Image Shown: Dividend growth idea Honeywell International Inc increased its full-year guidance for 2022 during its first quarter earnings update. We continue to be big fans of the name as the aerospace industry steadily rebounds. Image Source: Honeywell International Inc – First Quarter of 2022 IR Earnings Presentation

By Callum Turcan

On April 29, Honeywell International Inc (HON) reported first quarter 2022 earnings that beat both consensus top- and bottom-line estimates as its business continues to rebound from the worst of the coronavirus (‘COVID-19’) pandemic. Due to its strong performance, management raised the company’s full-year sales and earnings guidance for 2022 in conjunction with its latest earnings update. We continue to like Honeywell as an idea in the Dividend Growth Newsletter portfolio to gain exposure to the recovering aerospace industry and exposure to the nascent quantum computing industry. Shares of HON yield ~2.1% as of this writing.

Earnings Overview

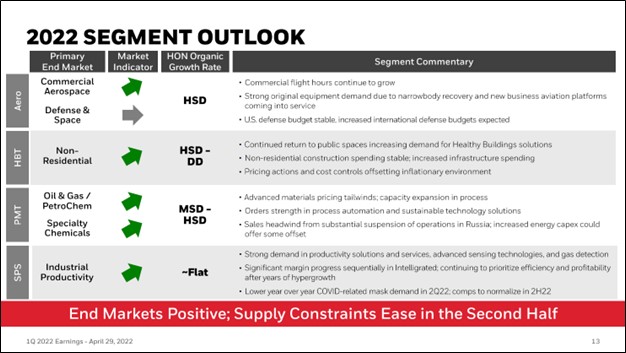

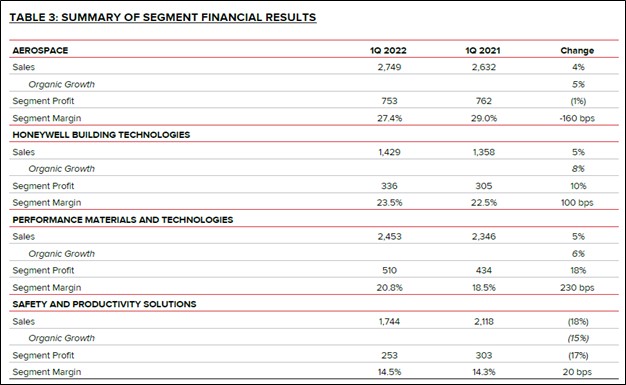

In the first quarter, Honeywell’s GAAP revenues declined 1% year-over-year due to a slowdown in COVID-19 mask purchases and the Ukraine-Russia crisis, as the firm suspended its business in Belarus and Russia in March 2022. Excluding those headwinds, Honeywell reported that its non-GAAP organic revenues advanced 1% year-over-year last quarter as its aftermarket aerospace sales rebounded robustly. Its air transport aftermarket and business and general aviation aftermarket sales rose 25% year-over-year while its commercial original equipment sales also grew double-digits last quarter, though defense-related sales slowed. Overall, revenues at its ‘Aerospace’ segment increased 5% year-over-year on an organic basis last quarter (which was its largest in terms of sales and segment-level profit last quarter).

Image Shown: The ongoing rebound at Honeywell’s Aerospace business segment is needle-moving for the firm due to this segment being the single largest source of its revenues and segment-level profit. Image Source: Honeywell – First Quarter of 2022 Earnings Press Release

Strong demand for building management systems and fire products helped drive organic sales at its ‘Honeywell Building Technologies’ segment, up 8% year-over-year last quarter, while organic sales at its ‘Performance Materials and Technologies’ segment increased 6% year-over-year due to strength at its advanced materials, thermal solutions, and lifecycle solutions offerings.

However, organic sales at its ‘Safety and Productivity Solutions’ segment dropped 15% year-over-year last quarter due to a reduction in COVID-19 mask demand and reduced warehouse automation volumes (removing the impact of reduced COVID-19 mask sales saw its organic sales at this segment drop 6% year-over-year last quarter). On the plus side, the company’s Safety and Productivity Solutions segment benefited from strong demand for gas detection offerings, productivity services and solutions, and advanced sensing technologies last quarter.

Although portions of Honeywell’s business are facing sizable headwinds, overall demand remains strong for its expansive slate of offerings. Its GAAP gross margins rose ~20 basis points year-over-year, aided by its pricing power, though its GAAP operating margin (defined as GAAP gross profit less SG&A expenses divided by GAAP revenues) declined by ~225 basis points due to a meaningful increase in its SG&A expenses.

The firm notes that its segment-level profit margin increased at its Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions segments year-over-year last quarter due primarily to favorable product mix shifts and pricing increases. However, its segment-level profit margin declined at its Aerospace segment year-over-year last quarter due to inflationary pressures, an unfavorable product mix, and the removal of a one-time gain seen in the same period last year, though its pricing power helped offset these headwinds, to a degree.

Honeywell is not immune to inflationary pressures and supply chain hurdles, though it has done a solid job navigating those headwinds as best it reasonably could under the circumstances. Its GAAP diluted EPS came in at $1.64 last quarter, down from $2.03 in the same period last year as its operating margin contended with meaningful headwinds, though that was offset somewhat by a 2% year-over-year reduction in its outstanding diluted share count.

The company had $9.8 billion in cash, cash equivalents, and current investments on hand at the end of March 2022 versus $6.7 billion in short-term debt and $12.6 billion in long-term debt, providing it with ample liquidity to ride out the storm going forward. Its cash flow performance contended with a large working capital build last quarter, though management reiterated the firm’s full-year guidance that calls for Honeywell to generate substantial free cash flows this year.

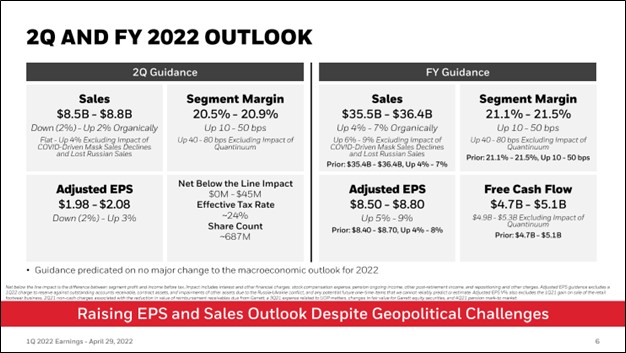

Guidance

As noted previously, Honeywell raised its full-year guidance for 2022 during its first quarter earnings report. The firm increased its forecasted sales to $35.5-$36.4 billion (versus $34.4-$36.4 billion previously), which saw the midpoint rise marginally, and it increased its adjusted EPS forecast up to $8.50-$8.80 (versus $8.40-$8.70 previously), which saw the midpoint rise modestly. Honeywell also reaffirmed its $4.7-$5.1 billion in free cash flow guidance this year (or $4.9-$5.3 billion when excluding the impact of a recent business combination), which we appreciate.

Image Shown: Strong underlying demand for Honeywell’s offerings along with its ample pricing power enabled the company to modestly boost its sales and earnings guidance for 2022 during its latest earnings update. Image Source: Honeywell – First Quarter of 2022 IR Earnings Presentation

In November 2021, Honeywell announced that Honeywell Quantum Solutions and Cambridge Quantum, two leaders in quantum computing technology, had received regulatory approval to merge. Last year, Honeywell contributed $270 million towards Quantinuum, the new firm, to provide it with ample working capital to fund its impressive growth story. Honeywell owns ~54% of Quantinuum.

According to Honeywell, Quantinuum is targeting what could be a $1 trillion industry in the coming decades. Quantum computing could create whole new opportunities in the realm of cybersecurity (a booming industry in the face of rising malevolent cyber actors around the world), drug discovery and delivery (data from clinical trials that are currently being overlooked could unlock new advances in this arena), material science (discovering new advanced materials without having to first physically create those materials), finance (with an eye towards identifying complex risks in financial products), quantum natural language processing, optimization as it concerns supply chains and logistic operations (something that is incredibly useful in the global economy), and artificial intelligence (which has applications in virtually every aspect of the economy).

The first product launched by Quantinuum was a cybersecurity offering, Quantum Origin, which was released in December 2021. We are intrigued by the upside. Honeywell includes this asset in its ‘Corporate and All Other’ business segment given the nascent nature of the technology.

Concluding Thoughts

Honeywell is a rock-solid enterprise with a nice dividend growth track record. The firm has increased its payout during the past 10+ consecutive years. We continue to like Honeywell in the Dividend Growth Newsletter portfolio and appreciate the company’s confidence in its near-term performance, especially as it concerns its free cash flows. Its longer term outlook is quite bright, aided by the ongoing recovery in the aerospace industry and its push into the realm of quantum computing.

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT), and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Republic Services is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.