Image Source: Phillips 66 Investor Update May 2022

By Valuentum Analysts

Phillips 66 (PSX) is a top-notch operator in the downstream space with impressive refining and petrochemical assets supported by various midstream operations. Its investment-grade credit rating (A3/BBB+), with stable outlooks, better enables Phillips 66 to tap capital markets at attractive rates, something that we especially like when considering new ideas in the high yield dividend arena. A growing global middle class and a growing global population supports Phillip 66’s longer term outlook for refined product demand. We like the company as one of our newest high yield dividend considerations.

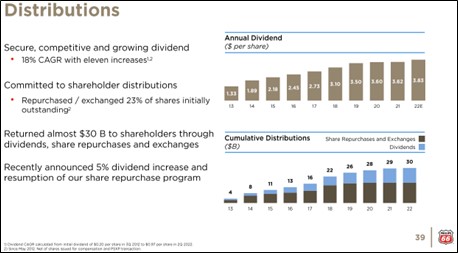

Phillips 66’s near-term outlook is supported by the ongoing recovery in the global thirst for refined petroleum and petrochemical products as the worst of the COVID-19 pandemic fades. We forecast that Phillips 66 will moderately grow its secure and competitive payout going forward (it last raised its dividend 5% in May), and we think the stock makes for a great addition to the simulated High Yield Dividend Newsletter portfolio. A small “position” in Phillips 66 will replace the “exposure” to the Vanguard Consumer Staples ETF (VDC) in the High Yield Dividend Newsletter portfolio July 1, as we have soured quite a bit on the consumer staples sector in light of recent performance by several bellwethers in the group.

For staters, as we noted in our latest work, many consumer staples entities aren’t able to price their goods high enough to drive earnings and operating-income expansion, despite top-line growth, and we’re not only seeing gross margin pressure essentially across the board among staples, but we’re also starting to witness some meaningful inventory build within the consumer discretionary space due to supply chain issues, perhaps most noticeably at Nike, Inc. (NKE)–whose quarter ending in May showed a huge 23% leap in inventories in part due to weakness in Greater China. We think “adding” some diversified refining exposure to the simulated High Yield Dividend Newsletter portfolio, as in PSX, makes more sense than “holding” the VDC at this time, particularly given inflationary trends and the level of gas prices at the pump, both of which play into PSX’s hands.

Image Source: Phillips 66 Investor Update May 2022

It’s hard to find much wrong with Phillips 66 with energy resource prices and margins soaring, but we caution that the firm needs to retain constant access to capital markets to refinance maturing debt, ideally at attractive rates. We don’t want to make too much of this, however, as Phillips 66 has ample access to liquidity, along with a staggered debt maturity schedule.

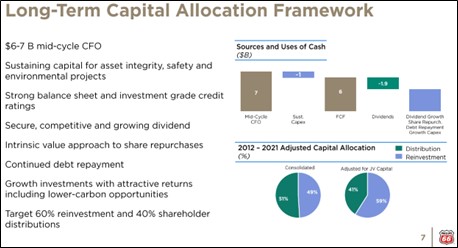

As it relates to dividend growth potential, we expect some moderate increases in the coming years, but it is worth noting that share repurchases compete for capital against Phillip 66’s dividend obligations, as does its net debt load. In light of the strong current market conditions for energy names and very healthy refining margins, we’re not too concerned about its liquidity position though, especially given the company’s stellar investment-grade credit rating.

Concluding Thoughts

Phillips 66 yields a lofty ~4.5% at this time, so it’s a good fit for the simulated High Yield Dividend Newsletter portfolio, though we do note that the company’s Dividend Cushion ratio is negatively impacted by its sizable net debt position and the magnitude of its dividend obligations to investors. Right now, however, things are going really well for Phillips 66 thanks to ongoing energy resource supply constraints and strong refined product demand, but readers should be aware of the inherent volatility within the refining space–as refining margins or “crack spreads” are bound to be volatile over long periods of time.

Image Source: Phillips 66 Investor Update May 2022

All told, we think Phillips 66 is a much better fit for the simulated High Yield Dividend Newsletter portfolio than the Vanguard Consumer Staples ETF at this time, particularly given the margin pressure across the consumer staples sector and the very real threat of branded consumer goods demand destruction. Phillips 66 last upped its payout ~5% in May, and it’s just hard for us to not like the favorable refining industry backdrop and fundamental momentum at the diversified refiner. Our fair value estimate of PSX stands at $90 per share at the time of this writing, roughly in-line with where shares are trading. This simulated High Yield Dividend Newsletter portfolio change will be reflected in the next edition of the High Yield Dividend Newsletter, to be released July 1.

———-

Tickerized for PSX, HES, MRO, HAL, FANG, VLO, DVN, OKE, BKR, PXD, EOG, SLB, COP, MPC, USO, XLE, CRAK, VDC

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE. Callum Turcan owns shares in DIS, META, GOOG, VRTX, and XLE and is long call options on DIS and META. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.