Image Shown: Domino’s Pizza Inc is incredibly shareholder friendly. Image Source: Domino’s Pizza Inc – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

Domino’s Pizza Inc (DPZ) is one of our favorite restaurant franchises. We include Domino’s as an idea in the Best Ideas Newsletter portfolio as we are huge fans of its asset-light business model, strong free cash flow generating abilities, bright growth outlook, and shareholder friendly management team. Our fair value estimate for Domino’s sits at $517 per share, substantially above where shares of DPZ are trading at as of this writing. Additionally, shares of DPZ yield a modest ~1.1% as of this writing, and its dividend program offers incremental upside to the potential return from capital appreciation.

Overview

In early March 2022, Domino’s reported fourth quarter of fiscal 2021 earnings (period ended January 2, 2022) that missed both consensus top- and bottom-line estimates. Domino’s is adjusting its business to cope with significant inflationary pressures, supply chain hurdles, labor shortages, and other obstacles. However, Domino’s remained a tremendous free cash flow generator last fiscal year, and its longer term growth outlook is quite promising.

Domino’s also announced in March that its current CEO, Ritch Allison, intends to step down from the top role at the end of this month. Russell Weiner, currently COO and President of Domino’s, will take over the CEO role at the start of this upcoming May and other executive changes (namely promotions) were made to support the transition. In our view, Domino’s remains in good hands as its leadership bench is deep.

In fiscal 2021, Domino’s grew its US same-store sales by 3.5% year-over-year, its international same-store sales by 8.0%, and added over 1,200 net new stores to its global unit count. Domino’s reported 6% year-over-year GAAP revenue growth, 8% GAAP operating income growth, and 9% GAAP diluted EPS growth in fiscal 2021. That strong performance comes on the heels of the banner performance Domino’s put up in fiscal 2020 (period ended January 2021).

We appreciate that the company was able to utilize scale, pricing increases, and productivity gains to grow its GAAP operating margin ~30 basis points year-over-year in fiscal 2021 to 17.9%. Sales growth was a product of pricing increases, net unit store count growth, and same-store sales growth. Domino’s noted that when excluding foreign currency movements and the impact of a 53rd week in the fourth quarter of fiscal 2020, its global retail sales grew 11.7% year-over-year in fiscal 2021. Underlying demand for the company’s offerings is robust.

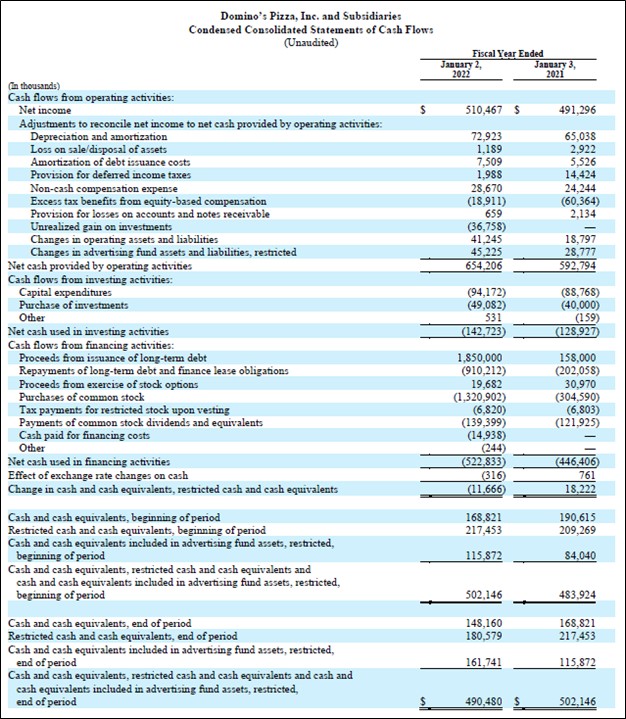

High-Quality Cash Flow Profile

As of early January 2022, ~98% of its 18,800+ global restaurant locations were franchised which is largely why Domino’s has relatively modest capital expenditure requirements to maintain a given level of revenues. In turn, that makes free cash flows easier to come by. Domino’s generated $560 million in free cash flow in fiscal 2021, up from $504 million in fiscal 2020. The firm spent $139 million covering its total dividend obligations in fiscal 2021 along with over $1.3 billion buying back its common stock.

Domino’s has strong dividend coverage though at times its share repurchases have been funded by its balance sheet. In March 2022, Domino’s increased its quarterly dividend 17% on a sequential basis, bringing its payout up to $1.10 per share of $4.40 per share on an annualized basis. The company’s management team is committed to returning cash to investors, which we appreciate.

As of January 2, 2022, Domino’s had a net debt load of $4.9 billion (exclusive of restricted cash and cash equivalents, inclusive of short-term debt). Domino’s had $0.1 billion in cash and cash equivalents on hand (exclusive of restricted cash and cash equivalents) at the end of this period along with $0.2 billion in available borrowing capacity under its 2021 variable funding notes program to meet its near-term funding needs.

We would like to see Domino’s pare down its net debt load over time. For now, given its strong “excess” free cash flow generating abilities (free cash flows after covering its total dividend obligations), we view its debt load as manageable. As shares of DPZ are trading well below our estimate of their intrinsic value as of this writing, share repurchases are a good use of capital when done in moderation.

Image Shown: Domino’s has a high-quality cash flow profile. Image Source: Domino’s – Fourth Quarter of Fiscal 2021 Earnings Press Release

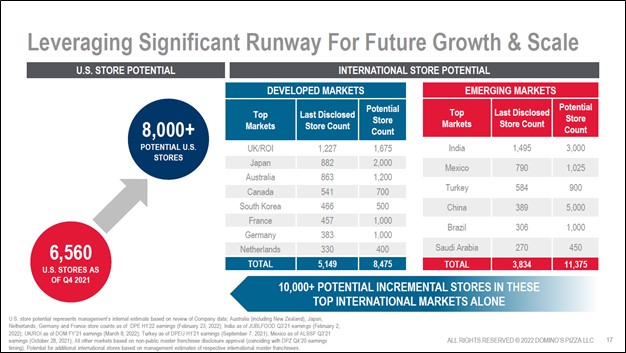

Growth Runway

The company’s growth runway is immense and underpinned by the attractive economics its pizza chain concept offers potential and existing franchisees. According to Domino’s, there is room to potentially add 10,000+ incremental restaurant locations across its top international markets along with room to potentially add 1,400+ incremental restaurant locations in the U.S. over the coming years.

Image Shown: Domino’s sees room for thousands of additional store locations in markets across the globe. Image Source: Domino’s – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

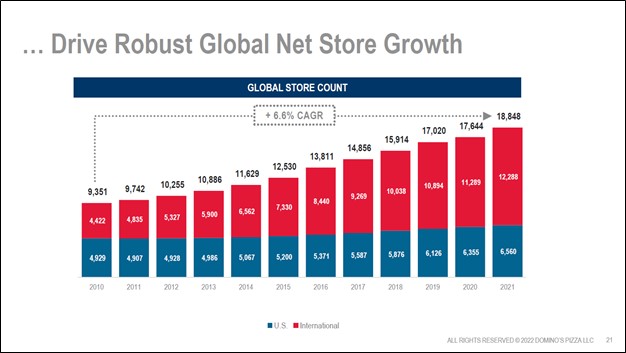

Over the past decade, Domino’s has delivered on its goal to significantly grow its unit store count. The company’s global store count increased from under 9,400 in fiscal 2010 to over 18,800 as of fiscal 2021. As Domino’s has a proven track record of growing its unit store count at a robust pace, that lends credence towards its growth ambitions as it concerns meeting its longer-term guidance.

Image Shown: Domino’s has seen its global store count grow rapidly over the past decade. Image Source: Domino’s – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

Concluding Thoughts

Domino’s aims to grow its global retail sales by 6%-10% annually and its global net unit store count by 6%-8% annually over the next two to three years. We appreciate its promising outlook as that underpins its bright free cash flow growth trajectory. Domino’s is run by a management team that is incredibly shareholder friendly, and we do not expect that to change anytime soon. There is a lot to like about Domino’s, and we view its capital appreciation upside quite favorably.

—–

Tickerized for DPZ, QSR, PZZA, PZRIF, BPZZF, WING, EATZ, YUM, YUMC, BYND, WEN, SHAK

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Related: VDC

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.