Image Source: Merck & Company Inc – Fourth Quarter of 2021 IR Earnings Presentation

By Callum Turcan

In Alphabetical Order by Ticker: ABBV, GILD, LLY, MRK

We include the Health Care Select Sector SPDR Fund ETF (XLV) in the Best Ideas Newsletter and Dividend Growth Newsletter portfolios to gain broad exposure to the health care sector. Instead of betting on one entity’s pipeline (which could be hit or miss), we like the exposure to lots and lots of “shots on goal” when it comes to the vast collective pipeline in the XLV ETF.

We wrote up the calendar fourth-quarter results of the top two weightings in the XLV ETF, United Health (UNH) and Johnson & Johnson (JNJ) here and here, respectively. We continue to like UNH a lot, but JNJ’s story has become a lot more complicated for dividend growth investors in recent months. Let’s have a look at some of the other key holdings in the XLV ETF, however.

We’ll cover the calendar fourth-quarter earnings reports from four heavyweights in the pharmaceutical arena (ABBV, GILD, LLY, and MRK). Additionally, we’ll cover the performance of some of their top-selling treatments that have already received regulatory approval from the U.S. Food and Drug Administration (‘FDA’) and key clinical trials that could produce new commercial growth opportunities.

The coronavirus (‘COVID-19’) pandemic has become more manageable during the past year or so after several vaccines and therapeutics for the virus were discovered in record time. While headwinds from the pandemic remain, the health care sector is steadily recovering and this space is home to plenty of attractive opportunities for capital appreciation and income seeking investors. XLV, UNH, JNJ, and Vertex Pharma (VRTX) [I] are a few that we like a lot.

AbbVie Delivers Solid 2021, Yields ~4%

Image: Shares of AbbVie have been strong of late.

On February 2, AbbVie Inc (ABBV) reported fourth quarter 2021 earnings that missed consensus top-line estimates but beat consensus bottom-line estimates. AbbVie’s GAAP revenues grew by 7% year-over-year and its non-GAAP EPS grew by 13% year-over-year last quarter due to strength at its immunology, hematologic oncology, aesthetics, neuroscience, and eye-care portfolio. Sales at its Humira (treats moderate to severe rheumatoid arthritis) offering came in strong at $6.7 billion in the fourth quarter (representing 36% of its total revenues during that period), up 4% year-over-year, while sales at its other immunology treatments including Skyrizi (up 70% year-over-year) and Rinvoq (up 84% year-over-year) performed incredibly well last quarter.

AbbVie’s Venclexta offering treats certain types of cancers and posted $0.5 billion in sales last quarter (up 33% year-over-year) while its Imbruvica offering, which also treats certain types of cancers, saw its sales decline to $1.4 billion (down 3% year-over-year). Revenue generated by the company’s Botox Cosmetic (part of its aesthetics drug portfolio) and Botox Therapeutic (part of its neuroscience drug portfolio) offerings came in strong last quarter, with the former posting $0.6 billion in sales (up 27% year-over-year) and the latter posting $0.7 billion in sales (up 18% year-over-year). In May 2020, AbbVie completed its merger with Allergan which added Botox to its portfolio. When the deal was first announced in June 2019, the merger had an equity transaction value of ~$63 billion.

The company’s eye care portfolio posted $1.0 billion in total sales last quarter (up 4% year-over-year), with revenue growth coming from its Alphagan/Combigan (treats pain and inflammation in patients that had cataract surgery) and Restasis (treats chronic dry eye) offerings. While Humira represents a large source of AbbVie’s revenue streams, the company has an expansive bench of commercialized treatments and is in the process of boosting sales of some of its faster-growing immunology and oncology treatments while also seeking to grow its Botox sales as the world emerges from the COVID-19 pandemic.

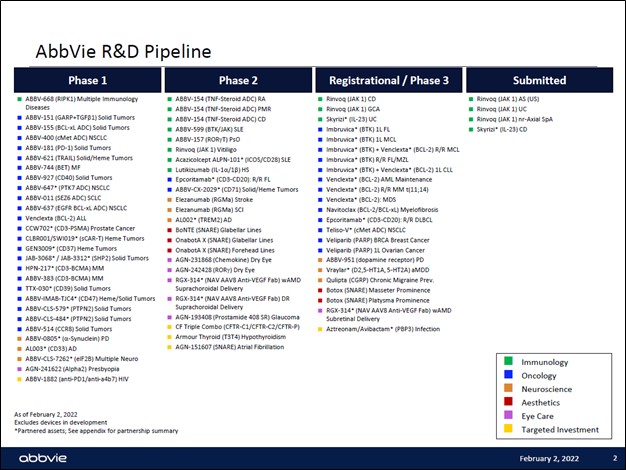

Looking ahead, AbbVie has plenty of drug candidates undergoing Phase 2 and Phase 3 clinical trials along with offerings in the regulatory review stage. Its drug development pipeline is extensive and includes regulatory reviews aimed at expanding the potential use of AbbVie’s treatments that have already received regulatory approval so the company can provide its treatments to a greater number of patients (if successful). Many of these potential and current treatments are in the realm of immunology and oncology as you can see in the upcoming graphic down below.

Image Shown: AbbVie has an extensive drug development pipeline that is heavily represented by potential treatments in the realm of immunology and oncology, and regulatory reviews aimed at expanding the approved application for its existing treatments. Image Source: AbbVie – Fourth Quarter of 2021 IR Earnings Presentation

Shares of ABBV have been on a powerful upward climb of late as investors cheered the company’s near term guidance put out during its latest earnings update. In 2022, AbbVie forecasts that it will generate $14.00-$14.20 in non-GAAP adjusted diluted EPS, which represents 11% year-over-year growth at the midpoint. Our fair value estimate sits at $114 per share of AbbVie and the upper bound of our fair value estimate range sits at $143 per share.

As of this writing, shares of ABBV yield ~4.0% though we caution that its Dividend Cushion ratio is below parity (at 0.5). While AbbVie will likely be able to continue tapping capital markets for funds to refinance maturing debt and make good on its payout obligations, its ability to push through sizable dividend increases going forward will be limited, largely because of its massive net debt load (we will get a better idea of its financial position at the end of December 2021 when it publishes its latest 10-K SEC filing).

Gilead Sciences Has Its Work Cut Out For It, Yields ~4.6%

Image: Shares of Gilead have been choppy in recent years given the curative nature of its blockbuster hepatitus C drug, Harvoni.

On February 1, Gilead Sciences Inc (GILD) reported fourth quarter 2021 earnings that beat both consensus top- and bottom-line estimates. However, its shares still sold off after its report was published as Gilead Sciences’ 2022 guidance was lackluster.

The company’s GAAP revenues declined 2% year-over-year last quarter as sales of its antiviral Veklury (also known as remdesivir) shifted lower by 30%, hitting $1.4 billion (representing 19% of Gilead Sciences’ revenue that quarter). Veklury was given emergency use authorization by the US FDA to treat patients with COVID-19 that require hospitalization back in May 2020, and in January 2022, the antiviral received approval to treat non-hospitalized patients with COVID-19 that are considered to be high risk individuals. Shrinking revenues and sizable special items (primarily sizable legal settlement and collaboration opt-in charges) saw Gilead Sciences’ non-GAAP diluted EPS drop by 68% year-over-year last quarter.

In November 2021, Gilead Sciences announced it was exercising its right to gain an economic interest in three of Arcus Biosciences Inc’s (RCUS) clinical-stage programs in return for upfront cash payments (worth ~$0.7 billion in total), building off an earlier agreement reached in May 2020. Going forward, Gilead Sciences and Arcus Biosciences will now both shoulder the drug’s development costs. This agreement also included a research collaboration component, and the accord closed in December 2021. Gilead Sciences gained access to some promising potential oncology treatments including domvanalimab and etrumadenant. We appreciate Gilead Sciences’ recent efforts to bolster its drug development pipeline to improve its growth outlook.

Gilead Sciences’ human immunodeficiency virus (‘HIV’) product sales were up 7% year-over-year, hepatitis B virus (‘HBV’) and hepatitis D virus (‘HDV’) product sales were up 9% year-over-year, and its cell therapy product sales were up 47% year-over-year in the final quarter of 2021. Its HIV treatments include Biktarvy, Descovy, Genvoya, and Odefsey along with a revenue share in Symtuza which was developed by Johnson & Johnson (JNJ). Last quarter, Gilead Sciences generated $4.5 billion in sales from its HIV portfolio, representing 63% of its total revenues that period.

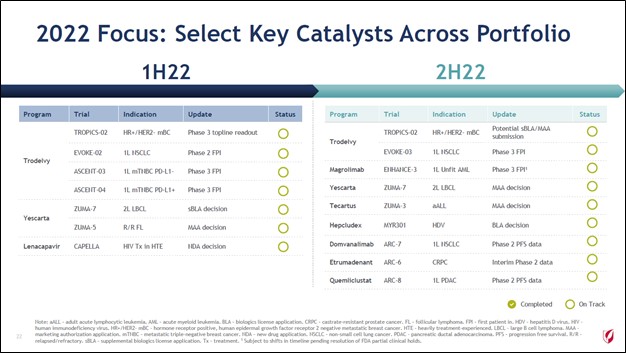

The company’s HBV/HDV drug portfolio includes its Vemlidy and Viread treatments. As it concerns its fast growing cell therapy portfolio, that includes its Tecartus (treats certain types of cancers) and Yescarta (treats certain types of cancers) offerings that have both been commercialized. Gilead Sciences’ oncology portfolio also includes its Trodelvy treatment, which was approved by the US FDA in 2021 and was later given approval to treat additional types of cancer. Going forward, Gilead Sciences aims to continue securing regulatory approval for Trodelvy to treat a wider array of patients with different types of cancer. The firm’s near term regulatory and development pipeline can be seen in the upcoming graphic down below.

Image Shown: Gilead Sciences is conducting clinical trials concerning its Trodelvy treatment to see if the drug would be effective at treating additional forms of cancer under a wider array of conditions in a greater number of patients than it is currently approved for. Image Source: Gilead Sciences – Fourth Quarter of 2021 IR Earnings Presentation

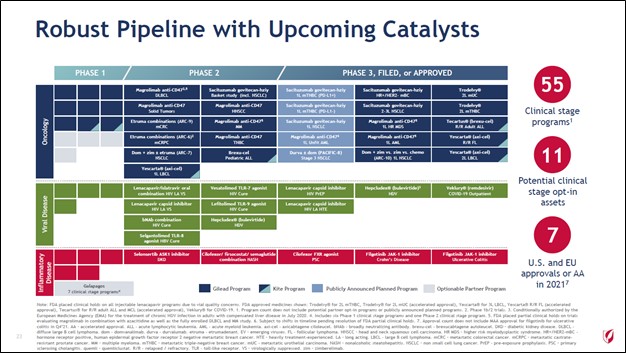

In the upcoming graphic down below, Gilead Sciences outlines its drug pipeline that should help the firm grow in the post-pandemic era over the long haul. Given that sales of its Veklury antiviral treatment will eventually fade as the COVID-19 pandemic fades, Gilead Sciences needs to find ways to revive its growth trajectory. Its HIV treatment portfolio, Trodelvy treatment, and cell therapy portfolio combined with upside that its drug pipeline could uncover supports Gilead Sciences longer term outlook, though the firm is expected to face sizable short-term headwinds as it concerns its revenue growth trajectory.

Image Shown: A look at Gilead Sciences’ drug development pipeline. The company’s sales declined on a year-over-year basis last quarter, and Gilead Sciences will need to prove that its can effectively commercialize its drug development pipeline to revive its growth outlook. Image Source: Gilead Sciences – Fourth Quarter of 2021 IR Earnings Presentation

Gilead Sciences offered up guidance for 2022 in conjunction with its latest earnings report. The firm forecasts it will generate $23.8-$24.3 billion in total product sales this year, which represents an 11% year-over-year decline (versus Gilead Sciences’ product sales in 2021, removing ‘royalty, contract and other revenues’ from the picture). Management expects Gilead Sciences’ Veklury sales will come in at $2.0 billion this year, down sharply from $5.6 billion in 2021. Gilead Sciences also expects it will generate $6.20-$6.70 in non-GAAP EPS this year, down 11% year-over-year at the midpoint of guidance.

Failure to find a solid revenue generator in its drug pipeline will make reversing the downturn in its revenues a difficult task. Shares of GILD yield ~4.6% as of this writing and its Dividend Cushion ratio is near parity (~1.0), indicating its payout is well-covered when assuming moderate per share payout growth over the coming years. Our fair value estimate stands at $70 per share of Gilead Sciences and the top end of our fair value estimate range sits at $88 per share.

Eli Lilly’s Dividend Health Is Solid, Yields ~1.6%

Image: Shares of Eli Lilly have done amazingly well the past several years.

On February 3, Eli Lilly and Company (LLY) reported fourth-quarter 2021 earnings that beat consensus top-line estimates but missed consensus bottom-line estimates. The firm’s GAAP revenue and its non-GAAP EPS both grew by 8% year-over-year last quarter. Shares of Eli Lilly shifted lower after its fourth quarter earnings update was published.

Eli Lilly sells a combination of two monoclonal antibodies (bamlanivimab and etesevimab) to treat mild to moderate cases of the COVID-19 disease (the combination was given emergency use authorization by the US FDA back in February 2021). Last quarter, sales of Eli Lilly’s COVID-19 antibody offerings grew by 22% year-over-year to reach $1.1 billion. The company’s Trulicity offering (treats type 2 diabetes) posted $1.9 billion in sales, up 25% year-over-year, and Eli Lilly’s Taltz offering (treats moderate to severe plaque psoriasis) posted $0.6 billion in sales, up 31% year-over-year, in the final quarter of 2021.

Looking ahead, the company is forecasting that it will post $8.50-$8.65 in non-GAAP EPS this year, which represents 5% year-over-year growth at the midpoint. Eli Lilly is also forecasting for $27.8-$28.3 billion in revenues in 2022, which represents a 1% decline year-over-year decline in sales at the midpoint. The firm is guiding for a non-GAAP gross margin of 80% and a non-GAAP operating margin of 32% this year.

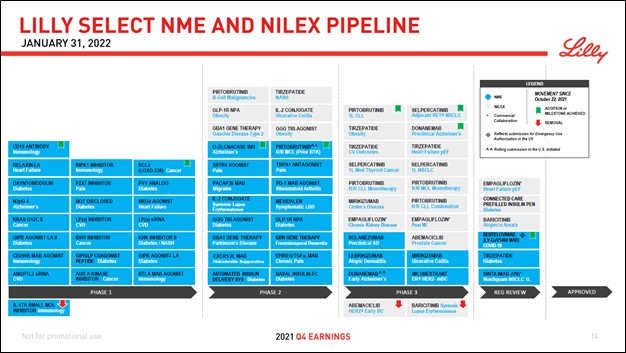

Sales of the company’s COVID-19 antibodies will likely decline in the coming years as the pandemic eventually fades, and that is something that investors are keenly aware of. Eli Lilly is focused on developing its potential donanemab treatment for Alzheimer’s disease which received a breakthrough therapy designation by the US FDA in 2021 and is currently undergoing Phase 3 clinical trials. However, recent delays have spooked investors. That being said, Eli Lilly had a robust drug development pipeline across multiple medical fields (oncology, diabetes, pain management, and much more) as you can see in the upcoming graphic down below.

Image Shown: Eli Lilly has a robust development pipeline. Image Source: Eli Lilly – Fourth Quarter of 2021 IR Earnings Presentation

As of this writing, shares of LLY yield ~1.6% and there is ample room for Eli Lilly to continue growing its payout over the coming years in a sustainable manner as its Dividend Cushion ratio sits well above parity (at 2.1). The high end of our fair value estimate for Eli Lilly sits at $191 per share with the top end of our fair value estimate range standing at $229 per share.

Categories Member Articles