Image Shown: Republic Services Inc is one of our favorite waste management companies. On February 9, the company announced it was acquiring US Ecology Inc through an all-cash deal. US Ecology provides specialized waste management services and has an asset base that is nearly irreplaceable. We like the deal as it could generate meaningful cost saving and revenue synergies. Image Source: Republic Services Inc – February 2022 Infographic

By Callum Turcan

On February 9, one of our favorite waste management companies, Republic Services Inc (RSG), announced a deal to acquire U.S. Ecology Inc (ECOL) through an all-cash deal worth about $2.2 billion when including net debt considerations. Republic Services is paying $48 per share in cash to take over U.S. Ecology, which provides specialized waste management services. We like this deal as it will add nearly irreplaceable assets to Republic Services’ asset base and is expected to be immediately accretive to its adjusted earnings and free cash flow performance once the transaction closes.

Deal Overview

Republic Services expects to realize $40 million in cost synergies within three years of the deal closing, which is expected to occur during the second quarter of 2022. Economies of scale, the ability to roll out Republic Services’ digital platforms across U.S. Ecology’s asset base, various operational synergies due to geographical overlap, implementing best business practices, and other factors will help improve the combined company’s cost structure over time. By 2024, Republic Services aims for the combined company to have an adjusted free cash flow conversion ratio of at least 47%, which we appreciate. Republic Services noted that its goal would be to bring its net-debt-to-EBITDA ratio down back below 3.0x within 18 months of the deal closing.

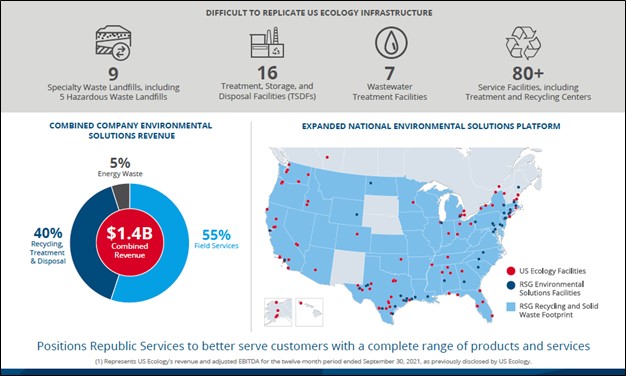

Assuming the deal goes through as planned, Republic Services would add nine specialty waste landfills to its asset base, including five hazardous waste landfills. What makes landfills so valuable in the US is that developing new landfills is an incredibly difficult task given opposition from certain regulators, politicians, political action groups, voters, and NIMBY groups. Considering that U.S. Ecology’s operations are largely represented by hard-to-replicate assets, arguably irreplaceable assets, adding such operations to Republic Services’ asset base should further support its already resilient business model.

Hazardous waste needs to be dealt with, though building new landfills that can handle such waste can be a very tough sell in many regions across the country. For Republic Services, expanding the capacity of existing landfills (if feasible) can be a tremendous source of upside over the long haul.

Furthermore, Republic Services is acquiring 16 treatment, storage, and disposal facilities (‘RSDFs’), seven wastewater treatment facilities, and over 80 service facilities (such as treatment and recycling centers) by buying U.S. Ecology. As one can see in the upcoming graphic down below, there is ample geographic overlap between the asset bases of both companies, which underpins Republic Services’ cost savings target. Integrating its operations so Republic Services could offer a more comprehensive slate of waste management services could lead to revenue upside as well. Locating cross-selling opportunities to realize revenue synergies is a core part of Republic Services’ reasoning behind acquiring U.S. Ecology.

Image Shown: There is ample geographic overlap between the operations of Republic Services and US Ecology, which supports the cost savings target Republic Services is aiming for once the deal closes. Potential revenue synergies are also possible. Image Source: Republic Services – February 2022 Infographic

Concluding Thoughts

We include shares of RSG as an idea in both the Dividend Growth Newsletter and ESG Newsletter portfolios (click here to learn more about our new ESG Newsletter product). Republic Services is a tremendous enterprise with a stable cash flow profile, bright outlook, and an asset base that is nearly irreplaceable. Adding U.S. Ecology’s asset base to its operations seems like a good fit, in our view, and the deal should generate meaningful cost saving and revenue synergies over the coming years.

This transaction is expected to support Republic Services’ free cash flow generating abilities, and over the long haul, should help the firm continue to steadily boost its dividend. Republic Services views the deal as enhancing its ability to pursue future bolt-on acquisitions to further extend its reach. We continue to be huge fans of Republic Services. Shares of RSG yield ~1.4% as of this writing.

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Tickerized for RSG, WM, WCN, CWST, SRCL, EVX, USMV, CLH, CVA, DAR, ECOL, VEOEY, SZEVY, ENGIY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT), and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Republic Services is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.