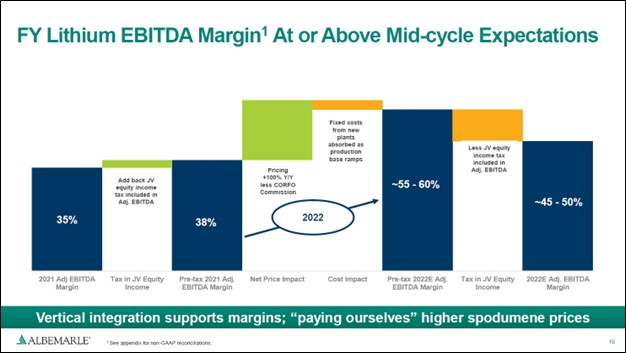

Image Shown: Albemarle Corporation’s lithium operations are benefiting from the favorable supply-demand dynamic and strong pricing of late, which is supporting its company-wide financial performance and outlook in a big way. Image Source: Albemarle Corporation – First Quarter of 2022 IR Earnings Presentation

By Callum Turcan

On May 4, Albemarle Corporation (ALB) reported first quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Due primarily to the outperformance of its ‘Lithium’ business reporting segment, Albemarle boosted its full-year guidance for 2022 in a big way during its latest earnings update. Shares of ALB skyrocketed after the news broke, and we continue to be big fans of the company. We include Albemarle as an idea in the ESG Newsletter portfolio (more on that publication here).

Lithium Update

Albemarle’s GAAP revenues grew 36% year-over-year in the first quarter as its Lithium segment reported 97% year-over-year sales growth. Lithium is used to produce lithium-ion batteries, and demand for lithium is on the rise due to strong demand for electric vehicles (‘EVs’), consumer electronics, industrial equipment with battery components, and utility-scale battery needs (to provide backup power to intermediate sources of supply, such as wind farms and solar plants), among other things. The company reported 28% year-over-year sales growth at its ‘Bromine’ business reporting segment last quarter, which sells fire retardant solutions used in numerous products, and a 1% year-over-year drop in sales at its ‘Catalysts’ business reporting segment, which sells chemicals used by oil refineries.

Last quarter, revenues from its Lithium segment represented almost half of Albemarle’s company-wide total. Back in December 2018, Albemarle announced the formation of a joint venture with Mineral Resources Limited (MALRF) that closed in October 2019. This created the MARBL Lithium JV which is 60% owned by Albemarle and 40% owned by Mineral Resources. As part of the agreement, Albemarle paid ~$0.8 billion in cash and transferred a 40% ownership in two lithium hydroxide conversion trains being built at the time by Albemarle in Kemerton (in Western Australia) to Mineral Resources, while Mineral Resources transferred a 60% stake in the Wodgina lithium mine in Western Australia to Albemarle.

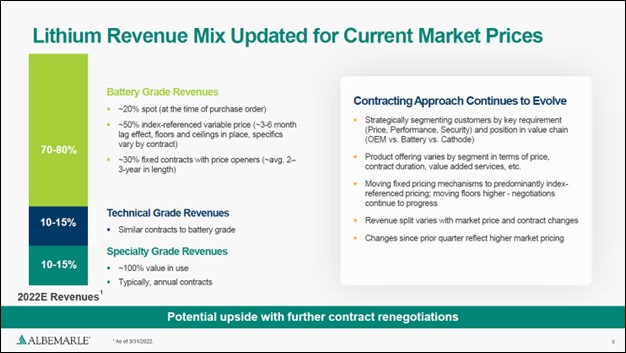

Image Shown: An overview of the contracts covering Albemarle’s lithium product sales. Image Source: Albemarle – First Quarter of 2022 IR Earnings Presentation

Now the MARBL Lithium JV operates the Wodgina lithium mine along with the two lithium hydroxide conversion trains. Due to the coronavirus (‘COVID-19’) pandemic and unfavorable market conditions for lithium and lithium derivatives during the 2019-2020 period, construction activities at the hydroxide conversion trains were scaled back and production activities at the Wodgina mine were suspended in 2019.

However, the outlook for lithium operations started to improve materially by 2021. This prompted the MARBL Lithium JV to resume production operations at the Wodgina mine, which is expected to produce its first spodumene concentrate in May 2022 since getting shut down. By July 2022, the JV intends to have two trains up and running at the Wodgina mine. At the Kemerton I plant, the first of two lithium hydroxide conversion trains, commissioning activities are underway, and first production is expected to begin in May 2022. The Kemerton II plant is expected to be mechanically complete by the second half of 2022, with sales forecasted to begin in 2023.

In February 2022, Albemarle and Mineral Resources announced they may modify and expand their existing joint venture. This change could see ownership of the Wodgina mine shift to a 50/50 structure from a 60/40 structure currently (Albemarle owns a 60% stake in the Wodgina mine). The ownership structure of the Kemerton I/II plants is expected to stay the same at 60/40 (Albemarle owns a 60% stake in both facilities) though future expansion projects would be conducted under a 50/50 ownership structure. Albemarle would commit to sending spodumene produced at its Greenbushes lithium mining operation in Western Australia to the Kemerton facilities, and Albemarle would remain the exclusive marketer of lithium products produced by the MARBL Lithium JV.

For reference, Albemarle owns a 49% equity interest in the Greenbushes operations alongside its Chinese partner Sichuan Tianqi Lithium Industries. In January 2015, Albemarle closed its ~$6.2 billion purchase of Rockwood Holdings, which gave Albemarle a stake in the Greenbushes lithium mine along with various other lithium operations (its purchase of Rockwood Holdings is what saw Albemarle gain a sizable footprint in the lithium industry).

As an aside, Albemarle is working towards purchasing all the outstanding equity of Guangxi Tianyuan New Energy Materials (‘Tianyuan’) for $0.2 billion through a deal now expected to close in the third quarter of 2022. Tianyuan is developing a lithium processing plant capable of producing battery-grade lithium carbonate and lithium hydroxide in the coastal city of Guangxi, China. Commissioning activities are underway and production activities are now expected to begin in the second half of this year (the original timetable for closing the deal and completing the lithium hydroxide facility was adjusted due to delays).

Looking at its lithium operations in Chile, Albemarle is working on beginning commercial production activities at its La Negra III/IV conversion plants. Its operations in the region produce lithium carbonate from lithium sourced from the Salar de Atacama, a desert full of lithium-rich brine. Currently, these plants are in the commissioning and qualification stage and soon should begin production activities.

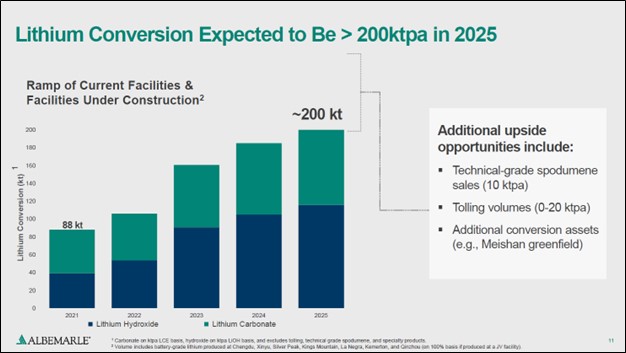

Image Shown: Albemarle has a roadmap in place to aggressively scale up its product of lithium derivatives. Image Source: Albemarle – First Quarter of 2022 IR Earnings Presentation

Pivoting back to Albemarle’s performance in the first quarter of 2022, its Lithium segment’s non-GAAP adjusted EBITDA almost tripled year-over-year. The adjusted EBITDA of its Bromine segment rose by 37% year-over-year while the adjusted EBITDA of its Catalyst segment dropped 34% year-over-year last quarter. Company-wide, Albemarle’s adjusted EBITDA rose 88% year-over-year last quarter, or 107% when removing the negative impact the divestment of its Fine Chemistry Services (‘FCS’) business in June 2021 had on its year-over-year performance. Albemarle’s GAAP operating income more than doubled year-over-year last quarter.

Outlook Update and Financing Concerns

At the end of March 2022, Albemarle had a net debt load of $2.0 billion (inclusive of short-term debt) though its $0.5 billion in cash and cash equivalents on hand should help the firm manage its near-term funding needs. The firm is spending heavily on scaling up its Lithium segment, and Albemarle is working towards expanding its operations (including lithium mining and processing activities) in Australia, Chile, China, and the US. In the US, Albemarle is working on expansion projects at its Silver Peak facilities in Nevada.

Hefty capital expenditure expectations are expected to see Albemarle post negative free cash flows this year. We caution that Albemarle is a capital-market dependent entity, though its rock-solid fundamental performance and promising guidance should help the company retain access to capital markets. As shares of ALB surged higher in the wake of its latest earnings update and guidance boost, the company appears to retain access to equity markets at attractive rates. It has a $1.0 billion revolving credit facility that matures in August 2024, which had no borrowings against it as of the end of March 2022, providing Albemarle with ample access to liquidity.

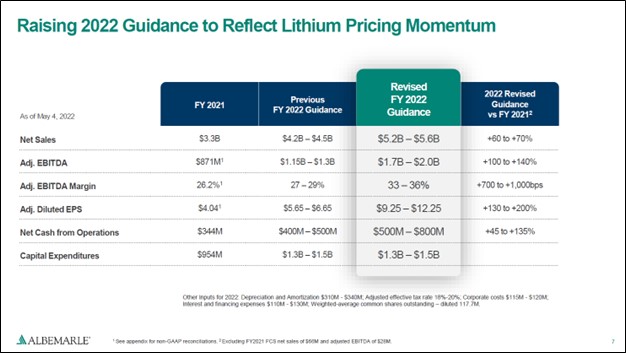

As noted previously, Albemarle raised its full-year guidance for 2022 in conjunction with its latest earnings update. Now the firm expects to post 60%-70% annual revenue growth in 2022 while more than doubling its adjusted EBITDA generation this year versus 2021 levels. Management cited strong performance at Albemarle’s Lithium segment as the reason for the revenue, adjusted EBITDA, and net operating cash flow guidance boost. Albemarle also raised its full-year adjusted EBITDA forecast for its Bromine segment in conjunction with its latest earnings report. This part of its business is benefiting from cost structure improvement initiatives, past expansion projects, strong demand for fire safety solutions, and pricing increases.

Full-year production volumes from its Lithium segment are expected to grow 20%-30% annually this year as new facilities come online, while its average realized pricing is expected to roughly double in 2022 on a year-over-year basis in the wake of the favorable supply-demand dynamic for lithium and lithium derivatives. Albemarle now expects to generate $0.5-$0.8 billion in net cash from operations this year, up sharply from $0.4-$0.5 billion previously.

Image Shown: Albemarle raised its guidance for 2022 during its first quarter earnings report due primarily to continued outperformance at its Lithium segment. We caution that Albemarle expects to generate sizable negative free cash flows this year due to its elevated capital expenditure expectations as it brings new lithium operations online. Image Source: Albemarle – First Quarter of 2022 IR Earnings Presentation

During the company’s latest earnings call, management noted that Albemarle is actively conducting a strategic review of its Catalysts business and may end up divesting the asset, which would raise a ton of cash while further improving its standing in the ESG investing realm in the process. Here is what management had to say on the subject (emphasis added):

“For Catalysts, 2022 EBITDA is expected to be flat to down 65% year-over-year. This is below our prior outlook due to significant cost pressures primarily related to natural gas in Europe and certain raw materials and freight, partially offset by higher pricing. The large outlook range for Catalyst reflects increased volatility and lack of visibility, particularly related to the war in Ukraine. Given the extraordinary circumstances and the resulting changes in oil and gas markets, the business is aggressively seeking to pass through higher natural gas pricing to its customers.

As previously discussed, we continue to expect a strategic review of the Catalyst business to be completed later this quarter. The review is intended to maximize value and position the business for success while enabling us to focus on growth.” — Scott Tozier, EVP and CFO of Albemarle

Surging energy prices are weighing quite negatively on the outlook for Albemarle’s Catalysts segment, particularly as it concerns the segment’s expected margin performance. Though Albemarle raised its full-year adjusted EBITDA outlook for both its Lithium and Bromine segments during its first quarter 2022 earnings update, it reduced its full-year adjusted EBITDA outlook for its Catalysts segment. Shedding this part of its business would significantly improve Albemarle’s business profile and outlook.

Concluding Thoughts

We are huge fans of Albemarle and view its capital appreciation and dividend growth upside quite favorably. Albemarle is a Dividend Aristocrat that as of 2022 has increased its payout over the past 28 consecutive years. Shares of ALB yield ~0.7% as of this writing, and management will likely strive to maintain Albemarle’s nice dividend growth track record. Albemarle has been firing on all cylinders of late, and its outlook is supported by powerful tailwinds and its growing exposure to the global lithium industry. We continue to like Albemarle as an idea in the ESG Newsletter portfolio.

—–

Mining & Chemicals Industry – APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, CMP, AA, KALU, MLM, VMC, NUE, CSL, SON, ALB, FUL, ATR, GGG, SHW

Related: MALRF, SOUHY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Albemarle Corporation (ALB) and South32 (SOUHY) are both included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.