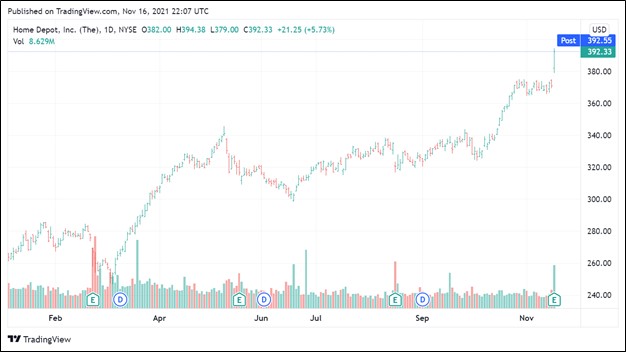

Image Shown: Shares of dividend growth idea Home Depot Inc have surged higher year-to-date on the back of the home improvement retailer’s stellar operational performance and impressive free cash flow generating abilities. We liked what we saw in Home Depot’s latest earnings report published on November 16.

By Callum Turcan

On November 16, Home Depot Inc (HD) reported earnings for the third quarter of fiscal 2021 (period ended October 31, 2021) that smashed past both consensus top- and bottom-line estimates. Shares of HD are up ~48% year-to-date (before taking dividend considerations into account) as of the end of normal trading hours on November 16 after shares surged higher by ~6% that day as investors clearly appreciated Home Depot’s latest earnings update, as did we. Home Depot’s retail footprint includes physical stores in Canada, all 50 US states and various US territories (including Puerto Rico, the US Virgin Islands, and Guam), and Mexico, along with an impressive e-commerce operation and a growing maintenance, repair, and operations (‘MRO’) business.

The company’s comparable sales advanced 6.1% year-over-year last fiscal quarter as its US comparable store sales rose by 5.5% year-over-year while its Canadian and Mexican operations posted stellar performance as well. We include Home Depot as an idea in our Dividend Growth Newsletter portfolio and shares of HD yield a nice ~1.7% as of this writing.

Home Depot recently acquired HD Supply Holdings, a major distributor of MRO products particularly for multifamily and hospitality end markets in the US and Canada, through an all-cash deal with an enterprise value of ~$8 billion (including net cash). That acquisition closed in December 2020 and so far, things appear to be going well on this front as it concerns integration efforts, though Home Depot’s management team has not mentioned the acquisition that much in recent fiscal quarters. We liked the deal and think it provides meaningful diversification to Home Depot’s business model while growing its exposure to an attractive space.

Earnings Update

In the third quarter of fiscal 2021, Home Depot’s GAAP revenues rose almost 10% year-over-year as a 5.5% drop in customer transactions was more than offset by a 12.9% increase in average ticket size. Sales per retail square foot increased 6.2% year-over-year last fiscal quarter. Strength at its omni-channel selling platform, specifically as it concerns integrating its e-commerce presence with its physical store footprint, continued to impress last fiscal quarter. During Home Depot’s latest earnings call, management had this to say (emphasis added):

“Home improvement demand remains strong. Our customers remain engaged with projects around the home, and we continue to focus on delivering the best experience in retail. As we mentioned last quarter, we continue to see customers taking on larger home improvement projects as evidenced by the continued strength with our pro customer, which once again outpaced the DIY customer.” — Craig Menear, CEO and Chairman of Home Depot

Later in the call, management also had this to say (emphasis added, lightly edited):

“On a 2-year basis, both comp average ticket and conference actions were healthy and positive. Big ticket comp transactions, so those over $1,000, were up approximately 18% compared to the third quarter of last year. During the third quarter, Pro sales growth continued to outpace DIY growth. On a 2-year comp basis, growth with both our Pro and DIY customers was consistent…

Similar to the second quarter, we saw many of our customers turn to Pros for help with larger projects. We see this in the strength several Pro-heavy categories like drywall… pipe and fittings, and several mill work categories. We remain encouraged by what we’re hearing from our Pros as they tell us their backlogs are healthy.

Sales leveraging our digital platforms grew approximately 8% for the [fiscal] third quarter, which brings our digital 2-year growth to approximately 95%. Our customers continue to shop with us in an interconnected manner… approximately 55% of our online orders are fulfilled through our stores.” — Ted Decker, COO and President of Home Depot

In the wake of the coronavirus (‘COVID-19’) pandemic, many households turned to home improvement projects to stay entertained and to perform much needed repairs and updates. While demand growth on this front has cooled off somewhat, overall demand in this area remains healthy according to recent management commentary. Demand from Home Depot’s professional customer base (its ‘Pro’ customers) is swelling higher as construction activities resume in earnest, providing a nice tailwind for the company’s growth trajectory.

As it concerns inventory management activities, Home Depot is working with its suppliers to get around various supply chain hurdles. This strategy includes Home Depot chartering its own ships to get around logistics bottlenecks. Introducing alternative products is also part of the company’s strategy here.

Home Depot’s pricing power is offsetting most inflationary headwinds as its GAAP gross margin was broadly flat year-over-year last fiscal quarter, while operating leverage helped the firm to grow its GAAP operating margin over 125 basis points year-over-year last fiscal quarter. We appreciate Home Depot’s resilient business model. Management briefly commented on the tight labor market during the firm’s latest earnings call, though Home Depot appears to be adeptly navigating these headwinds.

Financial Update

During the first nine months of fiscal 2021, Home Depot generated almost $13.4 billion in net operating cash flow and spent a little over $1.7 billion on capital expenditures, resulting in over $11.6 billion in free cash flows. Management noted during Home Depot’s latest earnings call that the long-term goal was to spend roughly 2% of the firm’s sales on capital expenditures (Home Depot spent roughly 1.5% of its sales towards capital expenditures during the first nine months of fiscal 2021).

Home Depot’s $11.6 billion in free cash flows easily covered $5.3 billion in dividend obligations during the first three quarters of fiscal 2021. Its $10.4 billion in share repurchases during this period were partially funded by its balance sheet. While Home Depot’s competing capital allocation priorities weigh negatively on its dividend growth potential, the firm remains committed to steadily grow its dividend. The company boosted its quarterly dividend 10% sequentially back in February 2021.

At the end of October 31, Home Depot had a net debt load of $34.1 billion (inclusive of short-term debt) though its $5.1 billion in cash and cash equivalents on hand at the end of this period provides the firm with ample liquidity. While we would prefer that Home Depot pare down its net debt load over time, the firm has a solid handle on that burden given its stellar free cash flow generating abilities, in our view. Please note that Home Depot also has sizable non-cancellable financial liabilities on the books as well such as operating lease liabilities.

Concluding Thoughts

Demand for home improvement activities appears to be holding up well, even as lockdown measures related to the COVID-19 pandemic ease up across North America. The outlook for housing activity and construction demand more broadly is quite bullish for several reasons including the need for US housing supply to catch up with new household formation and the large $1+ trillion US infrastructure fiscal stimulus bill that was recently signed into law. Home Depot has exposure to this upside via the Pro side of its home improvement retailing operations and its recently enlarged MRO business.

We view Home Depot’s dividend growth trajectory quite favorably and continue to like shares of HD as an idea in the Dividend Growth Newsletter portfolio. In light of better-than-expected fundamental performance of late, we may tweak our cash flow valuation model of the firm. As of this writing, shares of HD are trading near the top end of our fair value estimate range (which currently sits at $397 per share).

To read more about Home Depot, check out its recent local delivery partnership with Walmart Inc (WMT) by reading our October 2021 article Home Depot Teams Up with Walmart (link here). Home Depot continues to improve its fulfillment operations which supports its e-commerce business and ultimately its cash flow growth trajectory over the long haul.

Downloads

Home Depot’s 16-page Stock Report (pdf) >>

Home Depot’s Dividend Report (pdf) >>

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for HD, WMT, LOW, ITB, DHI, KBH, PHM, TOL, MAS, OC, SHW, LL, XHB, NAIL, HOMZ, LEN, FND, RDFN, Z, ZG, BZH, NVR, MTH, WHR, PKB, VMC, MLM, EXP, SUM, WSC

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.