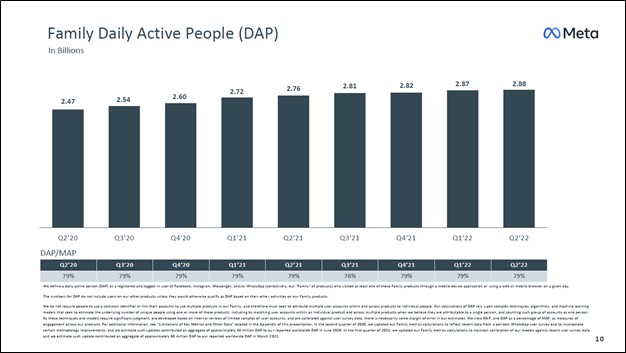

Image Shown: Meta Platforms Inc’s family of apps continued to grow its active user base last quarter. Its social media networks are used by billions of users every single day. Image Source: Meta Platforms Inc – Second Quarter of 2022 IR Earnings Presentation

By Callum Turcan

On July 27, Meta Platforms Inc (META) reported second quarter 2022 earnings that missed consensus top- and bottom-line estimates. We appreciate that its active user base across its family of apps (Facebook, Instagram, WhatsApp, and Messenger) and its ad impressions continued to trend in the right direction last quarter, though recent softness in its pricing power is concerning. Meta Platforms is responding by scaling back its targeted operating expense growth, which we appreciate. We continue to like Meta Platforms as an idea in the Best Ideas Newsletter portfolio, though we recognize that near term headwinds are weighing quite negatively on investor sentiment towards the name.

Earnings Update

Meta Platforms’ GAAP revenues dropped 1% year-over-year in the second quarter as a 15% increase in ad impressions across its family of apps was offset by a 14% decrease in its average price per ad. Its family daily active people and family monthly active people were both up 4% year-over-year last quarter, with Facebook daily active users up 3% and Facebook monthly active users up 1%.

Billions of users are still active across Meta Platforms’ social media networks (monthly active users across its family of apps stood at 3.65 billion last quarter) and demand for its advertising services remains strong. However, its pricing power has softened somewhat. Foreign currency headwinds are playing a key role here as well. In the second quarter of 2022, Meta Platforms’ GAAP operating income dropped 32% year-over-year due to its surging operating expenses in the wake of its headcount increasing 32%.

During the first half of this year, Meta Platforms remained a cash flow cow. It generated $13.3 billion in free cash flow and spent $14.7 billion buying back its Class A common stock during this period. The firm exited June 2022 with $40.5 billion in cash, cash equivalents, and current marketable securities along with another $6.5 billion in noncurrent marketable securities on hand with no debt on the books. We are very supportive of Meta Platforms’ share buyback strategy as we continue to view its stock as deeply undervalued, though we recognize that sizable near term headwinds have shaken investor confidence.

Guidance Update

Looking to the third quarter of 2022, Meta Platforms guided for $26.0-$28.5 billion in revenue during its latest earnings update with foreign currency movements expected to represent a 6% headwind to its revenues (courtesy of the strong U.S. dollar seen of late). At the midpoint, that represents an expected 6% year-over-year decline in Meta Platforms’ total revenues.

To adapt to the changing digital advertising landscape, Meta Platforms further reduced its full-year operating expense guidance during its latest earnings update. Its current operating expense guidance sits at $85.0-$87.0 billion for 2022, down from its previous forecast of $87.0-$92.0 billion. Additionally, its current guidance is down significantly from the preliminary forecast Meta Platforms’ put out in October 2021 that called for $91.0-$97.0 billion in operating expenses this year.

Meta Platforms expects to spend $30.0-$34.0 billion on its capital expenditures in 2022. At the midpoint represents an increase versus previous expectations calling for $29.0-$34.0 billion in capital expenditures this year (the same as its preliminary guidance put out in October 2021). The company is investing heavily in its “metaverse” growth ambitions (such as data centers, servers, and networking infrastructure) while also further developing its corporate office footprint. Please note that its forecasted capital expenditures and operating expenses for 2022 are both up sharply from the $18.6 billion Meta Platforms spent on capital expenditures and the $71.2 billion it spent on operating expenses last year.

Management Commentary

During Meta Platforms’ latest earnings call, management had this to say regarding the firm’s near term outlook (emphasis added):

“Turning now to the outlook. We expect third quarter 2022 total revenue to be in the range of $26 billion to $28.5 billion. This outlook reflects a continuation of the weak advertising demand environment we experienced throughout the second quarter, which we believe is being driven by broader macroeconomic uncertainty.

We also anticipate third quarter Reality Labs revenue to be lower than second quarter revenue. Our guidance assumes foreign currency will be an approximately 6% headwind to year-over-year total revenue growth in the third quarter based on current exchange rates. In addition, as noted on previous calls, we continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations.

Turning now to the expense outlook. We expect 2022 total expenses to be in the range of $85 billion to $88 billion, lowered from our prior outlook of $87 billion to $92 billion. We’ve reduced our hiring and overall expense growth plan this year to account for the more challenging operating environment while continuing to direct resources towards our company priorities.

We expect 2022 capital expenditures, including principal payments on finance leases to be in the range of $30 billion to $34 billion, narrowed from our prior range of $29 billion to $34 billion. Absent any changes to U.S. tax law, we expect our full year 2022 tax rate to be above the Q2 rate and in the high teens.

In closing, we’re in the midst of an economic cycle that is having a broad impact on the digital advertising business.We’re being disciplined on spending while still investing in those areas that will position to drive growth as the economic environment improves.” — David Wehner, CFO of Meta Platforms

Over the long haul, the digital advertising market is supported by powerful tailwinds and Meta Platforms is well-positioned to capitalize on that upside. However, in the near term, macroeconomic headwinds are weighing quite negatively on the firm’s pricing power and that is something we’ll be keeping a close eye on.

Concluding Thoughts

We appreciate that Meta Platforms is scaling back its operating expense growth and understand that it needs to develop the infrastructure to enable its longer term metaverse growth ambitions. Demand for its digital advertising services remains quite strong when looking at its ad impression growth metrics and its growing active user base, though weakness in its pricing power needs to be closely monitored going forward.

We plan to tweak a number of assumptions in our valuation model in light of recent events, but shares of META remain significantly undervalued, in our view. It’s important that investors not extrapolate the most recent quarterly performance into perpetuity, particularly as this quarter may reflect the nearing of a trough in online advertising spending for this business cycle. We continue to be bullish on the areas of big cap tech and large cap growth, both of which are staging a nice comeback as we write.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for META and SCHG.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, and V. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.