Image Source: Visa Inc – Second Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

The payment processing and payment solutions space is attractive. Companies operating in this industry have asset-light business models with relatively modest capital expenditure requirements to maintain a given level of revenues, making free cash flows easier to come by. Additionally, the industry’s growth outlook is incredibly bright and supported by secular tailwinds as the world continues to shift away from cash and towards other payment options (card, mobile apps, QR codes, online payment platforms).

Our two favorite companies in this space are PayPal Holdings Inc (PYPL) and Visa Inc (V), and we include both as ideas in the Best Ideas Newsletter portfolio. Online spending levels remain robust even as the worst of the coronavirus (‘COVID-19’) pandemic fades and households resume outdoor activities, while global travel activities are resuming in earnest as the economy opens back up. PayPal and Visa both recently updated investors on their financial standing and outlook, and overall, we liked what we saw.

PayPal

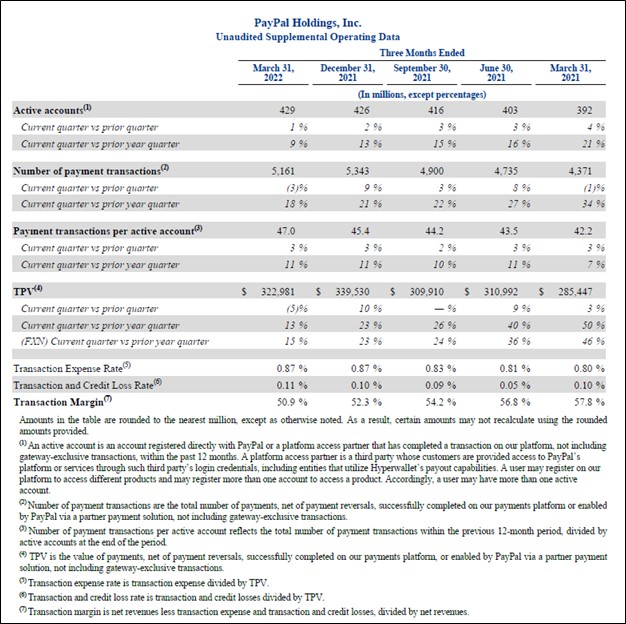

On April 27, PayPal reported first quarter 2022 earnings that beat consensus top-line estimates and matched consensus bottom-line estimates as it concerns PayPal’s non-GAAP adjusted EPS performance. Its GAAP net revenues grew 7% year-over-year as its total payment volumes (‘TPV’) rose by 13% in the first quarter. Total payment transactions were up 18% year-over-year.

We caution that foreign currency headwinds were a concern last quarter as PayPal’s revenues and TPV on a foreign currency neutral basis were up 8% and 15% year-over-year, respectively, slightly stronger than its nominal performance. As an aside, PayPal suspended its business in Russia in March 2022 in response to the Russian invasion of Ukraine in February 2022. The company is also actively assisting in raising funds for humanitarian efforts in Ukraine.

PayPal added 2.4 million net new active accounts (‘NNAs’) to its operations in the first quarter, bringing that figure up to 429 million (up 9% year-over-year). Additionally, payment transactions per active account were up 11% year-over-year. PayPal’s popular peer-to-peer money transfer app Venmo saw its TPV grow by 12% last quarter. We appreciate that underlying demand for PayPal’s offerings remains robust.

However, due in part to rising customer acquisition costs and rising competitive pressures, PayPal’s profitability levels took a big hit last quarter. Its non-GAAP operating margin dropped by ~700 basis points year-over-year to reach roughly 20.7% in the first quarter. PayPal’s non-GAAP adjusted diluted EPS came in at $0.88 last quarter, down 28% year-over-year. The company is taking measures to improve its profitability levels and generate operating leverage (i.e., revenue growth leading to margin expansion), topics which we will cover later in this article.

Image Shown: Demand for PayPal’s offerings remained robust in the first quarter of 2022, though its margins are contending with various pressures. Image Source: PayPal – First Quarter of 2022 Earnings Press Release

PayPal remains a free cash flow cow with a pristine balance sheet. The firm generated $1.1 billion in free cash flow and spent $1.5 billion buying back its stock in the first quarter. Shares of PYPL are trading well below the low end of our fair value estimate range (which sits at $122 per share) as of this writing, and we are supportive of its share repurchases given its strong financial position.

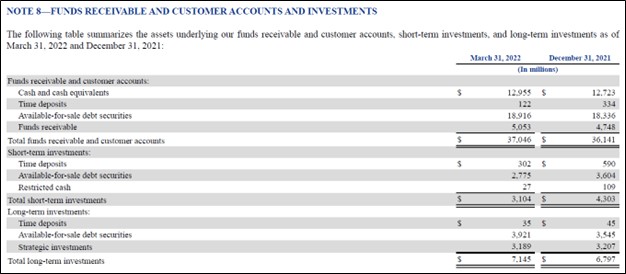

At the end of March 2022, PayPal had a net cash position of $3.7 billion with no short-term debt on the books when taking into account that $4.0 billion of its $7.1 billion ‘long-term investments’ line-item is made up of cash-like assets (time deposits and available for sale debt securities). The remainder of its long-term investments line-item is represented by strategic assets.

Image Shown: PayPal had a nice net cash position on hand at the end of March 2022 when taking its cash-like holdings included within its long-term investments balance into account. Image Source: PayPal – 10-Q SEC filing covering the First Quarter of 2022

During its latest earnings update, PayPal reduced its revenue and earnings guidance for 2022 versus the forecasts the firm put out during its fourth quarter of 2021 earnings update. Now, PayPal forecasts that its TPV will grow by approximately 13%-15% annually on a spot basis and roughly 15%-17% annually on a foreign currency neutral basis this year. PayPal’s annual net revenue growth on both a spot and foreign currency neutral basis is expected to come in around 11%-13% in 2022. The firm forecasts that it will generate approximately $3.81-$3.93 in non-GAAP adjusted diluted EPS this year, down 16% year-over-year at the midpoint of guidance.

While we are disappointed with PayPal reducing its guidance, we appreciate that its revenue growth rates are expected to pick up during the second half of this year. Going forward, we are keeping a close eye on PayPal’s forecasts. For the second quarter, PayPal is guiding for its net revenues on both a spot and foreign currency neutral basis to grow by approximately 9% year-over-year.

PayPal is contending with various hurdles, from competitive threats to inflationary pressures, and is adjusting accordingly. Management noted that the company aimed to improve its operating leverage going forward, indicating PayPal will follow through with its goals laid out during its fourth quarter of 2021 earnings call as it concerns scaling back customer acquisition spending levels (such as reducing incentive spending). Launching new offerings represents another part of PayPal’s turnaround strategy.

Here is what management had to say on PayPal’s overall outlook and strategy during its first quarter of 2022 earnings call (emphasis added):

“Hundreds of millions of consumers and tens of millions of merchants value our comprehensive set of products and services. And we are investing resources to both improve our existing products and innovate for the future with capabilities, including enhanced loyalty programs, package tracking, and returns management.

With branded checkout and full-stack processing as the foundational elements of our platform and competitive advantage, the opportunities ahead are significant. And we believe PayPal is well positioned to play a leading role in driving the future of digital payments and commerce. We believe we will continue to grow revenue faster than the rate of e-commerce growth and increase our market share in digital payments.

At the same time, we will continue to focus on improving operating leverage to support sustained value creation, accelerating the velocity of getting product into the hands of our customers and driving greater organizational effectiveness by simplifying processes and increasing accountability.” — Daniel Schulman, President and CEO of PayPal

We view PayPal’s longer term growth runway quite favorably and appreciate that the firm is taking advantage of its strong financial position to repurchase chunks of its stock. The company is contending with sizable headwinds and will need to prove that its nascent efforts to keep a lid on costs to improve its profitability levels will yield positive results. We have adjusted our models covering PayPal accordingly.

Visa

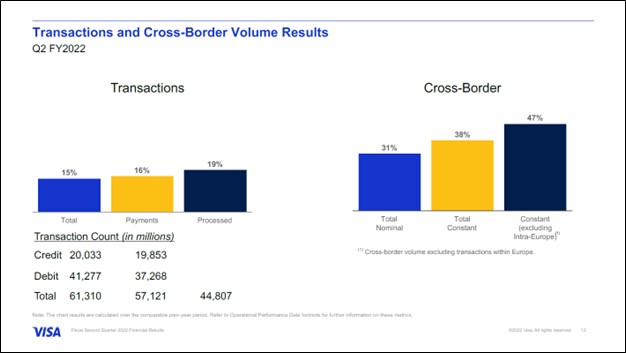

On April 26, Visa reported second quarter earnings for fiscal 2022 (period ended March 31, 2022) that beat both consensus top- and bottom-line estimates. Visa is benefiting from the resumption of travel activities worldwide as cross-border payment volumes were up 38% year-over-year (and up 47% excluding intra-European transactions) last quarter on a constant currency basis.

As with PayPal, Visa contended with sizable foreign currency headwinds last fiscal quarter, though robust demand for Visa’s offerings enabled the firm to adeptly navigate those hurdles. The company’s total processed transactions increased 19% year-over-year and its payment volumes grew 17% in the first quarter on a constant currency basis, which helped drive its GAAP revenues higher by 25% year-over-year. Growth in Visa’s nominal payments volume (up 14% year-over-year) and total cross-border volumes (up 31% year-over-year) were moderately lower than its constant currency growth rates last fiscal quarter.

Image Shown: The ongoing global recovery in travel activities is providing Visa’s operational and financial performance with an incredibly powerful tailwind. Image Source: Visa – Second Quarter of Fiscal 2022 IR Earnings Presentation

As an aside, Visa suspended its operations in Russia in March 2022 in the wake of the Russian invasion of Ukraine. Visa was still able to put up solid performance in the fiscal second quarter and its promising longer term growth runway remains intact. However, this decision will create near term headwinds for its financial performance.

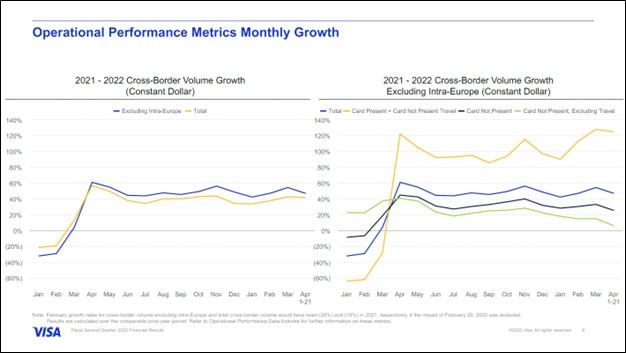

Last fiscal quarter, Visa’s card-not-present transactions, which is effectively a benchmark for its performance in the realm of online shopping, held up quite well in the US and overseas. We appreciate Visa’s strong performance on multiple fronts within the payment processing and payment solutions arena.

Image Shown: Both Visa’s card present and card not present payment volumes are holding up well in the US. The same is true in overseas markets. Image Source: Visa – Second Quarter of Fiscal 2022 IR Earnings Presentation

Visa’s GAAP diluted EPS rose 23% and its non-GAAP adjusted EPS rose by 30% year-over-year last fiscal quarter as the firm benefited from a combination of revenue growth and improving economies of scale. Its GAAP earnings performance was held back by a decrease in its non-operating ‘investment income and other’ line-item and a higher corporate income tax provision. We appreciate that Visa’s business is in the rebound.

The company generated $7.3 billion in free cash flow during the first half of fiscal 2022 while spending $1.6 billion covering its total dividend obligations and an additional $7.1 billion buying back its Class A common stock. Visa’s cash flow profile is phenomenal.

At the end of March 2022, Visa had a net debt position of $5.2 billion (inclusive of short-term debt, current investment securities, and noncurrent investment securities). Please note that the lion’s share of its investment securities portfolio is made up of US Treasury holdings. Visa had $15.8 billion in cash-like assets on the books at the end of March 2022, providing it with ample liquidity, and we view its net debt load as manageable.

Image Shown: Visa’s balance sheet is relatively strong. In our view, its net debt load is manageable given its ample liquidity on hand. Image Source: Visa – 10-Q SEC filing covering the Second Quarter of Fiscal 2022

During Visa’s fiscal second quarter earnings call, management offered up guidance for the firm’s fiscal third quarter and fiscal 2022 performance. For the current fiscal quarter, Visa is guiding for revenue growth in “the upper end of the mid-teens range in constant dollars” terms as the uplift from recovering global travel activities along with recent acquisitions (such as its deals for Tink and Currencycloud) support its outlook.

As it concerns Visa’s outlook for fiscal 2022, here is what management had to say during the company’s latest earnings call (emphasis added):

“Moving now to our outlook for the rest of fiscal 2022. Just as 2021 was a year of 2 distinct halves, due to the recovery, 2022 will be a year of 2 halves due to Russia. The suspension of our business in Russia will reduce second half revenues by about 4%. Russia will also negatively impact the payments volume and cross-border volume index to 2019, each by 4 points. The impact on process transactions index to 2019 will be under 1 point since we did not process domestic transactions in Russia. Ex-Russia and Ukraine, our domestic volume growth has stayed robust and stable for the past 4 quarters relative to 2019.

Our outlook for the second half assumes that these trends are sustained. While there are uncertainties created by high inflation, supply chain disruptions, rising interest rates and the invasion of Ukraine, there is no evident impact on our global payments volumes. E-commerce spend, both domestic and cross-border has remained strong and stable relative to 2019 at well above the pre-COVID trend line, even as pandemic effects fade, and we are assuming this will continue.

In line with payments volumes, we expect processed transactions growth relative to 2019 to remain strong and stable with the variability largely driven by the extent to which small ticket card-present everyday spend comes back. It is important to note that year-over-year growth rates will moderate as we lap the strong second half recovery in fiscal year ’21.

Ex Russia and Ukraine we’re assuming no spillover effects on other corridors in our cross-border business. Given where we ended the second quarter, we now expect cross-border travel ex intra-Europe to fully recover to 2019 levels by the end of our fiscal year despite the loss of Russian business. Including intra-Europe, that would put cross-border travel above 2019 levels.” — Vasant Prabhu, Vice Chairman and CFO of Visa

Our fair value estimate for Visa stands at $257 per share, comfortably above where shares of V are trading at as of this writing. Additionally, shares of V yield ~0.8% as of this writing and Visa offers investors incremental dividend growth upside alongside its powerful capital appreciation upside. In moderation, we view Visa’s share repurchases quite favorably given its strong free cash flow generating abilities and manageable net debt load.

Concluding Thoughts

The payment processing and payment solutions space is benefiting from the reopening of the global economy while e-commerce spending levels remain robust. In turn, these dynamics (to varying degrees) are providing firms like PayPal and Visa with powerful tailwinds to capitalize on going forward. We continue to like shares of PYPL and V as ideas in the Best Ideas Newsletter portfolio.

—–