Image Source: Life Storage Inc – First Quarter of 2022 Earnings Press Release

By Callum Turcan

We are big fans of the self-storage industry as real estate investment trusts (‘REITs’) operating in this space have historically generated “excess” free cash flows after covering their total dividend obligations. Life Storage Inc (LSI), a self-storage REIT, is one of our favorite income generation ideas. As of this writing, shares of LSI yield ~3.9% after Life Storage pushed through a nice 8% sequential increase in its dividend in July 2022, bringing its quarterly payout up to $1.08 per share ($4.32 on an annualized basis).

During the past decade, Life Storage’s dividend growth track record has impressed (its quarterly payout has more than tripled since 2012 on a per-share basis), though we caution that the REIT cut its payout back in 2009 in the wake of the Great Financial Crisis (‘GFC’). The self-storage REIT is a much stronger entity today than it was in 2009 on both a financial and operational basis. Additionally, the secular tailwinds that underpin its growth runway are quite strong as US households are increasingly seeking economical ways to maximize their living space at a time when home prices have skyrocketed in recent years.

Life Storage operates 1,100+ self-storage facilities across 36 US states, though please note that some of those are represented by third-party facilities operated by its management platform. At the end of March 2022, Life Storage’s third-party self-storage management platform operated ~380 facilities. Life Storage will often acquire some of the properties managed by this platform.

Earnings and Guidance Update

In May 2022, Life Storage reported its first-quarter 2022 earnings report that beat both consensus top- and bottom-line estimates when looking at its non-GAAP funds from operations (‘FFO’) per-share performance. Though FFO is an imperfect industry-specific metric, it provides a useful snapshot of a REIT’s financial performance. Life Storage’s FFO per share rose by 33% year-over-year in the first quarter to reach $1.44 as its same-store net operating income (‘NOI’) surged higher by 22%.

For reference, Life Storage’s same-store operations at the end of March 2022 were represented by the 580 self-storage facilities it has owned since the end of December 2020. These are classified by the REIT as its “stabilized stores” to differentiate these facilities from recent acquisitions or facilities that were recently constructed, as it can take some time to achieved normalized occupancy rates (~12-18 months).

Same-store NOI growth in the first quarter of 2022 was driven by a 16% year-over-year increase in Life Storage’s same-store revenues due largely to a 15% increase in realized rental rates, aided by a ~20 basis point increase in average occupancy rates. Life Storage’s weighted-average same-store occupancy rate stood at 93.6% in the first quarter of this year. As its same-store operating expenses rose by just 3% year-over-year in the first quarter, economies of scale provided a powerful tailwind to Life Storage’s financial performance. When including all of Life Storage’s self-storage properties in the picture, it exited March 2022 with an occupancy rate of 92.9%.

Life Storage acquired 18 self-storage facilities in the first quarter for $352 million, including one from its third-party management platform. The REIT also added 18 gross self-storage facilities to its third-party management platform in the first quarter.

On a GAAP basis, Life Storage’s revenue rose 36% year-over-year to reach $233 million in the first quarter of 2022, and its operating income increased 48% to reach $98 million. Its GAAP diluted EPS came in at $0.88 in the first quarter of this year, up from $0.63 in the same period last year, as net income growth more than offset a meaningful increase in its outstanding diluted share count. Life Storage, as with virtually all REITs, utilizes a combination of debt and equity issuances to fund its growth ambitions and meet its financing needs.

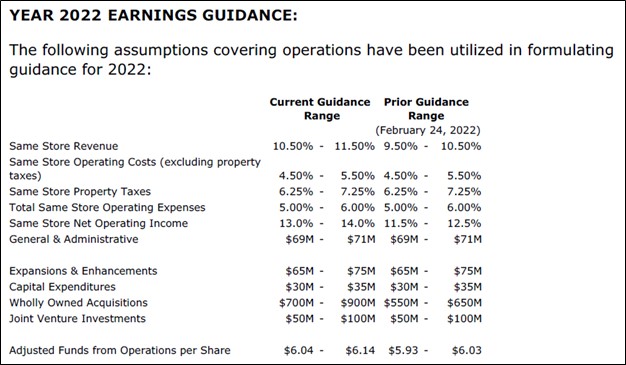

Furthermore, Life Storage increased its guidance for 2022 in conjunction with its first quarter earnings report. Its full-year forecasts can be viewed in the upcoming graphic down below. At the midpoint of its current guidance, Life Storage is forecasting that its adjusted FFO per share will grow by 20% in 2022 versus 2021 levels.

Image Shown: Life Storage increased its full-year guidance for 2022 in conjunction with its first quarter earnings update. Image Source: Life Storage – First Quarter of 2022 Earnings Press Release

We appreciate management’s confidence in Life Storage’s near-term outlook. Life Storage has been doing great of late, and its free cash flows should swell higher as a result going forward.

Stellar Cash Flow Profile

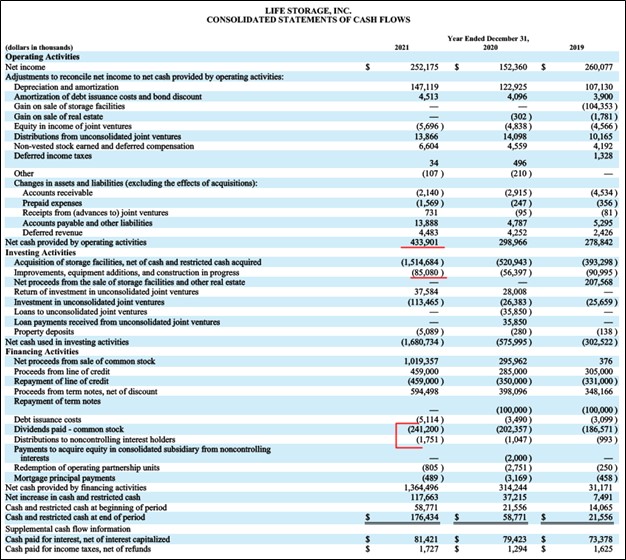

In 2021, Life Storage generated $349 million in free cash flow and spent $243 million covering its total payout obligations (‘dividends paid – common stock’ plus ‘distributions to noncontrolling interest holders’), allowing for $106 million in excess free cash flow. We define its capital expenditures as ‘improvements, equipment additions, and construction in progress’ with its other major investing cash outlays represented by acquisitions, which we do not consider to be capital expenditures. This wasn’t a one-off event as Life Storage generated $39 million in excess free cash flow in 2020 and a negligible amount of excess free cash flow in 2019.

Image Shown: An overview of Life Storage’s historical ability to generate excess free cash flows after fully covering its total payout obligations. Relevant line-items are underlined in red. Image Source: Life Storage – 2021 Annual Report with additions from the author

During the first quarter of 2022, Life Storage generated $89 million in free cash flow which fully covered $86 million in total payout obligations. We are big fans of Life Storage’s cash flow profile; however, it still remains a capital market dependent entity given its sizable capital expenditure requirements, total payout obligations, and large net debt load on the books. Going forward, given its financial strength, we expect that Life Storage will be able to tap debt and equity markets at attractive rates to meet its funding needs.

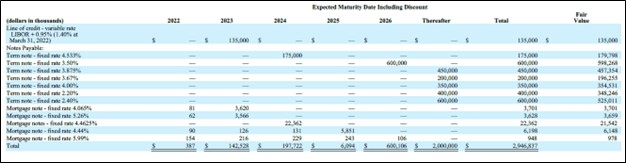

Life Storage exited March 2022 with $2.9 billion in total debt on the books (inclusive of short-term debt) with less than $0.1 billion in cash and cash equivalents on hand. At the end of this period, only a negligible amount of that debt matured in 2022, with a little over $0.1 billion maturing in 2023 and just under $0.2 billion maturing in 2024. We appreciate the well-staggered nature of Life Storage’s debt maturity schedule.

Image Shown: Life Storage’s debt maturity schedule was well-staggered at the end of March 2022, providing the REIT with some financial flexibility. Image Source: Life Storage – 10-Q SEC filing covering the First Quarter of 2022

The REIT’s near-term funding needs can be met in part through its $0.5 billion unsecured revolving credit line that matures in March 2023 (which had less than $0.15 billion drawn against it at the end of March 2022), though Life Storage will need to get the maturity date of that facility extended in the coming months. Life Storage has an investment-grade credit rating (BBB/Baa2) which should support its future refinancing activities. In April 2022, the company issued a modest amount of common stock under its continuous equity offering program according to its 10-Q SEC filing covering the first quarter of this year. Future equity issuances are quite likely.

Life Storage also noted in the 10-Q SEC filing that it had acquired five self-storage facilities for just under $0.1 billion in cash while entering into an agreement to acquire an additional three self-storage facilities subsequent to the end of the first quarter. Furthermore, Life Storage acquired the remaining stake in a joint venture that it did not already own for a modest cash sum in April 2022. The REIT is a highly acquisitive entity, and purchases of self-storage properties represent a core part of its growth strategy.

Concluding Thoughts

There is a lot to like about Life Storage, and we appreciate its bright growth outlook, ample pricing power, solid operational execution, and ability to generate substantial excess free cash flows. We caution that as a capital-market dependent entity with a large net debt load, Life Storage needs to be cognizant of its financial health at all times. Going forward, Life Storage should remain a stellar cash flow generator and its dividend growth outlook is quite promising. We continue to like Life Storage as an idea in the simulated High Yield Dividend Newsletter portfolio.

—–

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Tickerized for CUBE, PSA, PSB, LSI, EXR, REZ, STSFF, NSA, XLRE, IYR, VNQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, META, GOOG, VRTX, and XLE and is long call options on DIS and META. American Tower Corporation (AMT), CubeSmart (CUBE), Life Storage Inc (LSI), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.