Image Shown: The Walt Disney Company posted a rock-solid earnings report for the period ended July 3 as its business benefited from pent up demand for its theme parks and resorts offerings. Image Source: The Walt Disney Company – Third Quarter of Fiscal 2022 Earnings Press Release

By Callum Turcan

On August 10, The Walt Disney Company (DIS) reported third quarter earnings for fiscal 2022 (period ended July 3, 2022) that beat both consensus top- and bottom-line expectations. Its theme parks and reports business came roaring back from the worst of the COVID-19 pandemic while its video streaming services continued to add millions of paid subscribers to their customer bases.

Shares of DIS have surged higher in recent weeks, and we continue to like Disney as an idea in the Best Ideas Newsletter portfolio. Our fair value estimate sits at $156 per share of Disney, well above where shares are trading at as of this writing indicating the company has ample capital appreciation upside potential.

Earnings Update

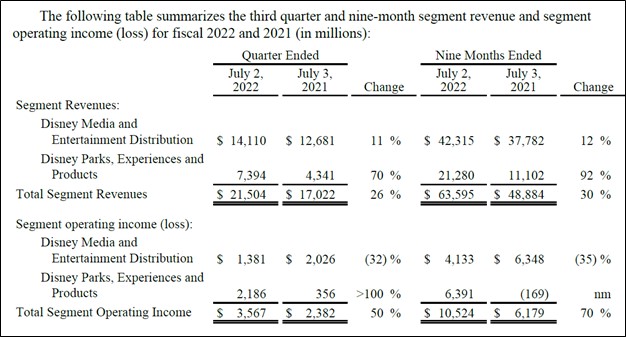

At its ‘Disney Parks, Experiences, and Products’ business reporting segment, the company reported that its segment-level revenues grew 70% and that its segment-level operating income grew over six-fold on a year-over-year basis last fiscal quarter. Consumers are flocking to its theme parks and resorts now that COVID-19 restrictions in most countries have been substantially reduced or eliminated entirely. In the event China pivots away from its “zero COVID” policies, that could unleash another wave of demand for these offerings. Historically, Disney’s theme parks and resorts have been its major profit driver, and we appreciate that this part of its business is doing great again.

Pivoting to its ‘Disney Media and Entertainment Distribution’ business reporting segment, which houses its various video streaming services (including Disney+, ESPN+, and Hulu), the company reported that its segment-level revenues rose 11% and that its segment-level operating income declined 32% year-over-year last fiscal quarter. This segment’s losses were driven by its direct-to-consumer operations, meaning its video streaming services, as Disney is in the process of aggressively scaling up the business by expanding into international markets and developing original content to grow its collective paying subscriber bases.

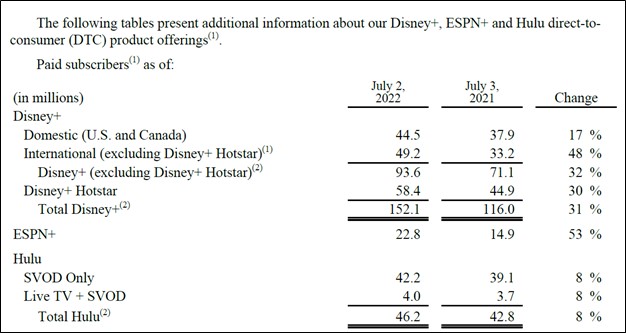

On the plus side, across Disney+, ESPN+, and Hulu, the company added a combined 15.5 million net paying subscribers by the end of the third quarter of fiscal 2022 versus the end of the second quarter of fiscal 2022. That includes 14.4 million net paying subscribers at its flagship Disney+ service. One of the reasons why shares of Disney have performed quite well of late, in our view, is that its Disney+ service continues to grow its paid subscriber base at a robust clip.

Image Shown: Disney’s video streaming services have grown their paid subscriber bases at a robust clip of late, especially its flagship Disney+ service. Image Source: Disney – Third Quarter of Fiscal 2022 Earnings Press Release

During Disney’s latest earnings call, management updated the firm’s fiscal 2024 guidance as it concerns the company’s paying subscriber forecast for Disney+, lowering it down to 215-245 million by that period (includes expectations for 80 million subscribers at Disney+ Hotstar, largely focused on India and other South Asian markets) from 230-260 million previously. However, investors were expecting something much worse. Disney’s current guidance still calls for substantial growth at Disney+ given the service had 152.1 million paying subscribers at the end of the third quarter of fiscal 2022. At the midpoint of its latest guidance, Disney is forecasting that its Disney+ service will grow its paid subscriber base by over 51% through fiscal 2024.

Please note that Disney owns a controlling 67% stake in Hulu and by January 2024, Disney may have to shell outs billions to acquire the 33% stake in Hulu that Comcast Corporation (CMCSA) owns. How this situation resolves itself remains to be seen, though by January 2024, either Comcast can compel Disney to purchase or Disney can compel Comcast to sell that stake in Hulu. There is a floor price of $27.5 billion for all of Hulu, though Comcast will likely push for a higher price for obvious reasons.

By fiscal 2024, Disney aims to either break-even or generate a profit from its core video streaming services. Paid subscriber increases are one way the company aims to achieve that goal, with price increases being another. Disney recently implemented sizable pricing increases across its various video streaming services and will likely continue to do so going forward, with the pace of the increases dictated by market conditions and other factors. The moderate reduction in its paid subscriber growth forecast through fiscal 2024 shouldn’t significantly hamper Disney’s ability to eventually turn these loss making operations into cash flow cows, given its ample pricing power and ability to rationalize original content spend.

On a GAAP basis, Disney’s revenues rose 26% year-over-year to reach $21.5 billion while its GAAP operating income more than doubled to reach $2.1 billion last fiscal quarter. Its GAAP diluted EPS stood at $0.77 in the fiscal third quarter of fiscal 2022, up from $0.50 in the same period last fiscal year. Due to a large working capital build, Disney generated negative $0.3 billion in free cash flow during the first three quarters of fiscal 2022. Going forward, as its theme parks and resorts business continues to recover while its video streaming services scale to achieve profitability, Disney’s ability to generate “gobs” of positive free cash flows should return in earnest.

Disney exited the fiscal third quarter with a net debt load of $38.6 billion (inclusive of short-term debt). Its $13.0 billion in cash and cash equivalents on hand at the end of this period provides Disney with ample liquidity to meet its near-term funding needs.

Concluding Thoughts

We are huge fans of Disney and investors are warming back up to the name, seen through the steady climb in DIS shares of late. Looking ahead, it will be essential for Disney to prove to the market that its video streaming strategy can achieve profitability in the medium term, and we appreciate its efforts on this front with an eye towards recent pricing increases. In the meantime, Disney’s theme parks and resorts operations should benefit from pent-up consumer demand for outdoors entertainment options after being cooped inside during much of the COVID-19 pandemic. We continue to like Disney as an idea in the simulated Best Ideas Newsletter portfolio.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for DIS, CMCSA, SEAS, SIX, CHDN, BC, FUN, MTN, ONEW, PATK, RRR, AOUT, VSTO, HZO, MBUU, MCFT

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, V, and VRTX and is long put options on RDFN and RKT. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.