of 2022 Earnings Press Release

Its latest guidance represents a modest boost from its previous forecasts when adjusting for the divestment, aided by strength at its non-same store facilities according to management commentary provided during Public Storage’s second quarter earnings call. When Public Storage reported its first quarter 2022 earnings update, its core FFO per share guidance stood at $14.75 – $15.65, which has since been raised up to $15.00 – $15.70 per share. There is a lot of noise here given the nature of non-GAAP metrics and the aforementioned divestment, though we appreciate that Public Storage is confident in its near term growth trajectory in the wake of various exogenous shocks.

Public Storage is guiding for double-digit same store revenue and net operating income growth in 2022 as the REIT expects its strong performance during the first half of this year will carry on into the second half. Its strong same store and non-same store performance is expected to drive double-digit growth in its core FFO per share in 2022, an impressive feat.

In 2021, Public Storage’s core FFO per share grew roughly 21% year-over-year to reach $12.93. At the midpoint of its current guidance, Public Storage is guiding for its core FFO per share to grow by approximately 19% year-over-year in 2022. The self-storage REIT is doing great, and its growth runway remains firmly intact, which should support its ability to generate sizable free cash flows going forward.

Concluding Thoughts

Public Storage is a stellar enterprise and a great income generation opportunity. We appreciate management’s commitment to income seeking investors, as witnessed through the substantial special dividend paid out in August 2022.

We recently updated our reports on the REIT industry, and Public Storage’s fair value estimate now sits at $366 per share with room for upside as the top end of our fair value estimate range sits at $458 per share. Public Storage has strong forward-looking dividend coverage as its adjusted Dividend Cushion ratio (which takes its ability to tap capital markets into account) sits above 2.0. We continue to like Public Storage in the High Yield Dividend Newsletter portfolio. Shares of PSA yield ~2.3% as of this writing when excluding its special dividend payout.

—–

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Tickerized for CUBE, BX, PSA, LSI, EXR, REZ, STSFF, NSA, XLRE, IYR, VNQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, V, and VRTX and is long put options on RDFN and RKT. American Tower Corporation (AMT), CubeSmart (CUBE), Life Storage Inc (LSI), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.