Image Source: General Mills Inc – Second Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

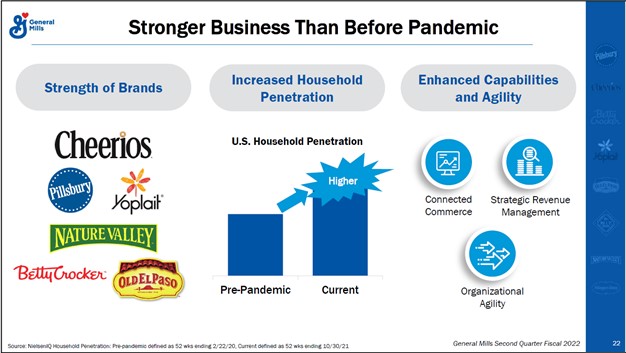

On December 21, General Mills Inc (GIS), the firm behind the Cheerios, Pillsbury, and Nature Valley brands (among various others), reported second quarter earnings for fiscal 2022 (period ended November 28, 2021) that beat consensus top-line estimates but missed consensus bottom-line estimates. The consumer staples giant also raised its full year guidance for fiscal 2022 in conjunction with its latest earnings report. In the face of major input cost inflationary pressures and supply chain constraints, brought on in part by the coronavirus (‘COVID-19’) pandemic and the fiscal/monetary policies enacted to offset the economic damage caused by the public health crisis, General Mills has done a solid job navigating the ever-changing landscape, all things considered.

Earnings Update

General Mills’ non-GAAP organic net sales were up 5% year-over-year in the fiscal second quarter. Strong performance at its ‘Convenience Stores & Foodservice’ (up 23% year-over-year) and ‘Pet’ (up 14% year-over-year) segments supported its growth efforts last fiscal quarter. Both segments experienced strong organic volume growth and benefited from pricing increases/favorable product mix shifts in the fiscal second quarter versus year-ago levels.

In July 2021, General Mills completed its acquisition of Tyson Foods Inc’s (TSN) pets treats business for $1.2 billion in cash, which provided a major uplift to its reported sales growth. Its organic net sales metric removes the impact of acquisition and divestment activities. Back in April 2018, General Mills completed its all-cash acquisition of Blue Buffalo Pet Products through a deal with an enterprise value of $8.0 billion. The “humanization of pets” trend in the US (i.e., rising household spending on pets) supports the sales growth outlook for pet food, pet treats, and related offerings. General Mills has built up a high-quality portfolio on this front as Blue Buffalo is generally considered to be a premium, but affordable, pet food brand, and adding Tyson’s pet treats business to its portfolio should help keep the momentum going in the right direction.

Last fiscal quarter, General Mills also reported that its ‘Asia & Latin America’ segment put up decent performance with organic net sales at this unit up 5% year-over-year, while its ‘North America Retail’ segment’s organic net sales were up 1% and its ‘Europe & Australia’ segment’s organic net sales fell by 2% during this period. General Mills is leaning heavily on pricing increases and, when possible, favorable product mix shifts to maintain its margins in the face of serious supply chain constraints and input cost inflation, though this strategy has its limits.

While General Mills’ GAAP revenues grew 6% year-over-year in the fiscal second quarter, its GAAP gross margin tanked by ~400 basis points during this period. Rising input costs were the main culprit here, with pricing increases only offsetting some of these inflationary headwinds. The firm’s GAAP operating profit fell 13% last fiscal quarter versus the same period the prior fiscal year, partially due to its GAAP gross profit falling by 5% year-over-year and in part due to its SG&A expenses rising by 3% year-over-year.

General Mills remained a cash flow generating powerhouse during the first half of fiscal 2022, generating $1.5 billion in net operating cash flow versus $0.2 billion in capital expenditures, allowing for $1.3 billion in free cash flows. The firm spent $0.6 billion covering its dividend obligations and another $0.4 billion buying back its stock during the first half of fiscal 2022, activities that were fully covered by its free cash flows.

At the end of the second quarter of fiscal 2022, General Mills had a net debt load of $11.7 billion (inclusive of short-term debt) due in part to its debt-fueled acquisition strategy seen over the past few years as it concerns bulking up its presence in the pets food and treats space. We view the firm’s net debt load as manageable given its ample liquidity levels ($1.0 billion in cash and cash equivalents on the books at the end of the fiscal second quarter) and strong cash flow generating abilities. However, its net debt load greatly limits its financial flexibility in the face of major input cost inflationary pressures.

On November 30, General Mills closed its transaction with Sodiaal (a French dairy cooperative), which saw General Mills take full ownership in the Canadian Yoplait business and gain a reduced royalty rate on Yoplait product sales in the US and Canada in return for divesting its 51% stake in its European Yoplait business to Sodiaal. This deal helps consolidate General Mills’ corporate structure and should help along the margins.

Guidance Update

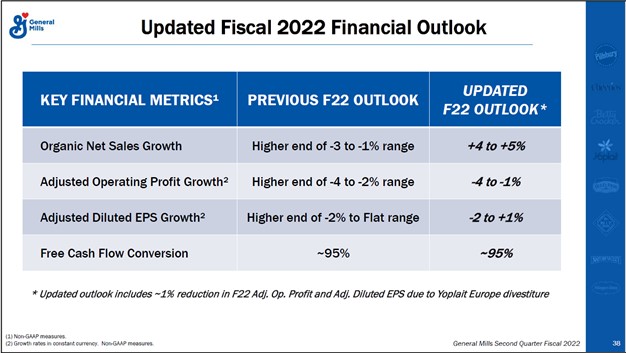

In light of its strong performance during the first half of fiscal 2022, keeping various headwinds in mind, General Mills increased its outlook for the full fiscal year. General Mills now expects its organic net sales will grow 4%-5% (up from 1%-3% previously) this fiscal year and that its non-GAAP constant currency adjusted EPS performance will range from a decline of up to 2% or grow by up to 1% in fiscal 2022 (versus previous forecasts to that called for up to a decline of 2% or flat performance).

Please note that General Mills is also now forecasting that its cost of goods (COGS) headwinds will come in ~$0.5 billion higher than initially expected due primarily to input cost inflation and supply chain hurdles. General Mills’ pricing power, favorable product mix shifts, and strong organic net sales growth of late are expected to offset those headwinds, to a degree. The company continues to expect that its free cash flow conversion ratio (net income divided by free cash flow) will come in at a rock-solid ~95% this fiscal year. We appreciate General Mills’ high-quality cash flow profile.

Image Shown: General Mills boosted its full year guidance for fiscal 2022 in conjunction with its latest earnings report. Image Source: General Mills – Second Quarter of Fiscal 2022 IR Earnings Presentation

Concluding Thoughts

Our fair value estimate for General Mills sits at $60 per share and the high end of our fair value estimate range sits at $72 per share. As of this writing, shares of GIS are trading within the upper bound of our fair value estimate range, indicating its stock is fairly valued at this time. Shares of GIS yield a nice ~3.1% as of this writing, and while its Dividend Cushion ratio sits below parity (<1.0), we give General Mills a “GOOD” Dividend Safety rating due to the high-quality nature of its cash flow profile and its meaningful pricing power. Going forward, we think it would be prudent for General Mills to trim its net debt load after its recent acquisitions.

That said, we are not interested in adding General Mills to any of our newsletter portfolios at this time, though we include Vanguard Consumer Staples Index Fund ETF (VDC) in the High Yield Dividend Newsletter portfolio (more on that product here) to gain exposure to the consumer staples sector. The VDC ETF had modest exposure to General Mills as of the end of November 2021. Please note that that many of the firms included in the VDC ETF have sizable net debt loads.

General Mills’ 16-page Stock Report (pdf) >>

General Mills Dividend Report (pdf) >>

—–

Recession Resistant Industry – BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT

Related: VDC

Tickerized for GIS, VDC, TTCF, STKL, THS, FARM, SMPL, FDP, BRBR, BGS, CVGW, LW, TWNK, ACI, GO, KR, COST, BJRI, TGT, WMT, HSY, SJM, UNFI, HAIN, SPTN, DOLE, ANDE, CENTA, USFD, PPC, IMPF, BYND, SAFM, HRL, NSRGY, ADM, DTEA, DAR, SENEA, CALM, FREE, KHC, K, FLO, CAG, OTLY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.