Image Source: Domino’s Pizza Inc – Third Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

Domino’s Pizza Inc (DPZ) runs a great business. Most of its store locations are franchised (~98% as of September 2021), meaning inflation cost headwinds fall more squarely on its franchisees. The company has put up great same store sales performance on both a domestic and international basis in recent fiscal years, and it continues to have an immense growth runway. Domino’s is a stellar generator of free cash flow, too, thanks to its asset light revenue model. We include shares of Domino’s as an idea in the Best Ideas Newsletter portfolio.

The restaurant franchise space is appealing because these companies have asset-light business models that requires relatively modest capital expenditures to maintain a certain level of revenues, which in turn supports the relevant company’s ability to generate sizable free cash flows. A core part of this dynamic requires the franchise to offer current and potential franchisees compelling unit economics, which usually means restaurant formats (such as a pizza shop with a great delivery operation) that are simple yet popular. That can be a difficult task as consumer tastes can change on a whim, but one thing that’s clear is that the world continues to enjoy a slice of pizza (or two).

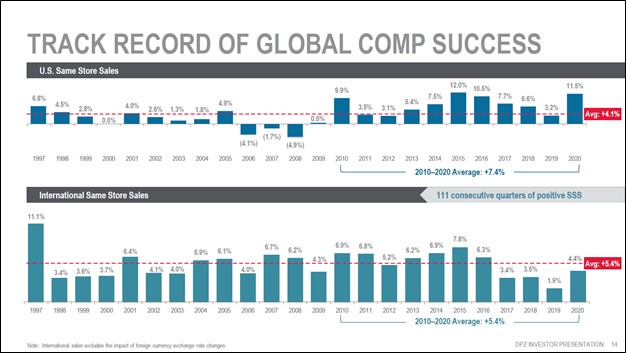

Image Shown: Domino’s has an impressive track-record of same store sales growth. Image Source: Domino’s – Third Quarter of Fiscal 2021 IR Earnings Presentation

Extensive Growth Runway

At the end of the third quarter of fiscal 2021 (period ended September 12, 2021), Domino’s had almost 18,400 store locations in over 90 markets around the world. Domino’s runs a stellar home delivery operation, which represents a key strategic advantage for the firm.

By integrating its digital presence with its physical restaurants and home delivery operations, Domino’s enables its consumers to track the pace of their orders online. Its customer loyalty program is also integrated with its digital presence and helps encourage consumers to place their orders online. Having customers place their orders online improves in-store efficiencies as employees can better optimize their time by not having to take down orders on the phone but instead can view the order on a digital dashboard. This also reduces chances for mistakes when it comes to transcribing orders over the phone in a loud and busy kitchen.

Domino’s is optimistic about its unit store count growth potential in Europe (France, Germany, and the UK), Asia (China, Japan, and India), the Middle East (Saudi Arabia and Turkey), North America (Canada, Mexico, and the US), along with potential expansion opportunities in Australia and Brazil as well. Combined, Domino’s sees room for an additional 6,500+ store locations across its top 15 geographical markets over the coming years, including 1,500+ incremental store locations in the US.

Image Shown: Domino’s sees ample room to grow its unit store count in key geographical markets around the world. Image Source: Domino’s – Third Quarter of Fiscal 2021 IR Earnings Presentation

During the third quarter of fiscal 2021, Domino’s reported that its international same store sales grew by 8.8% year-over-year which marked the 111th consecutive quarter of same store sales growth. While its US same store sales declined by 1.8% year-over-year during this period, ending 41 consecutive quarters of growth, the firm’s domestic same store sales surged higher during the initial phases of the coronavirus (‘COVID-19’) pandemic, which created noise in what was still solid performance in the fiscal third quarter. Please note that Domino’s grew its US same store sales by 11.5% in fiscal 2020 and 3.2% in fiscal 2019, while its international same store sales grew 4.4% in fiscal 2020 and 1.9% in fiscal 2019 (for reference, its fiscal year ends in late-December or early-January).

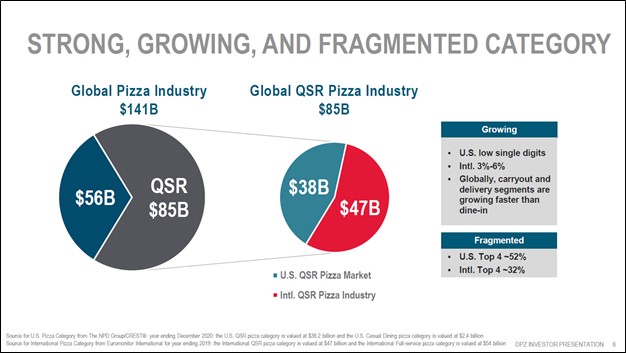

The US represents a large part of the quick-service restaurant (‘QSR’) side of the global pizza industry, though the international side of this industry is growing at a robust pace (the US side is steadily growing as well). In the third quarter of fiscal 2021, Domino’s reported global retail sales growth of 8.5% on a year-over-year basis when excluding foreign currency movements. Domino’s views the growth outlook for the global pizza industry quite favorably and cites third-party data to back up its bright outlook in the upcoming graphic down below.

Image Shown: Citing third-party data, Domino’s view the growth outlook for the global pizza industry quite favorably. Image Source: Domino’s – Third Quarter of Fiscal 2021 IR Earnings Presentation

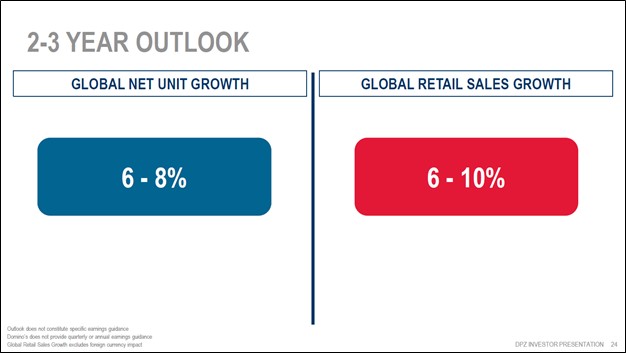

Strong same store sales growth on a normalized basis (removing noise created by the COVID-19 pandemic) highlights why franchisees continue to sign up with Domino’s. In fiscal 2020, Domino’s added 600+ net store locations to its asset base and during the first three quarters of fiscal 2021, the firm added another 300+ net store locations to its operations. We appreciate the steady growth in the company’s net store count and expect this trajectory will continue in earnest going forward, which in turn supports its revenue and ultimately free cash flow growth outlook.

Image Shown: Domino’s has a bright growth outlook. Image Source: Domino’s – Third Quarter of Fiscal 2021 IR Earnings Presentation

Rock-solid Financials

Domino’s generated $3.0 billion in GAAP revenues during the first three quarters of fiscal 2021, up 9% year-over-year, while its GAAP operating income grew 16% year-over-year during this period, hitting $0.6 billion. Revenue growth during this period was made possible through a combination of same store sales growth and net store count growth. Economies of scale and significant pricing power enabled Domino’s to grow its operating income and operating margin during this period (which was up over 105 basis points year-over-year during the first three quarters of fiscal 2021). Its pricing power has enabled Domino’s to navigate ongoing inflationary headwinds quite effectively so far.

Pivoting to its cash flow performance, Domino’s generated $0.4 billion in free cash flow during the first three quarters of fiscal 2021 (up from $0.3 billion in the same period in fiscal 2020) while spending $0.1 billion covering its dividend obligations and another $1.1 billion buying back its stock. Share buybacks were funded in large part by its balance sheet. Domino’s exited the fiscal third quarter with a net debt load of $4.8 billion (inclusive of short-term debt, exclusive of restricted cash).

Our biggest concern with Domino’s, if we had to pick one, is the company’s net debt load, though its stellar free cash flow generating abilities and apparent ability to tap capital markets at attractive rates (seen through recent refinancing activities) indicates that this burden remains very manageable. Going forward, Domino’s could moderate the pace of its share buybacks and focus on improving its balance sheet strength, so it does retain some nice financial flexibility.

Concluding Thoughts

Domino’s is a rock-solid enterprise with a bright growth outlook. We are big fans of Domino’s and appreciate its efforts to continue expanding its global footprint. Our fair value estimate sits at $532 per share of Domino’s (roughly where shares of DPZ are trading as of this writing) with room for upside as the high end of our fair value estimate range sits at $665 per share. As of this writing, shares of DPZ yield a modest ~0.7% as Domino’s prefers to return cash to shareholders via sizable share buybacks.

Downloads

Domino’s 16-page Stock Report (pdf) >>

Domino’s Dividend Report (pdf) >>

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL

Tickerized for DPZ, QSR, PZZA, PZRIF, BPZZF, WING, EATZ, YUM, YUMC, BYND, WEN, SHAK

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.