Image Source: Qurate Retail Inc – First Quarter of 2022 IR Earnings Presentation

Executive Summary: Qurate Retail Inc is home to several well-known retail brands including QVC and HSN that operate television networks and online marketplaces that sell curated products. The company is contending with several exogenous shocks such as inflationary pressures and supply chain hurdles, while customer engagement levels are on the decline after growing during the initial phases of the COVID-19 pandemic. Qurate Retail has a massive net debt load and sizable annual financing obligations, and its margins have deteriorated substantially of late. Due to its complex share structure and management organization, weak financial position, and lackluster outlook, we are not interested in Qurate Retail’s common or preferred shares at this time. Qurate Retail is too risky for our taste.

By Callum Turcan

Qurate Retail Inc (QRTEA) (QRTEB) owns several retail brands including QVC, HSN, and Zulily that sell curated products through various distribution channels. The company also owns Cornerstone Brands which consists of home products sold under the Ballard Designs, Frontgate, and Grandin Road brands and apparel products under the Garnet Hill brand. Qurate Retail is perhaps best known for selling curated products via broadcast television networks under the QVC and HSN brands in the US and other markets around the world. The company is headquartered in the U.S.

Operations Overview

Its QxH business segment is represented by its QVC and HSN operations focused on the U.S. and its QVC International business segment is represented by its overseas QVC operations, which are primarily focused on markets in Germany, Austria, Japan, the UK, the Republic of Ireland, and Italy. Together, its QxH and QVC International business segments are part of its QVC unit, which sell products via television networks, online marketplaces, mobile apps, and social media platforms.

Quarte Retail’s QxH operations involve 20 hours of live programming per day which is distributed to ~92 million US television households 364 days per year (virtually all US households with a television have access to QVC and HSN programming). Its main TV channels include QVC, QVC2, QVC3, HSN, and HSN2 and its distribution efforts are supported by its QVC.com and HSN.com websites along with other digital platforms. QVC International operates in a similar function. In 2021, 41% of all orders placed with QxH and 36% of all orders placed with QVC International were through mobile devices. QxH operates nine distribution centers and QVC International operates four distribution centers. Additionally, its QVC unit operates nine call centers to support sales activities.

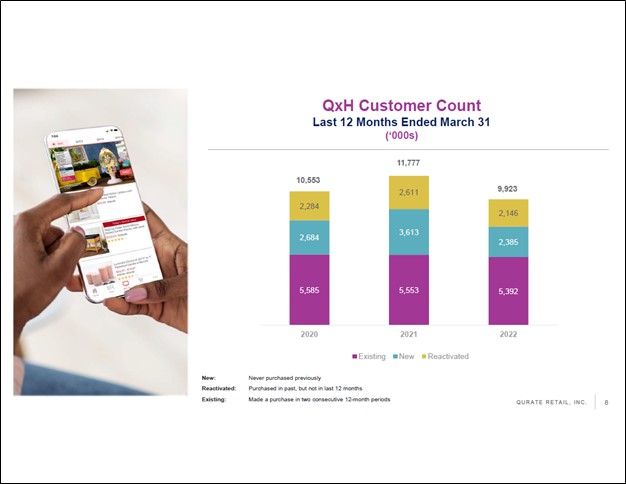

In 2021, Qurate Retail saw its QVC unit experience an 8% annual decline in its customer count as tailwinds from the initial phases of the coronavirus (‘COVID-19’) pandemic faded. However, the firm’s core customer base remains quite loyal. Last year, 88% of its QVC unit’s shipped sales came from repeat customers who had made a purchase within the last twelve months. These customers spent $1,336 on average in 2021. Additionally, QVC saw 6% of its shipped sales in 2021 come from new customers and the remaining 6% of its shipped sales came from “reactivated” customers, meaning customers that had made a purchase through QVC before though not in the past twelve months.

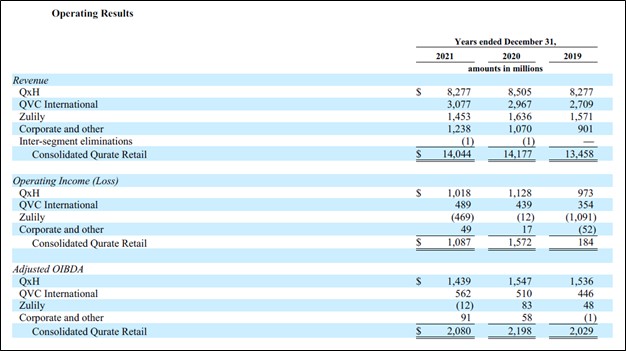

Please note that QxH and QVC International represented roughly four-fifths of Qurate Retail’s total revenues in 2021 and the lion’s share of its operating income.

Image Shown: Qurate Retail’s QxH and QVC International segments, which together form its QVC unit, represent the backbone of its business model and the source of the lion’s share of its revenue and operating income. Image Source: Qurate Retail – 2021 10-K SEC Filing

Pivoting to its other operations, Zulily sells curated products through its websites and mobile apps. The company’s Cornerstone Brands segment provides Qurate Retail the ability leverage its various distribution channels to generate synergies across the company. At the end of 2021, its Cornerstone Brands segment operated 22 retail and outlet stores in the US. The company includes its Cornerstone Brand operations within its ‘Corporate and other’ segment. While important parts of Qurate Retail’s business model, its bread-and-butter remains its QVC unit.

Complex Share Structure

Qurate Retail has multiple series of common shares including Series A shares (one share is entitled to one vote), Series B shares (one share is entitled to ten votes), and Series C shares (which have no voting rights) along with Qurate Retail Inc Preferred Shares (QRTEP) which is the company’s 8.0% Series A Fixed Rate Cumulative Redeemable Preferred Stock. Additionally, certain provisions require either a supermajority to vote in favor of the measure (~67% of the firm’s aggregate voting power) or at least three-quarters of the board of directors to vote in favor of the measure to get approved. Outside shareholders will find it hard to exercise any meaningful influence over major decisions at Qurate Brands.

The company also has a complex management structure as well due to Qurate Retail effectively being part of the broader Liberty family of companies. Qurate Retail, Liberty Media Corporation (LSXMA), Liberty Tripadvisor Holdings Inc (LTRPA), Liberty Broadband Corporation (LBRDA), and Liberty Media Acquisition Corp (LMACA) all share common management teams. Arguably, this leads to a leadership structure which lacks operational focus and has conflicting incentives.

Financial Overview

Pivoting to Qurate Retail’s financial performance, the firm has experienced a meaningful decline in demand of late after its businesses saw customer engagement grow during the early phases of the COVID-19 pandemic. When the company reported first quarter 2022 earnings on May 6, it missed consensus top- and bottom-line estimates by a wide margin. Its GAAP revenues declined by 14% year-over-year to reach $2.9 billion with revenue at its QxH (down 13%), QVC International (down 13%, though that decline falls to just 7% on a constant currency basis), and Zulily (down 38%) segments all down meaningfully though sales at Cornerstone Brands were up 19% in the first quarter of 2022.

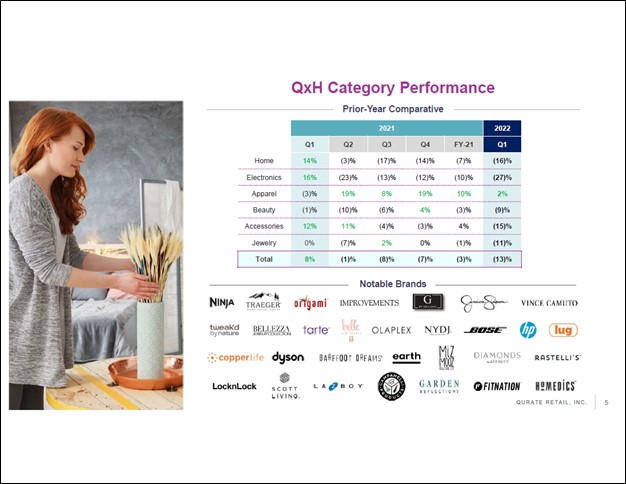

Demand for home, electronics, beauty, accessories, and jewelry products at its QxH segment were all down sharply year-over-year in the first quarter, which was only marginally offset by modest growth seen in apparel sales. The company experienced a fire at its fulfillment center in Rocky Mount, North Carolina, in December 2021 which negatively impacted its operational and financial performance (with its insurance policies offsetting some of the headwinds on this front).

Image Shown: Qurate Retail’s QxH segment experienced widespread softness in demand across almost all product categories during the first quarter of 2022. Image Source: Qurate Retail – First Quarter of 2022 IR Earnings Presentation

On a trailing twelve month basis, the firm’s QxH segment experienced a sharp decline in customer engagement through the first quarter of 2022 versus the meaningful increase seen through the first quarter of 2021. This is largely due to consumers resuming outdoor and in-person shopping activities. However, it is important to note that Qurate Retail operates in an incredibly competitive environment and its ability to truly differentiate its offerings is quite limited, in our view. Selling curated products is something virtually all e-commerce platforms can do, especially as it concerns the existing customer base of those platforms (due to the ability to retain spending data and utilize other forms of analytics to gauge shopping preferences).

Image Shown: After customer engagement with Qurate Retail’s various operating segments grew meaningfully during the initial phases of the COVID-19 pandemic, demand for its offerings has been shifting lower of late as consumers resumed outdoor and in-person shopping activities. Image Source: Qurate Retail – First Quarter of 2022 IR Earnings Presentation

Qurate Retail posted $106 million in GAAP operating income during the first quarter of 2022, down from $373 million in the same period last year. Restructuring expenses, particularly as it relates to its Zulily segment, and fire related costs on a net basis represented a $4 million headwind to Qurate Retail’s operating income in the first quarter (after recording $21 million in net fire related costs in 2021). Qurate Retail launched a restructuring program in the first quarter of 2022 at its Zulily segment which among other things involves closing its fulfillment center in Bethlehem, Pennsylvania to streamline this segment’s operations.

However, the real blow to Qurate Retail’s bottom-line didn’t come from special items but from a sharp decline in its GAAP gross profit, which fell from over $1.1 billion in the first quarter of 2021 down below $0.9 billion in the first quarter of 2022. Its GAAP gross margin declined by ~370 basis points during this period to reach 30.6% in the first quarter of this year. Inflationary pressures and supply chain hurdles are taking enormous chunks out of Qurate Retail’s bottom line.

The firm’s interest expense in the first quarter of 2022 totaled $117 million, exceeding its GAAP operating income of $106 million. Qurate Retail was still able to generate $1 million in positive GAAP net income due to special items including ‘realized and unrealized gains on financial instruments, net’ and ‘other, net’ during the first quarter of this year. In the same quarter in 2021, Qurate Retail generated $206 million in GAAP net income. Management is aware that Qurate Retail needs to change course to improve its outlook–as evidenced by the aforementioned restructuring program at its Zulily operations–though exogenous headwinds will make it difficult for Qurate Retail to right the ship in the near term.

Qurate Retail often cites the non-GAAP adjusted OIBDA metric which is defined “as operating income (loss) plus depreciation and amortization, stock-based compensation, and where applicable, separately identified impairments, litigation settlements, restructuring, acquisition-related costs and fire related costs, net (including Rocky Mount inventory losses).” Additionally, its non-GAAP adjusted OIBDA margin is defined “as adjusted OIBDA divided by revenue.” The firm views these metrics as a useful gauge of the underlying performance of each business segment.

In the first quarter of 2022, Qurate Retail generated $335 million in adjusted OIBDA, down 35% year-over-year. Looking at each core business segment, adjusted OIBDA declined at QxH (down 36% year-over-year), QVC International (down 27% year-over-year), and turned negative at its Zulily segment (versus positive adjusted OIBDA in the same period last year) in the first quarter of 2022 while rising 15% year-over-year at its Cornerstone Brands operation. Unallocated corporate costs declined marginally during this period as it concerns computing its adjusted OIBDA performance. Company-wide, Qurate Retail’s adjusted OIBDA margin fell by ~390 basis points to reach 11.6% in the first quarter of 2022. The firm’s margin performance is clearly deteriorating.

Massive Debt Load

From 2019-2021, Qurate Retail generated ~$1.3 billion in free cash flow per year on average (defining capital expenditures as ‘capital expenditures’ plus ‘expenditures for television distribution rights’), with 2020 representing a banner year for the firm. In the first quarter of 2022, Qurate Retail generated negative net operating cash flow and thus negative free cash flow, though working capital movements for a retail company will have an outsized impact on its quarterly performance. The company’s historical free cash flow performance is impressive, though whether that can be sustained going forward is an open question and we are not convinced that will be the case.

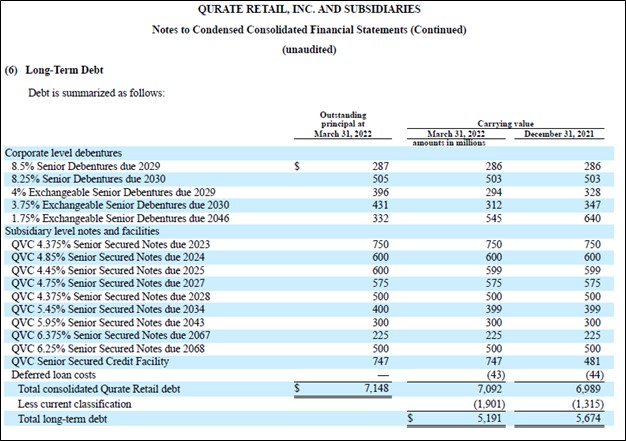

Qurate Retail has a substantial net debt load. At the end of March 2022, the firm had $0.6 billion in cash and cash equivalents on hand versus $1.9 billion in short-term debt and $5.2 billion in long-term debt, equal to a net debt load of $6.5 billion. It also had $1.3 billion in preferred stock on the books at the end of this period. To meet its near term funding needs, Qurate Retail is heavily dependent on its $3.25 billion secured revolving credit facility which matures in October 2026. At the end of March 2022, Qurate Retail had access to $2.5 billion in available borrowings through this facility, which is a secured credit facility backed by all the equity interests held by QVC, Zulily, and Cornerstone Brands.

Image Shown: An overview of Qurate Retail’s outstanding debt at the end of March 2022, keeping in mind the company had substantial outstanding preferred stock on the books as well. Image Source: Qurate Retail – 10-Q SEC Filing covering the First Quarter of 2022

Part of the reason why Qurate Retail has a weak balance sheet is due to the large special dividend the firm paid out in November 2021. The company would likely have benefited from retaining that cash on hand.

On June 9, Qurate Retail announced a cash tender offer for all of its outstanding $0.75 billion 4.375% Senior Secured Notes due 2023. Funding for the tender offer is expected to come from its cash on hand and its secured revolving credit line. While this move will help improve Qurate Retail’s debt maturity schedule and will effectively buy it additional time to help improve its financial performance, the ability for the company to continuously roll over its mountain of debt is questionable in the long run. Here is what the press release announcing the cash tender offer had to say regarding the terms:

Under the terms of the tender offer, holders of the 2023 Notes that are validly tendered and accepted at or prior to the expiration time, or holders who deliver to the depositary and information agent a properly completed and duly executed notice of guaranteed delivery and timely deliver such 2023 Notes, each in accordance with the instructions described in the offer to purchase, will receive total cash consideration of $1,010.00 per $1,000 principal amount of 2023 Notes, plus an amount equal to any accrued and unpaid interest up to, but not including, the settlement date, which is expected to be June 16, 2022.

The tender offer is contingent upon the satisfaction of certain customary conditions. The tender offer is not conditioned on any minimum amount of 2023 Notes being tendered. QVC may amend, extend or terminate the tender offer in its sole discretion.

Beyond the substantial annual financing obligations (including its interest expenses and the costs associated with rolling its debt burden forward) Qurate Retail is contending with, its preferred dividend obligations and payments to noncontrolling interests are also substantial. On May 18, Qurate Retail declared its $2.00 per share quarterly cash dividend on its 8.0% Series A Cumulative Redeemable Preferred Stock which was payable on June 15.

Historically, Qurate Retail has repurchased meaningful amounts of its common stock, though the firm did not repurchase any of its common stock in the first quarter of this year and is unlikely to do so for the foreseeable future. The company should prioritize deleveraging efforts going forward, in our view, due to its large net debt load.

Management Commentary

During Qurate Retail’s first quarter of 2022 earnings call, management communicated to investors that the firm was well-aware of the need to make serious changes to the business to ensure its longer term survival. Here is what management had to say (emphasis added):

“While we are in the early days of the organizational changes and turnaround, we feel good about the current business leadership. The leaders at QVC US and HSN are putting their imprint on their businesses, asking the difficult questions to uncover root causes and to elevate the accountability of their team. In summary, we are focused on stabilizing the core business and driving innovation in digital to enhance the value we create and deliver to shareholders. We believe the team understands the issues and have begun to address them.

It’s going to take quarters, not weeks and months, for our actions to become visible on the headline numbers, and we do not anticipate our recovery and turnaround will be a straight line. However, we are taking tangible actions to address and mitigate the pressures as we execute on the long-term strategy. We have ongoing work on the long-term strategic vision.

We will be hosting an investor event on June 27th, streamed live from our headquarters in Westchester. We’ll provide additional detail on strategic initiatives at this time, and we hope that you will join us.” — David Rawlinson, President and CEO of Qurate Retail

We appreciate management’s acceptance of the need to implement changes, though as Qurate Retail’s President and CEO noted, it will take some time for these changes to be reflected in the company’s financial performance. During its upcoming investor event on June 27 Categories Member Articles