- We view Johnson & Johnson’s capital appreciation and dividend growth upside potential quite favorably.

- The top end of our fair value estimate range sits at $206 per share of JNJ.

- In this article, we cover Johnson & Johnson’s stellar financial performance, recent guidance boosts, and some of its legal hurdles.

- Johnson & Johnson announced on November 12 that it would spinoff its consumer-facing operations while retaining its medical devices and pharmaceutical operations.

On October 19, Johnson & Johnson (JNJ) reported third-quarter earnings for fiscal 2021 (period ended October 3, 2021) that missed consensus top-line estimates but beat consensus bottom-line estimates. The healthcare giant also raised its full-year guidance (again) for fiscal 2021 as its ‘Pharmaceutical’ segment is growing at a robust pace, its ‘Medical Device’ segment is steadily recovering from the worst of the coronavirus (‘COVID-19’) pandemic, and its ‘Consumer Health’ segment is holding up well.

Shares of JNJ yield ~2.6% as of this writing. We view Johnson & Johnson’s dividend growth trajectory quite favorably given its improving growth outlook, rock-solid balance sheet, and stellar free cash flow generating capabilities. We also view the company’s capital appreciation upside potential quite favorably, too. Shares of the company are trading at $163 each.

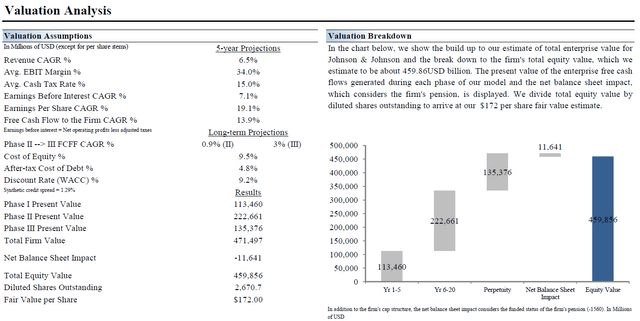

Our fair value estimate for shares of JNJ, however, sits at $172 per share, though should the firm outperform our “base case” scenario, the top end of our fair value range sits at $206 per share of Johnson & Johnson. Please note this fair value estimate is derived through our enterprise cash flow analysis process. The key valuation assumptions used in our base case scenario covering Johnson & Johnson are laid out in the upcoming graphic down below.

Image Shown: Johnson & Johnson’s fair value estimate sits at $172 per share with room for upside should it exceed the key valuation assumptions laid out in our base case scenario seen above. Image Source: Valuentum

Image Shown: Johnson & Johnson’s fair value estimate sits at $172 per share with room for upside should it exceed the key valuation assumptions laid out in our base case scenario seen above. Image Source: Valuentum

Spinoff Announcement

Johnson & Johnson announced on November 12 that it was spinning off its consumer-facing operations (including its band-aid, oral health, skin care, over-the-counter offerings such as its TYLENOL products), while retaining its medical devices and pharmaceutical operations. This move is supposed to sharpen Johnson & Johnson’s operational focus going forward, and the spinoff is expected to be completed within 18-24 months. In the press release the firm noted that:

The new Johnson & Johnson would remain committed to maintaining a strong balance sheet and to its stated capital allocation priorities of R&D investment, competitive dividends and value-creating acquisitions…

The Board of Directors’ intent is to effect the planned separation through the capital markets, creating two independent, market-leading companies. The transaction is intended to qualify as a tax-free separation for U.S. federal income tax purposes.

In addition, it is expected that the overall shareholder dividend will remain at least at the same level following the completion of the transaction.

The Company is targeting completion of the planned separation in 18 to 24 months, subject to the satisfaction of certain conditions including, among others, consultations with works councils and other employee representative bodies, as required, final approval of Johnson & Johnson’s Board of Directors, receipt of a favorable opinion and Internal Revenue Service ruling with respect to the tax-free nature of the transaction, and the receipt of other regulatory approvals. There can be no assurance regarding the ultimate timing of the proposed transaction or that the transaction will be completed.

We will have more to say on the move as more information becomes available, but the decision does not impact on our fair value estimate.

Earnings Update

Johnson & Johnson grew its GAAP revenues 11% year-over-year last fiscal quarter, hitting $23.3 billion, with growth reported across its three core business operating segments. Additionally, Johnson & Johnson reported strong sales growth performance across its key geographical markets as well last fiscal quarter.

Its GAAP gross margin rose by ~200 basis points year-over-year in the fiscal third quarter as improving economies of scale–with an eye towards its Medical Devices segment–supported the firm’s profitability. However, its GAAP net income margin dropped ~120 basis points year-over-year during the fiscal third quarter due in part to rising operating expenses (SG&A, R&D, and in-process R&D expenses) and growth in its ‘other expense, net’ line-item.

As it concerns the increases at its other net expense line item, that was largely due to Johnson & Johnson incurring meaningful legal liability expenses last fiscal quarter according to management commentary provided during the firm’s latest earnings call. Furthermore, as it concerns its in-process R&D expenses, that stems in part due to an impairment expense associated with the acquisition of Auris Health (that was completed back in April 2019) according to recent management commentary.

The company’s GAAP net income rose 3% year-over-year last fiscal quarter, hitting $3.7 billion, aided by a sharp reduction in its provision for corporate income taxes. Johnson & Johnson’s GAAP diluted EPS rose by 3% year-over-year, hitting $1.37 last fiscal quarter. Its non-GAAP adjusted EPS rose by 18% year-over-year, hitting $2.60 last fiscal quarter when removing special items from this picture.

Supply chain hurdles weighed on Johnson & Johnson’s performance in the fiscal third quarter to a degree, with management recently citing supply constraints as it concerns its LISTERINE oral health offerings as one example holding down sales. The Delta variant of the COVID-19 pandemic along with “the growing impact from reduced medical staffing” impeded the pace of elective surgeries in some markets last fiscal quarter according to recent management commentary. This, in turn, weighed negatively on Johnson & Johnson’s business last fiscal quarter, though the firm managed to overcome most of those hurdles.

The company’s management team also noted in Johnson & Johnson’s recent earnings call that hospitals will likely have to continue dealing with labor shortages into 2022, which in turn could weigh negatively on the resumption of elective surgeries to a degree, though the longer-term trend is that the pace of elective surgeries continues to recover. With that in mind, the J&J’s business model has proven to be quite resilient in the face of numerous exogenous shocks seen around the world.

Johnson & Johnson exited the third quarter of fiscal 2021 with a modest net debt load of $2.9 billion (inclusive of short-term debt), with its sizable total debt load ($33.9 billion) offset by its large cash and cash equivalent position on hand ($31.0 billion). The company was incredibly free cash flow positive during the first three quarters of fiscal 2021, generating $15.4 billion in free cash flow while spending $8.2 billion covering its dividend obligations and another $2.5 billion buying back its stock during this period. Its dividend strength is rock-solid and there is ample room for Johnson & Johnson to continue growing its payout going forward. Given that shares of JNJ have been trading below their intrinsic value for some time, we view the company’s share buybacks as a good use of capital if kept in moderation.

During the fiscal third quarter, Johnson & Johnson’s Consumer Health segment posted solid sales growth at its over-the-counter (‘OTC’) offerings. TYELNOL and MOTRIN analgesics, upper respiratory products, and digestive health (including its IMODIUM brand) products were cited as strong performers last fiscal quarter. Its AVEENO and NEUTROGENA skin health and beauty products also sold well in the fiscal third quarter.

At its Pharmaceutical segment, Johnson & Johnson’s DARZALEX (treats certain cancers), STELARA (treats plaque psoriasis and psoriatic arthritis), TREMFYA (treats moderate to severe plaque psoriasis), and ERLEADA (treats certain cancers) offerings posted solid revenue growth alongside several other treatments. Its treatments for schizophrenia for adults, INVEGA SUSTENNA/ XEPLION/ INVEGA TRINZA/ TREVICTA, and its treatment for pulmonary arterial hypertension, OPSUMIT, also posted solid revenue growth last fiscal quarter highlighting the breadth of Johnson & Johnson’s pharmaceutical portfolio.

The company’s Medical Devices segment posted growth across the board as well. Johnson & Johnson’s latest earnings press release noted that its electrophysiology products, wound closure products, surgical vision products and contact lenses, trauma products, hips products, knees products, energy endocutters products, and biosurgical products posted solid sales growth last fiscal quarter.

With the worst of the COVID-19 pandemic potentially behind key geographical markets in the US, Europe, and East Asia, elective surgeries are resuming in earnest. The ongoing recovery at its Medical Devices segment is playing a key role in supporting Johnson & Johnson’s improving cash flow growth outlook as that supports both its revenue growth outlook and provides room to expand its margins via increasing economies of scale.

Guidance Update

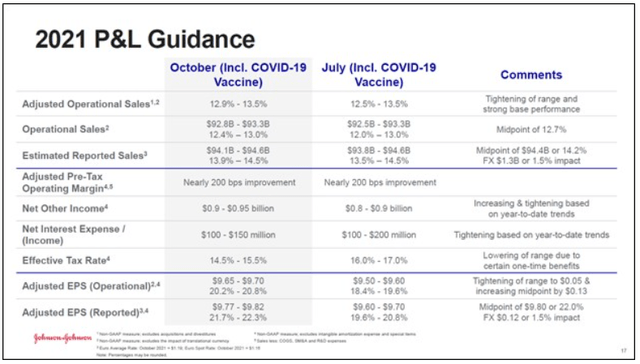

In the upcoming graphic down below, Johnson & Johnson provides an overview of its updated full-year guidance for fiscal 2021. The company’s ‘base business’ which excludes sales of its COVID-19 vaccine is expected to grow its revenues at a slightly stronger rate than previously forecast at the midpoint of guidance, and the same goes for its forecasted non-GAAP adjusted EPS at the midpoint of guidance. Please note Johnson & Johnson also boosted its guidance during both the first and second quarters of fiscal 2021, highlighting the firm’s growing confidence in its near term performance.

Image Shown: Johnson & Johnson once again boosted its guidance for fiscal 2021. Image Source: Johnson & Johnson – Third Quarter of Fiscal 2021 IR Earnings Presentation

Image Shown: Johnson & Johnson once again boosted its guidance for fiscal 2021. Image Source: Johnson & Johnson – Third Quarter of Fiscal 2021 IR Earnings Presentation

We appreciate Johnson & Johnson’s guidance boost as that indicates the company is set to post a strong fiscal fourth quarter performance and potentially enter fiscal 2022 on the upswing. That sets the stage for future dividend growth and further capital appreciation upside, underpinning why we are big fans of the firm.

COVID-19 Vaccine Update

After contending with some hiccups while ramping up its manufacturing capabilities, Johnson & Johnson’s COVID-19 vaccine is starting to post solid sales performance. The US Food and Drug Administration (‘FDA’) has given the firm’s COVID-19 vaccine emergency use authorization, and the vaccine is in use in the US and elsewhere in the world. During Johnson & Johnson’s latest earnings call, management noted that “global sales in the quarter included a $502 million contribution from the COVID-19 vaccine, bringing the year-to-date total to $766 million. Through the first 9 months of the year, revenue has been recorded at a not-for-profit price of $7.50.” Additionally, management expects Johnson & Johnson will record $2.5 billion in sales of its COVID-19 vaccine this fiscal year.

The vaccine recently received unanimous support from an advisory panel to the US FDA concerning booster shots of the vaccine for those aged 18 years and older that have already received their first Johnson & Johnson vaccine dose. On October 20, the US FDA gave the green light for a booster shot of Johnson & Johnson’s COVID-19 vaccine while also allowing “mix-and-match” uses of certain COVID-19 vaccines.

Johnson & Johnson put out a press release in October 2021 noting that clinical trials highlighted the substantial increased efficacy of a booster shot. For reference, the vaccine was originally designed as a single-dose regimen, but in the wake of variants of COVID-19, a booster shot provides much better protection against adverse health effects from the virus. A single dose still provides meaningful protection according to the clinical study data cited in Johnson & Johnson’s recent press release, however.

While we do not expect Johnson & Johnson’s COVID-19 vaccine to generate needle-moving revenues or profits (please note the vaccine is being sold at a not-for-profit basis), the rollout could earn the firm goodwill from regulators and households across the globe. Johnson & Johnson is currently contending with various lawsuits and legal liabilities, and playing a leading role in ending the global health crisis should help maintain its brand power as it works out its legal woes in the courts and via settlements.

Legal Update

On a related note, Johnson & Johnson reportedly placed its talc liabilities stemming from its baby powder offering into a new entity, LTL Management, and then had that company file bankruptcy to consolidate ongoing litigation. We view Johnson & Johnson as having the financial capacity to manage these liabilities while maintaining its financial strength going forward, and for reference, Johnson & Johnson has vigorously defended itself and its products during legal proceedings. The firm reportedly advanced $2.0 billion into LTL Management while also providing the entity with royalty streams with a present value of $0.35 billion to cover future legal expenses and legal settlement costs. Management confirmed the creation of this entity during Johnson & Johnson’s latest earnings call.

Johnson & Johnson is contending with other legal liabilities as well, including those that stem from its therapeutic RISPERDAL, which treats certain mood and mental health disorders. Here is what management had to say on the issue during its latest earnings call:

Other income and expense in the third quarter includes a $2.1 billion charge of litigation expenses, prim